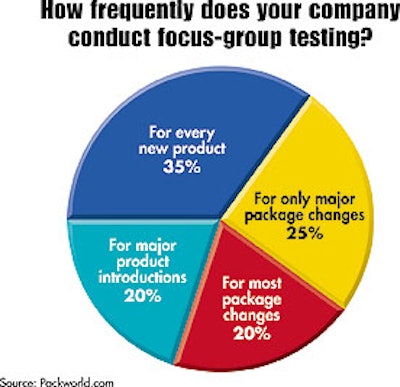

The consumer is queen (or king) when it comes to determining the ultimate success of a product and package in the market. But just how involved are consumers in determining a package before it’s introduced to the market? To find out, Packaging World conducted a survey among packagers. This article reports on the results of the survey conducted late last year on PW’s Web site, Packworld.com. This report covers 115 respondents, 107 from end-user packagers and eight from contract packaging companies (see sidebar, p. 86). More than 63% of the respondents said that they do involve consumers in evaluating packaging for new products before they’re introduced. When asked how often their company conducts focus-group testing, 35% of those responding to the question said they did so for every new product (see Chart A). One in four indicated such testing was conducted for only major changes to the package. One in five said focus groups were convened for most package changes, with the same ratio saying it was conducted only for major product introductions. The survey also asked how often consumer focus groups are used to examine just the packaging. Among those answering the question, 30% said focus groups are used for virtually every new package tested (see Chart B). The next most-frequent response came from the 26.3% who said their company’s testing involved a package most of the time. Less than half the time was cited by 18.7% of the question’s respondents. How often are consumer suggestions from focus-group testing incorporated into the commercial package? Twenty-one percent said those suggestions were used most of the time, while another 18% said ideas generated from consumer testing were incorporated for virtually every new package tested. For a look at how specific consumer suggestions led to packaging changes, see sidebar, “Suggestions that work,” p. 84. The survey asked what types of packaging-specific input a company most often looks for from focus-group test participants. Graphics appeal was identified as the most important area, cited by more than 43% of respondents, followed by handling and storage functionality (23%), opening and reclosing features (21%), and pourability and dispensability (13%).

At what price? Certainly, gaining consumer input when developing a package requires a financial investment. Roughly one in five survey respondents listed cost as the primary factor in determining how much focus-group testing is conducted for a new pack. Other factors were time, whether the package launch was national or regional, and the willingness of consumers to participate in such testing. So, just how much did companies spend each time they conducted packaging-related focus-group testing for a new product/package combination? Among those who answered the question, one in three respondents indicated spending ranged between $1ꯠ and $4꿇 (see Chart C). Another 21.7% said it was less than $1ꯠ. The next most-frequent answer came from the 16.7% of respondents who said their companies invested between $5ꯠ and $19꿇. Another 13.3% noted company spending between $20ꯠ and $50ꯠ. Factoring in company size Larger companies tended to invest the most money in packaging-related consumer focus-group testing. At the largest companies, for example, most respondents said expenditures ranged between $5ꯠ and $19꿇 for each test. Smaller companies most frequently cited lower spending. For companies employing between 101 and 499 people, and at firms with 500 to 2ꯠ employees, most focus-group spending was from $1ꯠ to $4꿇. At even smaller companies, spending was usually limited to less than $1ꯠ per test. Not only do larger companies spend more money on focus-group testing, they also conducted such tests more frequently than their smaller counterparts. In general, respondents from smaller firms reported that cost was the primary factor in determining test frequency. At the largest companies, the primary factors were whether the product/package launch was national or regional in scope and the uncertainty regarding test result reliability. It’s unclear what respondents meant by test reliability. One final area of interest related to how often the company incorporated consumer input into its packages. Here, 54% of respondents at the smallest companies said consumer suggestions were used at least half of the time. That figure slipped to 46% in slightly larger firms, and to 35% in companies with between 500 to 2ꯠ employees. Conversely, nearly 70% of respondents from the largest companies said their businesses incorporated consumer ideas at least half the time. Given their more substantial investment in time and money, it’s understandable that these larger companies make greater use of consumer input before they launch a package commercially.