The new millennium marks an opportunity for prognosticators to portend the future. For manufacturers of food and beverage packaging machinery, the future looks solid, though perhaps not as strong as in recent years.

That's according to a market intelligence report published by Specialists in Business Information, a "brand" of Kalorama Information (New York, NY). The SBI Market Profile: Food Processing and Packaging Equipment report is published irregularly, with its most recent version dated June 1998. What makes the report especially interesting is its five-year forecast.

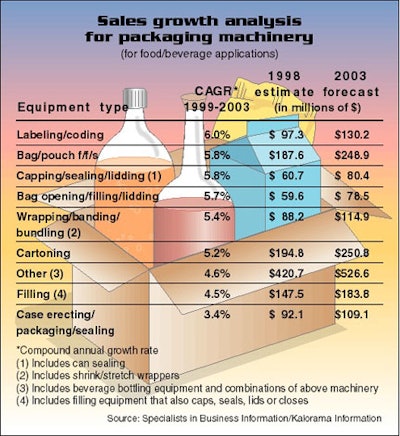

Based on market trends and historical factors, this report projects a compound annual growth rate (CAGR) of 4.9% for U.S. sales of packaging machinery for the food and beverage industries only. That figure reflects domestic sales minus exports plus imports.

In its executive summary, the report says, "Due to its competitive nature, food processing and packaging equipment industry growth patterns and profitability have only been average compared to other sectors of the domestic economy." Comparing processing and packaging equipment, the report says that between 1992 and 1998, processing equipment sales increased at a stronger rate than packaging machinery for food applications. "Despite this trend," it says, "food and beverage manufacturers continue to spend more on packaging machinery than on processing equipment."

Equipment-specific forecast

The report breaks down U.S. shipments of packaging and bottling machinery for food and beverage applications by equipment type. As shown in Figure 1, cartoning equipment tops the list of specific machinery, with sales forecast at $250.8 million. Bag and pouch form/fill/seal equipment follows closely at $248.9 million. "Other equipment" ranks first at $526.6 million, though the category includes beverage bottling carbonators and combinations of machinery classified in more than one category.

In percentage terms, the strongest individual machinery growth prediction is for labeling and coding equipment, at 6% per year between 1999 and 2003. Above-average growth rates are also expected for bag and pouch f/f/s equipment and for capping/sealing/lidding machinery. Both of those categories are forecast to grow at 5.8% during the same time period.

While the report focuses on equipment, it also forecasts U.S. shipments of rigid food and beverage containers. By 2003, 34.7 billion metal cans, or 67% of containers, are expected to be shipped. For glass, the forecast is for 9.4 billion containers (18.2%), with 7.7 billion plastic containers (14.8%). Compared to the report's 1998 estimate, plastic shows the strongest CAGR percentage in the five-year period, at 2.4%, with metal growing at 1%. Glass is forecast to decline by 3.4% each year.

In forecasting shipments of rigid beverage containers for 2003 (as compared to the report's 1998 estimate), plastic again leads the way in growth percentage, forecast at 2%, with glass up 1% and metal cans forecast to decline 1%. Total beverage container unit shipments for 2003 are forecast for metal at 110.8 billion, 33 billion for plastic and 24.4 billion for glass.

The publication discusses factors that affect domestic demand, the competitive environment and profitability, as well as the global marketing strategies that affect packaging equipment sales. Among the report's key findings:

* Stable interest rates have led to machinery investment to expand capacity, improve productivity and introduce new products in varying product sizes.

* An upturn in industry profit margins reflects moderating material costs and rising labor productivity.

The report states that "market growth trends are projected to slow over the next five years as food and beverage industry capital expenditures decline." In addition, the report expects U.S. interest rates to rise from their present levels due to the bias of the Federal Reserve to raise rates." The 151-page black-and-white report, including numerous charts, is available for $1괇.