Back in the days when dot coms roamed the earth and giddy fans of the New Economy proclaimed that “legacy?businesses would soon go the way of the dodo bird, a brave new world of supply chain management beckoned. Powerfully Web-enabled and seamless from end to end, it would do away with phones, faxes, and purchase-order paperwork that traditionally linked buyers and sellers together in a sequential process. Instead, those same buyers and sellers would become collaborators armed with real-time data that would make their communications simultaneous and automatic rather than sequential and laborious. In this new world, speed to market would be greatly improved and unnecessary costs banished.

As this new value proposition emerged, Packaging World reported on it. One story about 3Com described how that firm streamlined package design through the use of an application service provider called webPkg (see packworld.com/go/c016). Another story, on Procter & Gamble’s involvement with online solutions provider Packtion, even graced PW’s cover (see packworld.com/go/c017).

But the ink was barely dry on these stories when both Packtion and webPkg went out of business, though the latter company is said to be resurfacing at www.gpkg.com. So what new models do packaging supply chain managers look for now? Better yet, what happened to these recently departed models that glittered so brightly, only to fizzle out? Pete Desjardins, formerly of Packtion, has a few theories.

“The Packtions and webPkgs weren’t undone by their models,?says Desjardins. “They had a lot of the right pieces in place. But it takes more than a year to build a company around a new model.

“Packtion just ran out of cash and, consequently, time. Along the way, there were some misconceptions that probably didn’t help. One is that if you put enough bright people together and you have a good idea and a lot of cash, then over a short period of time you can succeed. Also flawed is the belief in the first-mover theory, that if you aren’t the first one in the marketplace it won’t happen at all. And finally, there has to be a period of education. The benefits to be gained from these new models need to be articulated at a finer level of detail than they have been for the last two years or so.?lt;p>

The ‘design chain?lt;/b>

These days Desjardins is head of business development at Paxonix (Parsippany, NJ). In business now for about 18 months and funded by MeadWestvaco (Stamford, CT), Paxonix is a packaging-focused application service provider that hosts an Internet-enabled “workspace?with collaboration capabilities. The firm is focused on helping packaged goods manufacturers better manage the product- and package-development process. The mission: Faster launches and greater innovation. It’s all about the front end of the supply chain, or what Paxonix calls “the design chain.?

“We studied how people create products and packaging and discovered that there is a lot of inefficiency in time and money throughout the process,?says Desjardins. “Especially challenging are the interrelationships of all the players involved. This kind of cross-functional/cross-enterprise area is what we’re taking aim at. Generally there hasn’t been a lot of focus across enterprises to improve the product- and packaging-development process—until now.?

Desjardins isn’t the only believer in taking a cross-functional/cross-enterprise approach to the packaging supply chain. Rexam Beverage Can Americas (Chicago, IL) is another. Last fall Rexam appointed Dean Guzlas vice president-supply chain to analyze supply chain processes and structure. Guzlas sees a more cooperative and far less adversarial tone taking hold in Rexam’s dealings with its suppliers and its customers. Why? Because the national and global forces of consolidation have made it wise to do so.

“Our customers and our suppliers are fewer in number, but they’re bigger,?says Guzlas. “This has led everyone to look at the purchasing network with an eye toward bringing standardization to the industry, maintaining and improving quality, and driving out unnecessary costs. Everything from housekeeping to the price of products to delivery and inventory management is looked at. It doesn’t mean anyone has to earn less money. It’s not geared at making pricing more favorable to one party or another. Favorable pricing becomes a side benefit. It’s really about driving out unnecessary costs that do not add value, and it’s happening all along the supply chain too, from our customer back to the raw material that comes out of the earth.

“It’s really a whole new vision. It used to be that the components that make up the supply chain were all treated like functional silos. Supply chain looked at one area, sales at another, IT at another, R&D at another, and manufacturing at yet another. Now those functional silos are breaking down, so that we are getting a more cohesive and cooperative approach across the entire supply chain network.?lt;p>

Supply chain council meetings

This new thinking has led Rexam to set up supply chain council meetings with its major aluminum suppliers. These councils meet quarterly to discuss ways of driving costs out of the equation. Automation, computerization, and the Internet are frequent topics.

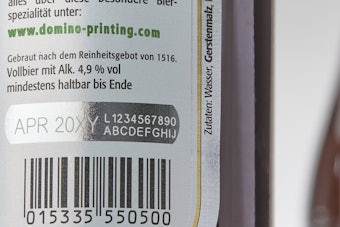

“The newest tools in the toolbox are the Web-enabled ones,?says Guzlas. “The automatic shipping notice, or ASN, is a good example. It’s an online method of having the mill replace the aluminum in our plant with no overt effort on our part. We scan a bar code on an incoming coil of aluminum as it comes in the door. Within two hours after the aluminum has been turned into beverage cans, all the information flows through our online enterprise resource planning system and is processed for payment to the mill. In addition, an order for another coil of aluminum is automatically generated.

“Not a single human touches a piece of paper, a phone, or a fax machine. It doesn’t mean the mill gets paid any more or any sooner or any later. What it does mean is that the mill is paid precisely when it expects to be, without any human interference on their end or our end. No touching paper, no losing paper, no questioning what’s on the paper. And the same happens if ever a material is not correct for the use. It can be scanned in and credited accordingly. That means we don’t need a separate system for quality control. We can react to quality issues much more quickly. Because we’re getting real-time information. We’re not waiting for it to be mailed to some QC department to be reviewed by someone and interpreted. It’s real-time information.?lt;p>

The promise of digital printing

Prepress is another component in the packaging supply chain that’s being mined for savings. Digital printing in particular, where prepress is inherently abbreviated because no printing plates are involved, seems poised to deliver some real speed-to-market benefits. Kraft Foods of Glenview, IL, has made digital printing a part of its packaging supply chain for some time now, both for sheet-fed paper and roll-fed film.

“Digital workflow can eliminate whole steps from prepress,?says Gary Vogt, group manager of prepress and print quality at Kraft. “Separations, approvals, and plate-making are good examples of things that disappear when you’re working with digital printing.?

Thus far digital presses don’t have the capacity of traditional presses. So Kraft has used this relatively new technology primarily for niche applications like test-market quantities, where runs are 10ꯠ or less. Also limiting a broader use of digital printing, says Vogt, is that special colors are not yet available. “Today’s digital presses are good with cyan, magenta, yellow, and black, but not with a signature Kraft red or blue,?observes Vogt.

In time these limitations will go away, Vogt predicts. “It may not be in my lifetime, but at some point everything will be printed digitally.?

Also recommending improvements in the prepress component of the packaging supply chain is Kevin Karstedt of Karstedt Associates (Eden, NY), a consultant who specializes in packaging graphics and printing. Karstedt believes that standardization is what’s called for now.

“Standardization in things like color management, digital signatures, approval processes, and the like are finally being talked about a little more freely,?says Karstedt. “You can only arrive at standards when you work cooperatively, and until now, consumer packaged goods companies have been too guarded about what they’re doing to streamline the prepress process. I think they’re starting to see that they’re all out there reinventing their own wheels.?

For advice on how to cooperatively develop packaging prepress standards, Karstedt thinks the graphics and prepress people at major packaged goods companies should look to their colleagues in the controls and integration field. These engineers have formed the OMAC (Open Modular Architecture Controls) Packaging Workgroup to bring standardization to today’s complex motion controls in packaging machinery. Karstedt thinks “the guys in graphics?should steal a page from the OMAC book.

“The packaged goods companies who are active in OMAC are precisely the right companies that should be seeking standardization in packaging prepress and graphics,?says Karstedt. (For more on packaging prepress standards, see page 11; for more on OMAC, see packworld.com/go/omac.)

Materials flow at Novartis

What about the tail end of the supply chain, where packaging materials are delivered to the packaging line? Are any new tools being used there?

They are at the Suffern, NY, facility of Novartis Pharmaceuticals Corp., which is based in East Hanover, NJ. The firm is completing the implementation of a manufacturing execution software system called PAS-X from Werum America (Rockaway, NJ) that will greatly improve and automate material flow from the warehouse to the packaging lines.

“We’re going from a paper-based replenishment system to an electronic one,?says Richard Lemire, pharmaceutical operations director of automation at Novartis. The benefits gained, he adds, will include labor cost savings, improved compliance with regulatory agency rules, and better use of available plant space. “There’s also the benefit of doing it right the first time,?Lemire adds. “That’s more difficult to get when you have a paper-based record. This new software system will tell you what to do and when. Then it will check to make sure the results are within spec.?

Until the new system can be implemented, packaging materials are supplied to packaging lines in this fashion. A line leader at a computer terminal pulls up a materials request screen from the company’s main resource planning system and fills it out. This request for packaging materials is transmitted to the warehouse controls system. The materials are then delivered to a packaging-materials staging area via automated guided vehicle (AGV) or forklift.

While this part of the process is paperless, what follows is not. A paper version of the materials request form is sent to the staging area so that a line leader can check the assembled materials against what is listed on the paper. The paper list is then checked again when the materials are moved from the staging area to the packaging line. “It is a very labor-intensive process,?says Lemire.

When the new software is implemented, the process will be simplified considerably. A big change is that it will no longer be necessary to stage all at once 100% of the packaging materials needed for a run. Lemire explains.

“One reason we currently stage the packaging materials as we do is so that everything to be used in a run can be reliably checked against the bill of materials all at once instead of piecemeal,?says Lemire. “With the new software in place, a line leader will see on a computer screen what the next run is and when it’s due to run. He can then begin ordering packaging materials for that run and have them brought directly to the line.?There a bar code on the bulk container will be scanned to instantly verify that the container is the correct one and to update inventory, which is tracked by the PAS-X system. “There will be no need to stage things and double-check the bill of materials anymore because the software has materials availability functionality built in. It eliminates the need to check a paper bill of materials.?

With the new system in place, a line leader will be able to schedule a delivery of caps from the warehouse to a packaging line every 20 minutes if that’s how frequently they need to be replenished. “It never made sense to pull so much material from the warehouse all at once. Why not pull one gaylord of caps every time it’s needed rather than pulling and staging 10 or 15 gaylords that will be needed for the total run? You can save a lot of floor space when replenishment is spaced out and smooth instead of lumped together.?

Replenishment is really what it all comes down to in matters of supply chain management, and most experts would probably agree that “spaced out and smooth instead of lumped together?is a fair description of replenishment’s future. Among those experts are the folks at Transora (Chicago, IL), the world’s largest global eMarketplace for the consumer packaged goods industry (see pack world.com/go/c017). Now backed by 57 consumer packaged goods companies, Transora’s very reason for being is to eliminate inefficiencies throughout the supply chain, from retailers right on back to the packaged goods companies and the manufacturers that supply them. The Transora vision is that every time a soft drink purchase is rung up at a cash register, a signal will be sent through a Collaborative Planning, Forecasting, and Replenishment system alerting the capmaker that there’s a beverage marketer who is one cap closer to needing a new shipment of caps.

While acknowledging that Transora’s vision is alluring indeed, Allan Waller says that the vision won’t be realized until the organization’s heavy-hitting packaged goods companies show they’re willing to collaborate in practice as well as in theory. Waller is the visiting professor at England’s Cranfield School of Management and is chairman at the Institute of Logistics and Transport, also in England.

“Historically, trying to get companies like Unilever and P&G to work together has been a bit challenging because they compete head-to-head in the marketplace,?observes Waller. “But that has to change. If you look at how business is developed today, you see that companies are depending more than ever upon supply chain performance to compete. It’s no longer just what’s in the pack or what it tastes like that counts. It’s also about having the best possible supply chain. Without that, Coca-Cola will never achieve its goal of having a Coke within arm’s reach of everyone on the planet.?

Waller believes that the only way to wring from the supply chain the kind of efficiencies that Transora envisions is for the Unilevers and P&Gs of the world to actively collaborate. He admits it’s ironic that such “hypercompetitors?should be asked to become supply chain collaborators. But he says he imagines them rationalizing it by saying to each other, “Let’s work together to make the cake bigger, and then we can each compete for our own slice of that bigger cake.?

Welcome to supply chain management in the new millennium.

Allan Waller addresses Supply Chain issues at a June conference; see: www.piranet.com