Author’s note: In this column, “plastic packaging” refers to rigid or semi-rigid containers, especially those carrying the recyclability symbol of a number within a triangle of chasing arrows.

Decades into the sustainability era, recycling has not lived up to its promotion as a solution to plastic packaging solid waste. Concerns about plastic pollution have even gone global. For example, the United Nations Environment Assembly is working on a treaty aimed at alleviating the problem. Consumer packaged goods (CPG) companies will be impacted by evolving conditions, so now is the time to strategize.

It’s not that CPGs have had no strategy about plastic packaging previously. To the contrary, promoting plastic’s recyclability seemed a logical strategy. Reduction (i.e., lightweighting) has its limitations, before negatively affecting package performance, machinability, etc. Reuse, too, has its limitations, subject to such factors as package size and open/reclose features. Of “the three Rs” [reduce, reuse, recycle] a strategy based on recycling made sense, justifying, for example, claims about the percentage of recycled content contained in a plastic package.

In the interim, what has become increasingly open to debate is whether recycling is a viable solution. An objective interpretation of industry forecasts is that the production of virgin plastic will continue to outpace recycling, short of intervening initiatives. Some critics claim that the plastics industry knows that recycling is not the solution but wants society to believe that it is. Even if one does not share such cynicism, one has to concede that the platforms for espousing it are many and varied.

CPGs need to strategize about which proposed intervening initiatives might see implementation. As a starting point, a company can be well-served by identifying those initiatives that are likely to have the most far-reaching ramifications. One such type of initiative is regulatory controls aimed at limiting annual production rates. Another type is to make the industry fund solution-seeking sustainability projects, grant-style. Even though the two types of initiatives would target the supply-side, CPG companies won’t escape the trickle-down effects.

In response to production limits and/or funding mandates, the plastics industry will increase its prices, to maintain profit margins. That doesn’t mean that price hikes will be the only reaction. Increases in production efficiencies is another. Nonetheless, nothing else is as immediately implementable as the passing-along-of-costs. The first recipients will be package suppliers, who will add their mark-ups, to be paid by package users, such as CPGs. And for CPGs, packaging is indispensable. After all, it’s part of the name of that industry sector. Adding to its plight, a CPG might find itself facing not only price hikes, but changes in attendant factors, such as quantity-discount terms.

Given this imagined scenario, CPGs will face hard choices. With the possible exception of the ultra-luxury market, consumers are price conscious. There’s no better example of that truth than the retail industry in general, and the grocery segment in particular. Narrowing the choices available to CPGs, consumers are aware and resentful of shrinkflation (products sold in smaller content packaging, at previous prices). A less than well-thought-out price increase (or its equivalent) can lead to reduced sells, which can lead to reduced shelf-space allotment, and at worst, can lead to a discontinuance by the retailer.

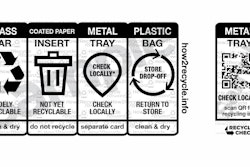

The recyclability of plastic packaging is not the same sustainability credential that it once was. Previously, greater indulgence was given to a systems argument. An example is Life Cycle Assessment (LCA), which proports to measure the net environmental impact of a package/packaging material across the stages of its lifespan. Its appeal was owed to its applicability, because depending on the variables used, any plastic can be said to have sustainability bona fides. Increasingly though, an all-things-considered argument finds itself straining under the weight of the observable presence of post-use plastic packaging in the environment, terrestrially, and aquatically. An inconvenient truth: the fact that plastic packaging is recyclable doesn’t guarantee, in and of itself, that it will be recycled.

Before segueing into what revised stance on recycling might benefit CPGs, a retrospect about the undeniable popularity of plastic packaging can lend perspective. Plastic is the newcomer among packaging materials, compared to paper, glass, and metal. All types of packaging are expected to satisfy the functions of containment, protection, communication, and convenience. It then follows that plastic packaging wins out when its performance proves optimal for certain application-specific conditions. The same has proven true of plastics when matched against hybrids and substitutes, such as biodegradables and compostables.

As the plastics industry continues lobbying, CPG’s companies need not resign themselves to awaiting results. Being proactive is better than being reactive. CPG’s companies still can support recycling; but, at the same time, why not be more promoting of the direct-to-consumers advantages of plastic packaging?

Depending on the product, it can behoove CPG’s companies to display reminders on the plastic packaging, itself. Possibilities include shatterproof, lightweight, stay-fresh, see-through, and easy-carry handle. They are low-cost (no-cost?) attempts to favorably dispose consumers regarding their purchase decisions. Consumers know that plastic packaging is recyclable, but the majority of consumers of products in plastic packaging don’t recycle. That contradiction will persist, at least for the near future, regardless of how aggressively recycling is promoted. In the meantime, CPGs should not pass up opportunities to assuage the misgivings that some consumers might experience.

Sterling Anthony, CPP, consults in packaging, marketing, logistics, and human-factors. A former faculty member at the Michigan State University School of Packaging, his contact info is:100 Renaissance Center, Box-176, Detroit, MI 48243; 313/531-1875; [email protected]