Surprisingly, though, the success of this strategy is spotty at a time when the survival of many CPG companies depends on it. A new survey brings the reasons into focus. Though quickly produced packaged products—we’ll use the term quick-changeover packaging (QCOP)—have become an indispensable business strategy, many companies seem to be wasting time and money while executing it—and sometimes creating the dilemma of what to do with accumulated product inventory that has become obsolete.

In cases such as these, speed overtakes solid forecasting, past learning, and inventory management across the complex value chain. As a result, good management practices, such as leveraging marketplace analysis, blend into the background, and opportunities are lost to forecast and manage future product and packaging needs to prevent obsolescence.

A Contract Packaging and Packaging & Technology Integrated Solutions (PTIS) survey of about 300 packaging professionals, conducted during May, identifies two factors that are impeding efforts to get packaged products produced as fast and efficiently as packaging teams would like:

• The marketing and operations departments seldom or never talk to each other. Poor communication too often is resulting in gaps between what marketing believes is possible in package creation and what operations says is realistic on the packaging line.

• Project management systems are either non-existent or managed ineffectively by both CPG companies and packagers. Those involved in QCOP often aren’t mapping workflows and systems to identify process-improvement opportunities.

Why are excellent communications and project-management skills essential for stellar QCOP practices? John Henry, president of Changeover.com, says the costs of changeover rarely are measured, but they typically total as much as tens of thousands of dollars per hour. For a one-hour daily changeover on a fairly significant packaging project with the line running 240 days per year, the annual cost is $1.8 million.

Potential benefits of good communication and project management are great. “You can take 50% out of the cost and time out of your project,” says Phil McKiernan, a principal at PTIS. He accomplished that measure of success at Kimberly-Clark Corp., where he developed a project management system while leading packaging organizations. “A speed-to-market project is complex. It involves lots of activities, steps, and people. But no one is stepping back and looking at the big picture. What are all the steps, and how do they fit together?”

Drivers of QCOP

In general, QCOP packaging capability is becoming a must-have for product manufacturers because of several fundamental drivers. First, savvier shoppers are demanding that products meet their expectations. Second, many retailers are fighting for survival in a still-weak economy; retailers are competing against each others’ own brands, as well as with national brands. Third, advances in machine technology and in process management techniques for operating modern production facilities are making possible the rapid-change packaging that CPG companies and retailers need to compete.

The following top-line results of the CP/PTIS survey reflect these marketplace dynamics:

• The ability to change out package formats, sizes, labels, and other components is almost universally seen as a critical packaging strategy today. That’s a change from 2006, when a separate survey, developed by CP, PTIS and Changeover.com, showed that 74% of the respondents identified quick-changeover capability as being very or extremely important at their company.

• Respondents wrote that QCOP orders represent 50% to 80% of their total workload—and in many cases have doubled or tripled from five years ago.

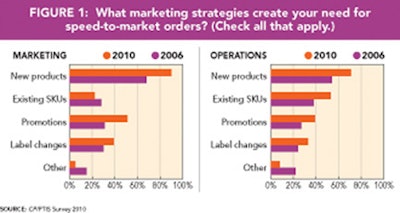

• Among those who filled out the marketing section of the survey, “new products” was the most often identified (90% of respondents) marketing strategy that creates speed-to-market orders (Figure 1). For those answering the operations section, the leader was new products (71%).

• Interestingly, marketing respondents define “quick” very differently than those in operations, in the context of getting a package to the store shelf faster. Marketing respondents most often (82%) described it as being anywhere from one day to six months, (Figure 2), while 49% of operations respondents defined it as less than one day and 38% as one day to one month.

• Cross-functional teams continued to be the exception rather than the rule in making critical decisions on packaging lines (Figure 3). Only 28% of the time does a cross-functional team perform this role, and that is down from 35% four years ago.

• The results also showed that small consumer product companies work more cross-functionally and nimbly.

The influx of additional new products that is creating higher demand for speed to market intrigues Brian Wagner, PTIS co-founder. New-product introductions seem to be rising in 2010 after a recession-related dip in 2009, and Wagner suspects CPG companies are looking to improve their prioritizing new launches rather than continuing to rush through potentially unprofitable products.

But Wagner continues to see warning signs, given the tendency for marketing and operations to work independently of each other.

“Marketers start with their own assumptions, such as that they will get innovation for the same or a bit more price than the previous innovation,” Wagner observers.

“Their assumption, unfortunately, is based on existing cost, not on something new. By the time marketing tells anyone what they’re working on, what they’re told is the supplier can’t get it in that amount of time or that they can’t deliver it within budget.”

Hence, the survey’s uncovering of different definitions for what is “quick” (Figure 2). Wagner theorizes that the marketing perspective is assigning more time to launches in 2010 versus 2006 in part to more measured thinking in developing the right product in the right package. But he also suspects they’re procrastinating on bringing operations into the mix until very late in the process. In the case of operations, “quick,” as discussed in the survey’s written comments, may be a description of the reality of “get it out the door fast.”

Project management deficiencies

Beyond serious gaps in communications, verbatim responses in the survey point to other unresolved issues in the quest to push packaged products out the door faster. Marketing respondents cited reduced times for final approvals and getting artwork approved, and the need for better overall planning as being among the biggest challenges to a successful QCOP project. Operations personnel, on the other hand, listed more effective decision-making; better coordination and integration of design, materials, and equipment; and repeatability on the production line as primary challenges.

McKiernan says the results point to a clear need for better project management. Written comments in the marketing section of the survey describe challenges like “access to all decision-makers” and “getting all parts of the process to move quickly in decision-making.” These concerns tell McKiernan that CPG companies aren’t mapping workflows and developing opportunities to improve the process itself.