Brand marketers describe it as “speed-to-market” packaging. In operations, terms such as “quick changeover packaging” are used. Whatever the terminology, the need for packaged products to get in front of shoppers at breakneck speed, with packaging lines started and stopped to make changes such as package sizes and tooling as efficiently as possible, is essential for success today. The ability to get to market fast has become both a driver of marketing strategies for consumer packaged goods (CPG) companies and a cornerstone of value-added production services for contract packagers and others who package products.

Surprisingly, though, the success of this strategy is spotty at a time when the survival of many CPG companies depends on it. A new survey brings the reasons into focus. Though quickly produced packaged products—we’ll use the term quick-changeover packaging (QCOP)—have become an indispensable business strategy, many companies seem to be wasting time and money while executing it—and sometimes creating the dilemma of what to do with accumulated product inventory that has become obsolete.

In cases such as these, speed overtakes solid forecasting, past learning, and inventory management across the complex value chain. As a result, good management practices, such as leveraging marketplace analysis, blend into the background, and opportunities are lost to forecast and manage future product and packaging needs to prevent obsolescence.

A Contract Packaging and Packaging & Technology Integrated Solutions (PTIS, www.pti-solutions.com) survey of about 300 packaging professionals, conducted during May, identifies two factors that are impeding efforts to get packaged products produced as fast and efficiently as packaging teams would like:

1. The marketing department and those in operations are communicating seldom or never with each other. When they do speak, they tend to talk in different “languages” and often lack shared meaning. Poor communication too often is resulting in gaps between what marketing believes is possible in package creation and what operations says is realistic on the packaging line.

2. Project management systems are either non-existent or managed ineffectively by both CPG companies and packagers. Those involved in QCOP often aren’t mapping workflows and systems to identify process-improvement opportunities.

Why are excellent communications and project-management skills essential to creating stellar QCOP practices? John Henry, president of Changeover.com, says the costs of changeover rarely are measured, but they typically total as much as tens of thousands of dollars per hour. For a one-hour daily changeover on a fairly significant packaging project with the line running 240 days per year, the annual cost is $1.8 million. At that level, the costs of making changes on a packaging line to swap out a label or produce 8-oz bottles after running 12-oz bottles could factor heavily in calculating the profitability of a packaged product.

The benefits of good communications and stellar project management are greater than those who are involved in QCOP might realize. “You can take 50% out of the cost and time out of your project,” says Phil McKiernan, a principal at PTIS. He accomplished that measure of success at Kimberly-Clark Corp., where he developed a project management system while leading packaging organizations. “A speed-to-market project is complex. It involves lots of activities, steps, and people. But no one is stepping back and looking at the big picture. What are all the steps, and how do they fit together?”

Drivers of QCOP

In general, QCOP packaging capability is becoming a must-have for product manufacturers because of several fundamental drivers. First, savvier shoppers are demanding that products meet their expectations. Second, many retailers are fighting for survival in a still-weak economy; retailers are competing against each others’ own brands, as well as with national brands. Third, advances in machine technology and in process management techniques for operating modern production facilities are making possible the rapid-change packaging that CPG companies and retailers need to compete. The issue now is how to harness the opportunities that the advancements offer.

The following top-line results of the CP/PTIS survey reflect these marketplace dynamics:

• The ability to change out package formats, sizes, labels, and other components is almost universally seen as a critical packaging strategy today. That’s a change from 2006, when a separate survey, developed by CP, PTIS and Changeover.com, showed that 74% of the respondents identified quick-changeover capability as being very or extremely important at their company.

• Respondents wrote that QCOP orders represent 50% to 80% of their total workload—and in many cases have doubled or tripled from five years ago.

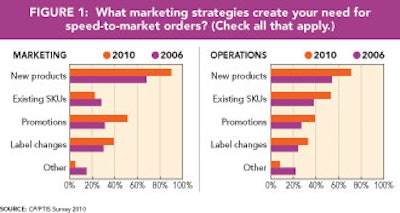

• Among those who filled out the marketing section of the survey, “new products” was the most often identified (90% of respondents) marketing strategy that creates speed-to-market orders (Figure 1). Following close behind were promotional packaging (51%) and label changes (39%). For those answering the operations section, the top three were new products (71%), existing SKUs (53%), and promotional packaging (39%).

• Interestingly, marketing respondents define “quick” very differently than those in operations, in the context of getting a package to the store shelf faster. Marketing respondents most often (82%) described it as being anywhere from one day to six months, (Figure 2), while 49% of operations respondents defined it as less than one day and 38% as one day to one month.

• Cross-functional teams continued to be the exception rather than the rule in making critical decisions on packaging lines (Figure 3). Only 28% of the time does a cross-functional team perform this role, and that is down from 35% four years ago. When the decisions fall to specific departments, packaging, operations, or marketing are the most likely to make them.

• The results also showed that small consumer product companies work more cross-functionally and nimbly, and with better-integrated operations, than large companies.

The influx of additional new products that is creating higher demand for speed to market intrigues Brian Wagner, PTIS co-founder. New-product introductions seem to be rising in 2010 after a recession-related dip in 2009, and Wagner suspects CPG companies are looking to improve their prioritizing new launches rather than continuing to rush through potentially unprofitable products.

Still working in silos

But Wagner continues to see warning signs, given the tendency for marketing and operations to work independently of each other.

“Marketers start with their own assumptions, such as that they will get innovation for the same or a bit more price than the previous innovation,” Wagner observers. “Their assumption, unfortunately, is based on existing cost, not on something new. By the time marketing tells anyone what they’re working on, what they’re told is the supplier can’t get it in that amount of time or that they can’t deliver it within budget.”

Hence, the survey’s uncovering of different definitions for what is “quick” (Figure 2). Wagner theorizes that the marketing perspective is assigning more time to launches in 2010 versus 2006 in part to more measured thinking in developing the right product in the right package. But he also suspects they’re procrastinating on bringing operations into the mix until very late in the process. At that point, packaging line decisions, for better or worse, need to be made very quickly. In the case of operations, “quick,” as discussed in the survey’s written comments, may be a description of the reality of “get it out the door fast” rather than a measure of the multi-department planning and execution that should be occurring in production.

“What we find in our discussions with companies is that the better CPG companies get their suppliers involved early,” Wagner says. “In early concept development, marketing asks operations, ‘What can we do for 7 cents per unit, or 5 cents per unit?’ That way, their suppliers have time to offer some options that will also work on the line.”

Project management deficiencies

Beyond serious gaps in communications, verbatim responses in the survey point to other unresolved issues in the quest to push packaged products out the door faster. Marketing respondents cited reduced times for final approvals and getting artwork approved, and the need for better overall planning as being among the biggest challenges to a successful QCOP project. Operations personnel, on the other hand, listed more effective decision-making; better coordination and integration of design, materials, and equipment; and repeatability on the production line as primary challenges.

McKiernan says the results point to a clear need for better all-around project management capabilities.

“One way or another, you need a process, and someone to manage it, whether it’s a department or an influential or knowledgeable person,” McKiernan says. Written comments in the marketing section of the survey describe challenges that range from “access to all decision-makers” to “getting all parts of the process to move quickly in decision-making.” These concerns tell McKiernan that CPG companies aren’t mapping workflows and developing opportunities to improve the process itself.

The survey results suggest this challenge is particularly acute with larger CPG companies. Both Wagner and McKiernan say that in general, the larger the company culture, the more difficult it becomes to introduce project-management techniques.

Contact Jim George at [email protected].

[Sidebar 1]

Glossary

John Henry, president at Changeover.com, divides quick-changeover packaging into two broad areas:

• Product changeover, which is the total process of bringing a new product or a modification of an existing product, to market. It begins with the identification of a need for the product and ends when the consumer purchases the first new product. Product changeover normally is a one-time occurrence.

• Line changeover, which describes the process of changing a production line from running one existing product to another existing product. It begins when the last unit of the previous product is made and ends when the line is producing “good” units of the next product at normal speed and efficiency. Line changeover is repetitive.

[Sidebar 2]

Go slow to go fast with process mapping

It sounds counterintuitive. Why go slow when the objective is to reach the endpoint as fast as possible?

That’s exactly the issue at many organizations: They fail to recognize the complexities of effective project management and focus only on doing the “mad scramble,” where individuals and groups operate independently to change out packaging fast on the line.

To go fast, organizations must step back and assess the cross-functional development process from end to end. Process mapping is a tool to determine who is involved, when they are engaged, what activities and value are provided, and how much time it takes for each task. Once mapped, organizations realize there are many process loops, redundancies, and unnecessary parties in the process.

Developing a streamlined process map typically requires senior leader sponsorship to drive organizational change, eliminate turf wars, and ensure the process is focused on competitive advantages of delivering reduced cost and significant speed to market. Typical benefits include:

• Reduced resource effort across the organization.

• Consistent delivery of high-quality and error-free solutions.

• 50% or better reduction in process cost and concept to execution time.

• Improved organizational collaboration and process understanding.

—Phil McKiernan, PTIS

[Sidebar 3]

How the survey was conducted

This article is based on about 300 responses to an online survey conducted in May 2010 by Contract Packaging and PTIS. Those who took the survey were instructed to complete either the marketing or the operations section.

Respondents came from a mix of small, medium, and large consumer packaged goods companies; contract packaging service providers, suppliers, and consultants to the industry.

Responses were received from titles including CEO/president, vice president of marketing, brand/innovation/marketing manager, operations/packaging manager, packaging engineer, quality control manager, package design manager, designer, and brand consultant.

[Sidebar 4]

Four steps to better project management

Brian Wagner and Phil McKiernan at PTIS list four steps to project management:

1. Make it a priority

2. Keep it simple

3. Map your processes

4. Enable the person who manages the process to have the authority to effect change

McKiernan says these steps don’t change much for small or larger CPG companies: “They’re bundled differently, with fewer people wearing more hats at a smaller company, but the steps are the same.”

[Sidebar 5]

Improving operation-side processes

A well-conceived QCOP strategy involves operational issues in addition to marketing considerations, and success requires tight coordination between marketing and manufacturing operations.

John Henry, president of Changeover.com, divides QCOP into two broad areas:

• Product changeover, which is the total process of bringing a new product or a modification of an existing product, to market. It begins with the identification of a need for the product and ends when the consumer purchases the first new product. Product changeover is normally a one-time occurrence.

• Line changeover, which describes the process of changing a production line from running one existing product to another existing product. It begins when the last unit of the previous product is made and ends when the line is producing “good” units of the next product at normal speed and efficiency. Line changeover is repetitive.

In either case, Henry, says, it is essential for marketing and operations to work seamlessly. To do that, each department should consider walking in the other’s shoes. But operational managers in the survey say that is not happening nearly often enough in marketing circles, and the result is costly delays for modifications when the package design doesn’t work as intended on the production line.

His observations are reflected in one written comment in the CP/PTIS survey:

“Every minute a machine is not running, it is not creating the wealth the owner purchased it to create. A multiday changeover costs the company in lost production, which many times exceeds the cost of the changeparts. No one really thinks about it, but it is there all the time, eating away at a company’s potential for success.”

Marketing should understand that even minimal design changes could significantly affect a package’s performance on a production line, Henry adds. The right design can bring significant cost savings by simplifying or reducing the amount of required line changeover, but the wrong design can invite costly delays, so any design changes should be well justified before the package reaches production.

Conversely, says Brian Wagner, PTIS co-founder, contract packagers and those working in operations can increase their value to the marketing department by understanding the forces that prompt marketers to request changes to package designs. Changes come in response to carefully conducted marketing research that uncovers trends or identifies sudden shifts in consumer and retailer preferences and demands. If marketers don’t make those changes to keep current with marketplace sentiment or push their brands ahead of the curve, their brands could lose sales or perish.