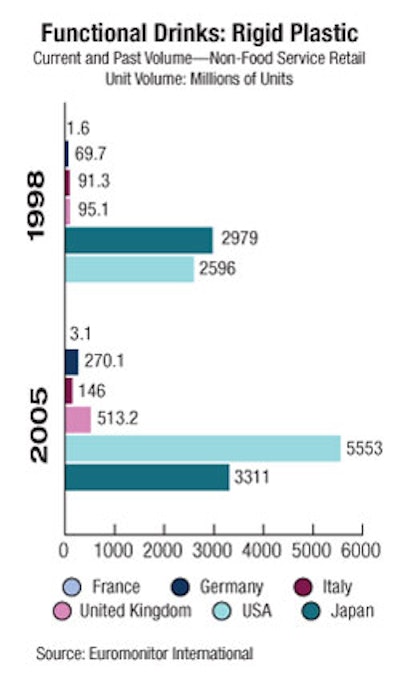

Massive global beverage brands such as Coca-Cola and Pepsi continue to account for the lion's share of global soft drink sales. However, in recent years, a new contender has appeared offering the strongest growth of any category in many global markets. This growth has come from relatively high-value, low-volume sectors such as ready-to-drink (RTD) tea, energy drinks, and functional beverages.

In the United States, products such as Fuze vitamin fortified beverages, Izze sparkling fruit juices, and Starbucks' Frappuccino RTD coffees have all achieved success with higher-margin, lower-volume products. Elsewhere around the globe, products such as Georgia Kuromame Café Au Lait, a "health and beauty" coffee drink marketed to women (Japan), Britvic's Ame line of sparkling fruit juices with herbal extracts (United Kingdom), and Rauch's Nativa, an RTD Tea with added ginseng and gingko biloba (Europe), have all done well. In each case, manufacturers have targeted a specific consumer seeking more energy, physical fitness, or simply a healthier, more "premium" alternative to standard carbonated soft drinks.

The implications of this trend for packaging companies are profound. While cost remains a primary concern, factors such as product differentiation, barrier protection, and a premium positioning have become equally important in many sectors. Glass has seen resurgence in recent years as an attractive option for hot-filled beverages, many containing functional ingredients that require strong barrier protection.

Metal cans have been revived by booming sales of energy drinks in slimline cans while PET manufacturers have worked hard to create a hot-fill bottle that retains the smooth appearance of glass. Consumers and manufacturers have grown more demanding of these products, yet also more willing to accept a range of unconventional packages in a sea of competing products.