Could 2018 be the year of the raise for packaging professionals? You can bet that would be more than welcome news for 2018 Salary Survey respondents who reported a meager 0.1% average salary increase last year.

Combine those flat incomes with a growing economy, and you might think packaging professionals would be readying their resumes in search of greener pastures. Yet results were mixed when it came to job seeking.

Several factors merit consideration here. Take job security, for example, where only 15% of respondents indicated they were either a little worried or very worried. Contrast that with 70% who feel either very or somewhat secure.

Salary likely plays a part in that security, with overall average salary/bonus/cash incentives/commission reaching $117,050 this year versus $116,910 reported in 2017. Not much difference there until you see that domestic respondents enjoyed a 1.67% bump to $121,708 this year versus $119,714 in 2017. Conversely, foreign workers saw their incomes decline from $88,415 in 2017 to $86,052 this year.

The 2018 Salary Survey was conducted by the Institute of Packaging Professionals and Packaging World magazine. It was developed in cooperation with Gros Executive Recruiters, recently acquired by MBS Advisors. Kane Consulting tabulated and summarized the results.

Big jump in respondents

“The most significant aspect of this year’s survey is not contained in the statistical detail. It is in the sheer number of responses,” notes Dennis Gros, President, MBS Advisors, Recruiting Div. He refers to the 29% rise in the overall base of respondents to 1,182 this year.

Could the increase in respondents be attributable to packaging pros having more free time to fill out the survey? “Are ya kidding me?” Gros jests.

Could it be that people employed in packaging functions flourished in the past year? “Look around,” he says. “Did they hire anybody to help YOU?”

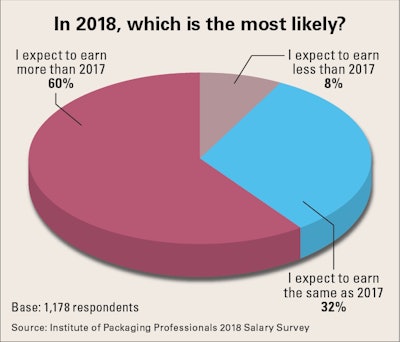

The real reason, Gros suggests, is that curiosity—and optimism—about compensation is swelling. This is driven by the signs of a robust economy. “We’re hoping, praying, and anticipating that robust business levels will act like Santa Claus and deliver a financial present for each of us in 2018,” he says.

Limiting income factors

According to the U.S. Inflation Calculator, the current U.S. inflation rate was 2.4% for the 12 months ending March 2018. That means survey respondents aren’t keeping up with inflation.

Looking closely at this year’s salary survey respondents reveals the following factors contributed to this year’s flat salaries:

• More respondents within the two years or less experience category: 8% in 2018 versus 5% last year. At this beginning experience level, the average salary is $73,040, barely rising above last year’s $72,970.

• Two age categories, 35 to 44 and 65+, saw pay losses this year compared to 2017. For the latter group, the decrease was $5,540; $4,900 for the younger group.

• More females responded in 2018, 24%, compared with the 22% in 2017. Females earned $102,090 in 2018 while males made $121,990. The news on this front is that the gender pay gap narrowed, with incomes for women rising on average $3,130 in 2018, yet only $220 for men.