Handle it internally or outsource it? If outsourced, is the task performed by a systems integration firm or by a packaging machinery OEM acting as contractor for the entire line? What about the role of the IT department—do you see it growing in importance?

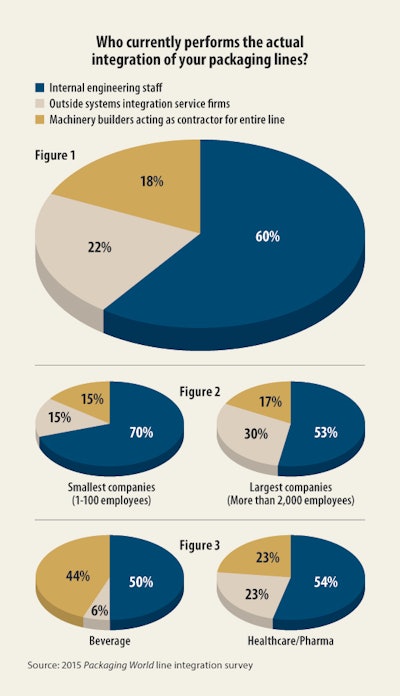

These are but a few of the questions about packaging line integration that have been rattling around in our collective editorial brain, questions that persuaded us it was time to conduct a survey on the topic. More than anything else we wanted to learn if the responsibility for integrating packaging lines these days is borne by inside or outside personnel. As Figure 1 shows, 60% of respondents indicated it’s being handled by an internal engineering staff. And when the responsibility is outsourced, the likelihood of it going to a systems integrator is just slightly greater (22%) than to a machine builder acting as contractor (18%).

Figure 2 illustrates the breakdown of respondents grouped by the size of their company. In companies employing fewer than 100 people, an internal engineering staff handles packaging line integration 70% of the time compared to 53% for companies with more than 2,000 employees. So the smaller the firm, the more likely it is that packaging line integration is handled internally. It’s likely that cost issues are what cause the smaller firms to try managing integration internally without having to pay an outsider.

When integration is not handled internally, in companies employing fewer than 100 people the same percentage of companies (15%) have an outside systems integration firm do the job as have a machinery builder acting as contractor. For the larger firms who outsource integration, a considerably higher percentage (30%) go to outside systems integrators than to machinery builders (17%).

One final observation on the question of who performs packaging line integration. When we directly compare Beverage respondents to Healthcare/Pharma respondents (Figure 3), we learn that 50% of Beverage and 54% of Healthcare/Pharma respondents have it performed by an internal engineering staff. So basically half for each industry. If integration is outsourced, 23% of Healthcare/Pharma respondents pick outside systems integration service firms and the exact same percentage picks a machinery builder acting as contractor for the entire line. Beverage respondents who outsource integration, on the other hand, pick machinery builders far more often at 44% than outside systems integration service firms, at only 6%. This comparative preference on the part of Healthcare/Pharma respondents for outside systems integration service firms is probably due to the tangle of regulatory issues Healthcare/Pharma companies face compared to what Beverage respondents face, a situation that makes a specialized outside systems integration provider more attractive to Healthcare/Pharma respondents than a mere packaging machinery OEM.

Verbatim comments

Some of the questions we posed were aimed at teasing out verbatim comments and observations from the respondents. For example: “What was positive about your most recent experience with an outside or third party systems integration service?” We expected the fairly predictable comments about how welcome the additional resources were and how helpful it was to have an outside opinion. Or as one respondent put it, “It widened the thinking space.” One respondent was especially grateful for the “high-level expertise in PLC control,” another for “open platform support such as OPC,” and another for “good quality programming, good documentation, and an overall good result—but partly because we provided a clear and comprehensive functional specification.” Having a single point of contact was mentioned repeatedly, too, as a very welcome thing.

We also asked what was negative about recent experience with an outside or third party systems integration service, and one thing that cropped up frequently was the high cost of the service provided. One respondent appeared to have difficulty with an outside integration service because they didn’t know the product well enough. He put it this way: “They need to know the product well to provide the best recommendation for integration because this will be a long-time commitment.” Also showing up was evidence that the packaging machinery OEMs represented on a new line and the outside integrator responsible for roping them all together aren’t always on the same page: “The integrator didn’t take responsibility for delivering a working system and none of the machine suppliers would own up to the fact that their machine was a problem.” Finally, one respondent felt the outside integrator was too fond of complexity: “It’s like that cartoon about the Marketing Department asking for a swing from a tree limb and the Engineering Department delivering instead a massive construction of beams and girders.” Apparently there can also be issues surrounding controls options: “We are sometimes pushed to stray from our preferred PLC/HMI or drive preferences in order to avoid delays in machine delivery.”

We also asked about positive and negative experiences with packaging machinery OEMs acting as packaging line integrators. On the positive side came these comments:

• “The benefits to a single, qualified, OEM integrator were lower TCO, faster time to startup, and reliable support through design, build, install, startup, and running support.”

• “As the OEM we chose got involved in selecting other pieces of packaging equipment needed in the line, they became a key part of the project team.”

On the negative side, in addition to numerous complaints about cost or cost overruns, came these comments about machinery OEMs acting as packaging line integrators:

• “Just the cost of change parts was astronomical. Simple tasks became mammoth jobs as they chose various items of machinery to do the job. Things became so complex and hard for an average operator to set up and keep running efficiently that I’m currently looking at ‘old school’ machinery that can do the job quicker, more efficiently, with less waste, minimal change over time, and a huge reduction in change part costs.”

• “Our senior engineers retreated to being contract administrators, and they became reluctant to get involved in detailed learning about the new equipment. This was exacerbated by OEM reluctance to explain everything clearly.”

• “They made change parts for packaging that did not allow a wide enough tolerance for variations in packaging materials.”

Back to the data. Figure 4 illustrates respondents’ plans for the future. What we see in Figure 5 is that considerably more than half of the respondents keep the buying decision to themselves, 58%, while only 35% occasionally authorize other machinery suppliers and just 6% frequently do so. Considering the amount of capital tied up in a new packaging line, it’s little wonder that so few respondents authorize other machinery suppliers to make buying decisions for them with any kind of frequency. Also of note, this preference for always making the entire buying decision is slightly more pronounced in the smaller firms (61%) than in the larger ones (51%).

We also looked at how the answer to this question broke out among these specific industries: Cereal, Cheese, IQF Frozen Food, Meat or Poultry, Pasta, Powders, Produce, Seafood, Beverages, Healthcare/Pharma, Personal Care, and Industrial. Three of these industries, it turns out, always make the entire buying decision: IQF/Frozen Food, Meat or Poultry, and Seafood.

Buying teams, not surprisingly, are very popular, with 80% of respondents saying their company relies on such a team to specify machinery on packaging lines. Company size doesn’t make much difference: 76% of small firms and 87% of large firms acknowledged that such a team is in place. As for who occupies the buying team (Figure 6), the job title selected most frequently (53%) was “Plant production, operations, quality.” A close second at 47% was “Packaging line engineering,” and third was “Packaging machinery engineering” at 42%. Knowing that engineering and operations professionals are part of the buying teams as frequently and consistently as they are should come as welcome news to those in the packaging profession who fret that machinery buying decisions these days are too excessively influenced by financial advisors, accountants, procurement people, or various denizens of the C-Suite.

In an effort to uncover whatever pain points might be out there in the packaging line integration arena, we asked what obstacles are most frequently encountered as integration projects unfold (Figure 7). The obstacle cited most frequently, at 51% overall, was “Changing of project goals/scope during the integration project.” (See sidebar below for more on this data point.) Next was “Difficulty integrating machines from different vendors” at 44%. It’s probably worth pointing out that this particular obstacle could be minimized considerably if PackML, officially ISA-TR88.00.02, were more heartily embraced and implemented.

Among the verbatim comments or observations about obstacles to the packaging line integration process was this one: “Getting engineers to plan for future innovation is an obstacle. Currently they only buy to suit existing products. It’s hard to give them guidance on ‘What might be.’” Another respondent offered this as a pain point: “Integration of new packaging equipment with process plant beyond that supplied by packaging machinery suppliers.”

What about IT’s role?

Considering how increasingly influential Information Technology has become in shaping our every waking moment, it was a little surprising that only 36% of respondents indicated that IT’s role in influencing decisions about integrating packaging lines is increasing.

It’s also useful, in discussing packaging line integration, to ask about the role played by machinery suppliers’ capabilities, which is why we included this question in the survey: “Some large machinery suppliers have broad product lines, or consist of several individual machine companies to provide a one-stop shop for their customers. Is this useful to you?” Considerably more respondents, 64% to be precise, favor such all-in-one machinery suppliers (Figure 8). Perhaps it’s in response to this marketplace preference that we see unified groups of OEMs like ProMach continuing to add new OEMs to the group, or that we see a Bosch Packaging Equipment buying a Kliklok-Woodman. When we broke out the responses by industry (Figure 9), 100% of respondents in both the Cheese and the Seafood industries indicated that they favor such all-in-one machinery suppliers. The only industry showing a strong preference for choosing machines from individual suppliers was Powders.

Comparison with 2007 survey

Since this is the first integration survey conducted by Packaging World for editorial purposes, there are no comparisons to earlier published data available. However, in 2007, on behalf of a packaging machinery supplier, we did send a very similar survey to an audience essentially the same as the audience that received this 2015 survey. Three specific questions drew considerably different responses:

• In 2007, 74% of respondents said that internal engineering staff performed packaging line integration. In 2015 that number dropped to 60%. It’s a pretty safe bet that the drop-off reflects the ongoing trend to thin the ranks of people employed directly in the nation’s manufacturing sector, a trend that accelerated significantly in the 2008 economic downturn.

• In 2007, 52% of respondents said they favor packaging machinery suppliers having broad product lines because it facilitates one-stop-shopping. In 2015, that number rose to 63%.

• In 2007, when asked to name the obstacles that stood in the way of packaging line integration projects, 46% picked “Difficulties integrating machines from different vendors.” In 2015, that number stayed about the same: 43.92%. But one response that changed noticeably was that in 2007, 38% of respondents picked “Changing of project goals/scope during the integration project” as an obstacle. In 2015, that number rose to 50% and was the obstacle identified most frequently by the respondents. It’s likely that this reflects the increasingly complex challenge faced by CPG companies as they try to cope with SKU proliferation. For example, a packaging line integration project might get underway in January only to have the Marketing Department in March identify a demographic—millennials, seniors, singles, craft beer aficionados, empty nesters—whose unique buying preferences require modifications to the line.