Its name is “Network of the Future.” Kimberly-Clark Corp. (K-C)’s multiyear plan to reinvent its supply chain sounds like something out of a sci-fi movie, but its objective is very down-to-earth: Give retailers and club stores the products they want, when and how they want them, while also satisfying shopper needs.

Several years into the effort, K-C is finding success by introducing greater reliability and flexibility to its packaging value chain. The company has consolidated contract packaging and distribution operations into 10 megacenters around the U.S. and Canada, with the following results:

• Product volume outflows already are higher, and they will increase as much as 25% by the project’s seventh year.

• More than 80 warehouse sites in the U.S. have been consolidated to 25.

• Product orders are arriving at customers’ destinations 85% of the time in one day or less. That compares with about 60% under K-C’s previous operations approach.

• Shipping points have been minimized, leading to better regional product-forecasting accuracy.

“We’re getting more pressure from our customers for shorter product runs and special, exclusive packs,” Joe DeYoung, distribution operations manager for Kimberly-Clark North American Consumer Products, says in explaining the impetus for Network of the Future. “We believe this is going to set us up to have a strategic advantage over our competitors. We feel pretty good about our product forecasting accuracy three to four weeks out.”

Key to the Network of the Future operation is having third-party logistics companies (3PLs) provide contract packaging, warehousing, and distribution services inside K-C’s distribution centers (DCs). A few consumer packaged goods (CPG) companies are beginning to embrace the service-in-the-DC model as another way to achieve lean contract packaging through better logistical efficiency. The model saves costs and increases speed-to-market, among other benefits, by reducing the number of times products are touched as they move through the supply chain.

Changes were inevitable

For years, K-C previously operated two separate distribution networks for its products. One network handled family-care products such as Kleenex brand facial tissue and Scott brand bath tissue and towels while the other one focused on personal-care products including Huggies brand diapers and Depend brand incontinence products. Sites in each of these networks operated near K-C’s facilities, but not necessarily close to the company’s customers.

Inefficiencies in the old approach became obvious about five years ago as K-C began to add more products. Across K-C’s stable of brands, the number of SKUs doubled over a 10-year period. As a result, the supply chain had become exceedingly complex and difficult to manage.

Beyond changes in package design, warehouse capacity limitations prevented K-C from storing all the SKUs at any of its facilities because none of them was set up to accept both personal-care and family-care products. Consequently, retailers and club stores were required to order separately for these products; the shipments arrived at stores in separate truckloads. In addition, it became increasingly common for K-C to search for other sites to handle its overflow-space needs. The use of many facilities created a logistical challenge. These and other logistics matters made product forecasting difficult at K-C’s warehouses, challenging production planners to make the right products in the right quantities within each region.

More recently, other challenges have added further layers of concern for K-C and other national brand owners as retailers and club stores refine their own merchandising strategies and also begin to impose their own harsher requirements on supply chains. Here are three areas of concern:

1. Shelf space for national brands is diminishing or disappearing entirely from some categories. Retailers are grabbing extra shelf space to increase the selection of their own brands and cater to frugal consumers’ desire to hunt for bargains.

2. Retailers are changing the mix of products in their stores more frequently than ever to build their outlets as a destination “brand.” The idea is to entice shoppers to return continually in search of new and unexpected “treasures.”

3. And in February, Walmart introduced a four-day deadline for suppliers to ship products to its DCs after orders have been placed. Walmart said it would assess a “reimbursement” fee equaling 3% of the cost of products sold for companies that deliver less than 90% of their merchandise each month within the retailer’s guidelines.

Simply put, Kimberly-Clark and other national-brand owners can win the battle for shelf space in this new era of competition only if two requirements are met. Their products need to be packaged to forge the right relationship with their consumers, and it’s essential that brand managers also have packaging formats that can change on a dime to reflect current retailer merchandising sentiment.

Responding to each of these issues, K-C reflects consumer product companies that recognize the imperative to become faster and more nimble through made-to-order, shipped-to-order fulfillment. K-C and other consumer product companies who use it, and 3PLs who execute the details, tell CP that this is the future of contract packaging.

Network of the Future is just one model that CPG companies are crafting in which a 3PL company provides a full range of integrated packaging and distribution services right inside the product manufacturer’s DC. The idea is to consolidate co-packers and move packing operations closer to the customer, thereby postponing order fulfillment as long as possible and improving forecast accuracy.

This approach contrasts traditional contract packaging operations, whereby materials and product go back and forth between the manufacturing facility and the product manufacturer’s warehouse or DC. It has become an increasingly complex chain of events that costs both valuable time and money and often provides limited opportunities to ship directly from the production line to stores. In K-C’s traditional linear supply chain, for example, goods and materials formerly went from K-C facilities to a contract packager and then to a DC before heading to stores.

K-C’s Network of the Future consists of 10 regional DCs. Locations are in Romeoville, IL; Pittston, PA; New Century, KS; McDonough, GA; Redlands, CA: Kent, WA; Granitville, SC; Toronto, Canada; Conway, AR; and Coppell, TX. CP recently toured the Romeoville facility to observe the K-C network going through its paces.

The Romeoville campus consists of two sprawling buildings totaling more than 1.5 million sq ft. One building, spanning 802,000 sq ft, houses K-C’s DC. The adjacent facility is a distribution and warehousing center that also includes 100,000 sq ft for contract packaging operations. Within these facilities, Kane is Able (www.kane

isable.com) provides complete 3PL services, including contract packaging, producing 210,000 product pallets filling 7,000 trucks annually. (Kane is Able also provides 3PL services in the regional facilities in New Century and Pittston.)

“Our goal is to postpone production to the last minute,” explains Mike Marlowe, vice president customer solutions at Kane is Able. “By doing this, you allow for better forecast accuracy since you are closer to the ship date. To execute on this, 3PLs must collaborate closely with their partners or MABDs (Must Arrive By Dates) will be missed, and more important, out-of-stocks will occur.”

DeYoung clarifies further, “The 3PLs manage our facilities for us. They are in a better position to streamline efficiencies and manage flexible resources. That way, you’re starting to leverage your scale more for better pricing.”

Case in point: Using the figure of 7,000 trucks filled and deployed annually, Marlowe estimates savings of $2.1 million per year by conducting operations inside the customer’s DC, rather than having the packing work done elsewhere, if the additional transportation costs totaled $300 per truckload.

Within the 100,000 sq ft of contract packaging operations in Romeoville, Kane is Able operates 60,000 sq ft of display-building and finished-product space, 27,000 sq ft of material storage space, a 13,000-sq-ft clean room, and also a shrink tunnel. Operations follow a closed-loop procedure in which the goal is for each site to have the capability to make full lines of products.

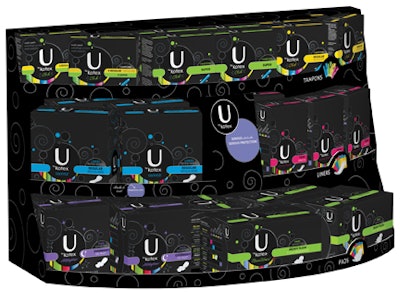

In Romeoville, Kane is Able packs K-C’s diaper, tissue, tampon, and paper towel brands. One example is handled in the FDA-certified clean room: Regular and superabsorbent Kotex brand tampons arrive in separate bulk-shipping cases. To satisfy one retailer’s shipping preferences, they need to be reassembled into 18-count cases bearing 9 cartons of both product varieties. Elsewhere in the co-packing areas, on the day when CP visited the co-packing operation, line workers were manually emptying four-count cases of Huggies Pull-ups brand training pants and repacking them as multi-sku cases. The new cartons then were fed through a taping machine and palletized.

Once products are finished and ready to exit the co-packing facility, they are bound for one of two destinations. They either are loaded directly off the packing line into trucks for direct shipment to customers or placed into inventory, where they eventually are picked and shipped to order. Marlowe says K-C’s goal is 45% direct loading off the packing lines.

As part of its service offering, Kane is Able provides other CPG companies with some design services in collaboration with Smurfit-Stone . “The CPG companies give us the specs and Kane is Able can procure the materials, and we work with the vendor to create a prototype,” Marlowe says. “Most CPG companies want to control that because it’s a marketing thing. We may provide feedback once it gets back in-house to reduce damage and take out labor costs. That’s one of the value-adds of Kane having engineering services on-site.”

Shared risk

The benefits of a 3PL operating directly in a consumer product manufacturer’s DC also are evident in the machines that push the product through the Romeoville campus. Marlowe explains that Kane is Able purchases custom-designed machinery that is used solely for K-C products.

“CPG companies in general are shedding internal resources and are looking for outside vendors to provide third-party input and learning over multiple CPG companies on labor considerations and equipment design,” Marlowe says. “We own the equipment, but it’s Kimberly-Clark’s buildings. They hold the lease.”

The issue of purchasing or building custom machinery provides a bit of a conundrum for co-packers, who sometimes are reticent about taking on the risks associated with such large capital expenditures without the guarantee of enough volume to produce an acceptable return on investment. But it has become a more frequent requirement of product manufacturers, and K-C, for one, is willing to mitigate the risk. DeYoung at Kimberly-Clark says, “We are asking the 3PLs to make the investment in the equipment.

We will set up the pricing of the product so they can recoup the cost of the equipment.”

Both DeYoung at K-C and Marlowe at Kane is Able describe the Network of the Future operations in Romeoville as a win-win-win proposition. And they are being repeated at K-C’s other regional DCs. Concludes Marlowe, “Kimberly-Clark is looking for 3PL providers that can do the full breadth of services. 3PLs that are positioned to do that, in general, are seeing growth. We think that in-DC operations are the wave of the future. If you’re only offering warehousing, you risk losing business to a company that offers complete services.”