Continued market-share gains for private-label products are intensifying the uneasy relationship between retailers and owners of national brands. That development could have potentially unsettling ramifications for packaging innovation, judging from responses to an exclusive Packaging World targeted survey.

Notably, more than half of the respondents from consumer packaged goods (CPG) companies said growth in private-label products provides opportunities for their national brands. This is a significant change from polls in recent years in which CPG companies generally regarded the growth of private-label brands—some retailers refer to them as “own brands”—as a competitive threat. However, nearly one-third of respondents from CPG companies in the PW survey also believe retailers impede packaging innovation.

The question going forward is how well retailers can co-exist alongside CPG companies in their dual roles as store operators and brand owners in their own right, functioning as both an ally and competitor of national brands. Whatever happens, the survey results indicate, packaging suppliers can play a role in package development and innovation by identifying opportunities that drive growth across categories. But optimal supplier input can occur, the survey results indicate, only if suppliers are brought earlier into the picture.

For their part, material and service providers expressed a different set of concerns. Those who responded to the survey believe they are somewhat caught in the middle of the tug-of-war between private-label and national brands. They expressed apprehension, for example, in providing innovative packaging ideas for a retailer’s own brand at the risk of upsetting a national-brand customer that markets a competing product. Contract packagers that service both private-label products and national brands offer one snapshot of this quandary as they scramble to enforce confidentiality agreements on their packing lines and in their warehouses.

Packaging World conducted its on-line survey in July 2009 with the assistance of Packaging & Technology Integrated Solutions . Responses totaled 209, and they broke down this way: 33% were from CPG companies of different sizes, 27% from suppliers, 10% from retailers and the rest from a variety of areas, such as equipment manufacturers, consultants, and industry educators. Top-line results from the data and the analysis show:

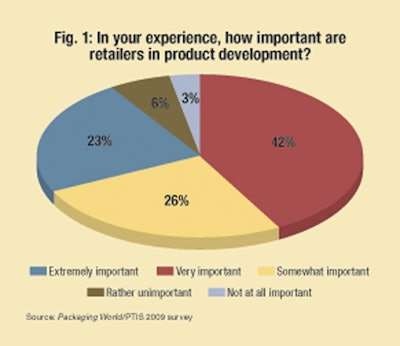

• 65% of respondents overall say retailers are very or extremely important in product development (see Fig. 1). The figure rises to 67% for retailer respondents and dips slightly to 60% for CPG company respondents.

• Asked about package development, 65% of all respondents agreed retailers are very or extremely important (see Fig. 2). 60% of the CPG company respondents and 57% of the retailer respondents concur.

• About 60% of respondents on the whole said private-label products present an opportunity for their business (see Fig. 3). The figure was 53% for CPG companies and 52% for retailers. The survey results suggest that this belief gives suppliers approval to work on retailers’ products, as there are plenty of packaging-innovation ideas to go around.

• About 24% of respondents overall say retailers hinder product and package innovation (see Fig. 4). Among CPG company respondents, 31% agreed, as did—candidly—14% of the respondents from retailers.

• Asked who should foot the bill for “retail-ready” packaging, CPG company respondents were more likely than retailer respondents to agree the costs should be shared universally (see Fig. 5).

Retailers can’t leverage the same volumes for their own brands as CPG companies can for their national brands, so retailers already pay a premium for stock packaging. They know their shoppers well and are beginning to understand the important role packaging can play in a marketing strategy. It appears that once retailers resolve upfront design and tooling costs, they probably can afford innovative packaging and are willing to pay a premium for it, says Brian Wagner, vice president at PTIS.

“National brands don’t value packaging as much and focus on squeezing costs out of packaging,” Wagner continues. “For both retailers and CPG companies, the ones who wake up and understand packaging’s value as a brand differentiator, and as an investment, will win.”

How do CPG companies and their supply chains feel about retailers and innovation? From the product manufacturers’ perspective, product category seems to be a factor driving their angst.

The assertion by 31% of the CPG respondents (Fig. 4) that retailers sometimes block packaging innovation may owe in part to a perception held by some package-creation teams that retailer acceptance of innovation correlates with private-label penetration in some categories. One view held in package-design circles is that some categories reward innovative packaging more than others. This usually occurs when one or two national brands dominate high-volume product categories such as soup and soft drinks, and bring in shoppers. Prevailing thought is that retailers, therefore, believe in the need to follow the leader to keep sales high.

Does approach vary?

This perception also holds that retailers are more likely to place cost savings over innovation in categories lacking a dominant national brand. In pet food and elsewhere in the store, private-label products have gained more of a foothold with packaging that showcases much-improved printing and graphics, but often includes stock packaging components to keep costs low. That appears to be the lead that national brands must follow in some categories.

“Retailers see some categories as not value-driven on the part of the national brands, so they feel they can be much bolder in seeking price concessions from the big brands, and in questioning any innovation that would drive up price,” observes Anne Bieler, a consultant at PTIS.

Despite those concerns, the overall view about the impact of private-label growth on packaging development was positive in the survey (Fig. 3). Own brands are seen as jump-starting some product categories and providing opportunities to lift competing brands. And many respondents held the view that packaging suppliers have plenty of valuable, untapped ideas sitting on their shelves for the benefit of all. Effective communications earlier on in package development between retailers, product manufacturers, and suppliers could bring those ideas to the forefront, the results suggest.

But others said that already is happening, at least to some degree. Said one respondent who was representative of those in support of retailers: “Sometimes retailers push for innovation that would not come otherwise.”

The pro-retailer segment also said the stores’ role provides the benefits of drawing directly from their intimate understanding of their shoppers’ needs and preferences. And they are helpful with designing for space considerations.

But those who believe retailers hinder more than help packaging innovation cited the following reasons: inconsistent packaging requirements and restrictions from store to store, thereby increasing production complexity. In turn, the complexity leads to delays and excessive focus on cost.

Respondents who fell into this camp lamented that retailers often set restrictions rather than drive innovation.

“They typically do not know what they want and are unrealistic in their timing expectations,” was one typical comment in the written remarks.

Another said, simply, “They help, they hinder. Depth of knowledge in retailing is the issue.”

And a respondent from a winery that supplies retail stores had this to say: Retailers aid package innovation, but they also could add more value to the innovation process “ by helping packaging companies test their innovations.”

Besides retailer/CPG company competitive tension and insufficient communication, survey respondents cited cost as another obstacle to packaging innovation. Some of the most noteworthy innovation is seen in “retail-ready” packaging, increasingly a retailer requirement in which products are shipped in shelf-ready cartons to reduce in-store labor costs. But disagreement is strong about who should shoulder the costs for retail-ready packaging. Only 42% of respondents overall agreed that costs for such packaging should be shared universally (Fig. 5). Some of those who disagreed believe retailers should bear the burden when requiring packaging that reduces labor costs, but others believe packaging is a function of getting a national brand to market, and primarily should be a CPG company cost.

What the future might hold

A small core of CPG companies and retailers understand packaging’s impact on product development and branding. More of them understand there is a wealth of research on what makes consumers buy, although some of the information is shared and some is closely guarded.

The next steps toward progress, the survey results suggest, should attempt to bring more of that knowledge together for the greater good. A sustained effort should include finding ways to encourage more retailer and CPG company collaboration. Written comments in the survey support the idea that packaging suppliers should play a key role in the dialogue—and earlier in package development—to identify opportunities that drive growth across categories. However, discussions must get past retailer/product manufacturer tension as competitors and also disagreements about price.

“By liaisoning with the (retail) buyers to get the departmental heads and seek definitive feedback from customers at the cash register, it means deep teamwork to achieve the best result for all,” one supplier offered.

One possibility, a number of the written comments suggested, could be “innovation sessions” in which retailers, product manufacturers, and suppliers brainstorm ideas. Wagner and Bieler agree such a suggestion has merit, but it also presents another challenge. Supplier input is essential, but who is the supplier’s customer? Some suppliers and service providers are reluctant to work with retailers, lest they feed retailers packaging innovation ideas that could upset their CPG company customers.

Some packaging materials and service suppliers avoid that conflict by working with retailers or CPG companies, but not both. One of them is The Visual Pak Companies, which provides contract manufacturing, packaging, and logistics services in Waukegan, IL, and Atlanta, GA.

“Retailers come to us all the time, but we’ve promised our CPG customer base we won’t compete against them,” said Tim Koers, Visual Pak’s chief operating officer. “In the end, the retailers respect that. We have to be consistent.”

“It is clear from all sides that there is an interest in talking to each other. But how do you bring them together?” Bieler concludes. “The voice of the retailer is the buyer, and you need to have a forum with them to get any collaboration going.”