The continuous manufacturing market is expected to reach US$650.4 million by 2022, up from US$348.5 million in 2017. That represents a Compound Annual Growth Rate at of 13.3%. The end product manufacturing segment is estimated to represent the largest share of the market as easily available technology for end product as compared to API.

These figures come from a reportsnreports.com forecast that segments the continuous manufacturing market on the basis of product, application, end user and geography. The product segment includes integrated systems, semi-continuous systems and controls.

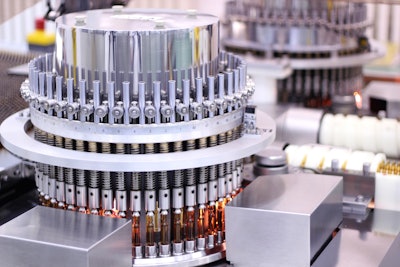

ReportsnReports says the integrated systems segment is expected to account for the largest share of the continuous manufacturing market in 2017. The integrated systems enable end-to-end manufacturing to convert raw materials into final products. In addition, these systems save substantial cost and time by integrating various pharmaceutical processes in a single system.

By application, the end product manufacturing segment is estimated to account for the largest share of the market this year. FDA approval for certain drugs manufactured by the continuous process is the primary factor driving the growth of this segment.

On the basis of end user, the full-scale manufacturing companies are expected to hold the highest share of the market in 2017. The large share of this segment can primarily be attributed to the increasing adoption of continuous technologies by pharmaceutical manufacturing companies and CMOs to address the challenges related to product quality, drug supply and operational costs.

The geographic segments in this report includeNorth America,Europe,Asia-Pacific, and RoW. Of these, the North American segment is expected to account for the largest share of the market in 2017. This large share can primarily be attributed to the support from regulatory bodies, initiation by leading pharmaceutical companies, and the need for pharmaceutical manufacturers to reduce rising operational costs and eliminate issues related to the inconsistent quality of pharmaceutical products produced through batch manufacturing.

Product launch was the dominant strategy adopted by key industry participants to increase their market share and cater to unmet needs. Major players include GEA Group AG (Germany), Thermo Fisher Scientific Inc. (U.S.), Bosch Packaging Technology (Germany), Coperion GmbH (Germany), and Glatt GmbH (Germany). Other players include KORSCH AG (Germany), Munson Machinery Company, Inc. (U.S.), L.B. Bohle Maschinen + Verfahren Gmbh (Germany), Gebruder Lodige Maschinenbau GmbH (Germany), Baker Perkins Ltd. (U.K.), Scott Equipment Company (U.S.), and Sturtevant, Inc. (U.S.).