In recent years we’ve seen an evident change in the way products are packaged. Fresh produce, wine, and even beauty products have made the switch from rigid to flexible packaging. New studies from the Flexible Packaging Association (FPA) explore why more brand owners are packaging their goods in flexible packaging and why more consumers are choosing flexible packaging over rigid.

Findings from the new study build off FPA’s 2015 Brand Value Study, which determined that flexible packaging fits contemporary consumer lifestyles and retail trends. The study also found consumers are willing to pay premium prices for product attributes enhanced by flexible packaging. Additionally, it confirmed packaging has a positive, documented impact on brand value. To see coverage of FPA’s 2015 Brand Value Study, visit pwgo.to/2792.

The 2016 Flexible Packaging Transition Advantages Study integrates insights from brand owners surveyed online in September 2016 by Packaging World magazine and consumers surveyed online in September 2016 by Harris Poll.

Of those surveyed, most brand owners indicated they are using a mix of flexible and rigid packaging for their products. Only 14 percent of respondents are exclusively using flexible packaging and 14 percent are exclusively using rigid. While the current use of flexible and rigid packaging is fairly evenly weighted, data from the survey shows that in the past five years, 26 percent of brand owners transitioned to a higher mix of or entirely to flexible packaging, while just 13 percent of brand owners made the transition to a higher mix of or entirely to rigid packaging.

Survey results suggest this trend will continue and brand owners are likely to lean toward even greater use of flexible packaging in the near future, as 31 percent of respondents projected they will switch to a higher mix of or entirely to flexible packaging in the next five years.

Multiple benefits

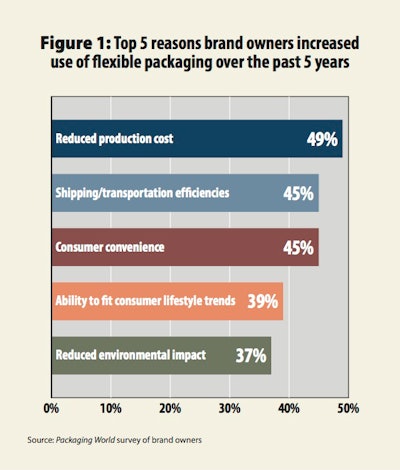

Brand owners who switched from rigid to flexible packaging cited operational benefits and ability to meet consumer needs as key reasons. Among the brand owners who increased their use of flexible packaging in some way, the top reasons cited for the shift included (see Figure 1):

• Reducing production cost (49%)

• Shipping/transportation efficiencies (45%)

• Ability to meet consumer needs like convenience (45%)

• Fitting consumer lifestyle trends (39%)

Brand owners who switched to using more flexible packaging did, in fact, experience operational benefits and consumer-related benefits after making the switch. Among those who increased their use of flexible packaging in some way, 57 percent lowered production costs and nearly half (49%) achieved supply chain efficiencies and/or lowered transportation costs.

Additional results from the brand owner survey include these:

• Many brand owners are already using some form of flexible packaging (83%).

• 31 percent of respondents expect to transition to a higher mix of flexible packaging in the next five years.

• 58 percent of respondents who have already transitioned to a higher mix of flexible packaging intend to use more in the future.

• Among those who increased their use of flexible packaging, reasons cited most frequently for the shift were reduced production cost (49%) and shipping/transportation efficiencies (45%).

• Brand owners also said convenience (45%) and fitting consumer lifestyle trends (39%) are benefits that influenced them to transition to flexible packaging.

• Among those who increased use of flexible packaging in some way, 57 percent were able to lower costs of production.

• 55 percent of those who increased their use of flexible packaging reported a sales improvement.

Consumer survey

Results from the online consumer survey of more than 2,000 adults in the United States conducted by Harris Poll on behalf of FPA in September 2016 provide some additional insight into the sales benefits brand owners are reporting with flexible packaging. Consumers recognize the benefits of flexible packaging, prefer it over non-flexible, and are willing to pay more for food stored in it. When asked to choose between different packaging for a product they were considering purchasing—assuming the product is exactly the same and only the packaging type differs—71 percent of respondents said they preferred the product in flexible packaging over non-flexible.

A majority of Americans, 79 percent, believe there are benefits to having food products stored in flexible over non-flexible packaging. This percentage is even higher among adults ages 18-34 (86%). Benefits most often cited by consumers appear to point to convenience as a key influence on buying decisions. Attributes consumers indicated of food stored in flexible packaging include (see Figure 2):

• Ability to reseal (47%)

• Easy to store (44%)

• Easy to open (35%)

• Reusability (29%)

Snacks and salty snacks top the list of products consumers most want to purchase in flexible packaging instead of non-flexible packaging (61%), followed by cereal and breakfast products (44%).

FPA’s 2015 Brand Value Study found consumers are willing to spend more for packaging with certain benefits. Those results are consistent with the findings in this year’s study. Almost half (46%) of consumers are willing to pay more for food products stored in flexible packaging than they would for food products stored in non-flexible packaging. On average, they are willing to spend 10.3 percent more, and consumers under the age of 45 are more likely to spend more for flexible packaging than consumers ages 45 and older.

Additional results from the consumer survey include these:

• When asked to choose between flexible and non-flexible packaging for a product they were considering purchasing (assuming the product was exactly the same and only the packaging differed), 71 percent of Americans said they would prefer flexible packaging over non-flexible.

• Seventy-nine percent of Americans believes there are benefits to having food products stored in flexible packaging compared to non-flexible packaging.

• Forty-six percent of Americans are willing to pay more for food stored in flexible packaging than they would for food products stored in non-flexible packaging.

Insights from both packaging professionals and consumers in the Flexible Packaging Transition Advantages Study suggest the flexible packaging industry will experience steady growth, continue to innovate, and outpace rigid packaging. Many brand owners (83%) already use flexible packaging and more than half (58%) of those who have switched to using more flexible packaging in the last five years say they will also use a higher mix of flexible packaging in the next five years. As a result of the operational benefits and ability to meet consumer needs associated with use of flexible packaging, brand owners will continue to reap the benefits of transitioning to a higher mix of flexible packaging in the years to come. While the packaging industry continues to evolve, brand owners can leverage the innovative aspects of flexible packaging to meet consumer demands for convenience.

Methodology

The Flexible Packaging Association commissioned Packaging World to conduct a cross-industry brand owner survey in September 2016. More than 200 packaging professionals were surveyed for the analysis, representing food and beverage, healthcare/pharmaceutical, personal care, consumer products, industrial, and other industries. Those surveyed represent package developers, package machinery engineers, procurement executives, brand managers, package designers, consultants, and sales representatives. Respondents were surveyed about packaging use, preferences, and business impact. To gather responses for this FPA survey conducted by Packaging World, three e-mail invitations were sent to the publication’s e-mail database. Respondents who identified themselves as packaging suppliers were filtered out of the results. This resulted in a net total of 201 product users for analysis.

The Harris Poll survey of consumers was conducted online within the United States by Harris Poll on behalf of G&S Business Communications from September 9-13, 2016 among adults ages 18 and older and from September 28-30, 2016 among 2,007 adults ages 18 and older. This online survey is not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated.