A new market and trend report, Bio-based Building Blocks and Polymers – Global Capacities, Production and Trends 2018-2023, from the German nova-Institute shows capacities and production data for all bio-based polymers. In 2018, the report says, the total production volume reached 7.5 million tonnes—these are already 2% of the production volume of petrochemical polymers. The potential is much higher, but it is currently hampered by low oil prices and a lack of political support.

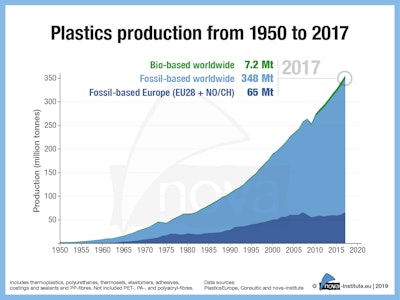

The production of bio-based polymers has become much more professional and differentiated in recent years. By now, there is a bio-based alternative for practically every application. The capacities and production of bio-based polymers will continue to grow with an expected CAGR of about 4% until 2023, almost at about the same rate as petrochemical polymers and plastics Therefore, the market share of bio-based polymers in the total polymer and plastics market remains constant at around 2% (Figure 1).

The increase in production capacity is mainly based on the expansion of the polylactic acid (PLA) production in Thailand and the polytrimethylene terephthalate (PTT) and starch blends production expansion in U.S. Especially PLA and starch blends will continue to grow significantly until 2023. Also, new capacities of bio-based polyamides, polyethylene, and, for the first time, polypropylene and poly(butylene adipate-co-terephthalate) (PBAT) will also be added in Europe in this period. The great hopeful, polyethylene furanoate (PEF), will presumably only be able to offer commercial capacities after 2023. Overall, the market environment remains challenging with low crude oil prices and little political support.

So far, the two major advantages of bio-based polymers have not been politically rewarded. The first advantage is that bio-based polymers replace fossil carbon in the production process with renewable carbon from biomass. This is indispensable for a sustainable, climate-friendly plastics industry, but it is not yet politically rewarded.

The second advantage is offered by about a quarter of bio-based polymer production: They are biodegradable (depending on the environment) and can therefore be a solution for plastics that cannot be collected and enter the environment where they can biodegrade without leaving behind microplastics. Only a few countries such as Italy, France, and in the future, probably Spain will politically support this additional disposal path.

The most important market drivers in 2018 were brands that wanted to offer their customers environmentally-friendly solutions and critical consumers looking for alternatives to petrochemicals. If bio-based polymers were to be accepted as a solution and promoted in a similar way as biofuels, annual growth rates of 10% to 20% could be expected. The same applies as soon as the price of oil rises significantly. Based on the already existing technical maturity of bio-based polymers, considerable market shares can then be gained.

The 380-page market report is updated every year and the update for the year 2018 offers very special highlights: It contains comprehensive information on capacity development from 2018 to 2023, per bio-based building block and polymer and for the first time production data for the year 2018, per bio-based polymer. A total of 17 bio-based building blocks and 16 polymers are covered in the report. In addition, the new issue includes analyses of market developments and producers per building block and polymer, so that readers can quickly gain an overview of developments that go far beyond capacity and production figures. For the first time, a detailed research, calculation, and explanation of the market development of cellulose acetate (CA), bio-based epoxy resins, and bio-based polyurethanes was made possible through a cooperation with the main experts in this area. The deep dive into the producing companies was comprehensively updated and now shows 175 detailed company profiles—from startups to multinational corporations.

The data published annually by European Bioplastics are taken from the market report of the nova-Institute, but with a reduced selection of bio-based polymers.