InfoTrends recently completed research about brand owners and their opinions regarding the printing of packaging and labels. Our objective is to gain understanding of what brand owners want from package and label printing, and what they will want in the years ahead. Packaging World has been our partner for a key part of our research, a structured survey of managers at companies in several vertical industries. We’re grateful for the help that Packaging World has provided, and this month we offer a detailed summary of core results from that survey, as well as insights from related interviews.

Because InfoTrends’ client base is mainly makers of digital printing equipment, a strong share of the questions in the survey concern color digital presses—such as systems from EFI Jetrion, HP Indigo, Xeikon, and Xerox—that are dedicated to packaging or label applications. Still, many of our survey questions concern printing in general, and so the results should also interest makers and users of flexo, offset, and other conventional presses. Some of the key findings:

• Awareness of color digital presses is now high, at 75% of our total respondents, and actual use, while much lower, is still significant.

• Prime labels are by far the top application for color digital presses, followed by two much smaller adjacent uses: folding carton and flexible packaging.

• Commitment to sustainability is now a big factor in the choice of printing methods and materials for packaging and labels.

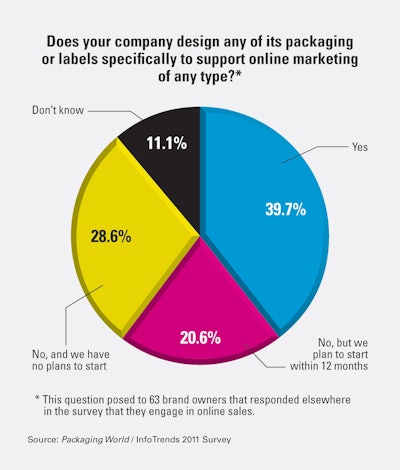

• Interest in on-line marketing and interactivity is high, and for many brandowners packaging now has special features to support that interest.

• Versioning to meet different goals will continue to grow, adding still more short runs to meet brand owners’ marketing needs.

As we’ll show in the text that follows, many of these findings point to a stronger role for digital printing, not just by color digital presses but by wide format and other printers used for prototyping and very short runs.

Our survey was completed in May 2011 and drew 155 brand owner respondents. The food and beverage industry provided the most respondents (42.6%), followed by health and beauty (14.2%), pharma (10.3%), durable goods (11.0%), and software (2.6%). By region, North America dominates the response, at 83.9% of total, followed by Western Europe, 6.5%, Asia Pacific, 6.5%. A few other details about the respondents:

• Product and packaging designers or engineers are 38.1% of respondents, CEO/other top managers are 22.6%, marketing/sales managers are 13.5%, product/brand management, 10.3%

• Big and small companies responded, ranging from 36.8% companies with under $10 million in annual revenues to 23.2% with $1 billion or more.

Awareness and use of color digital

Among all 155 respondents, about 75% say that they are aware of color digital presses, either electrophotographic or inkjet, that are now an increasingly common option for printing packaging and labels. InfoTrends has determined from other research that labels, and especially prime labels, are the application that has caused this relatively high awareness and are by far the biggest application that such presses are used for. In Chart A, we isolate the 117 respondents who are aware of color digital presses and ask about use or non-use of these presses by their brands. As seen in the chart, 67.6% of them say that there is some use of color digital presses to print their packaging or labels, and that translates to 51.0% of all responding companies. Based on follow up interviews with a number of respondents, those uses in fact range widely, from very short test runs to production runs of 20,000 or more labels or other packaging units. Whatever the case may be, the most important wedge in the pie chart below is the 17.9% who say their brands use no color digital presses now but probably will in the future. Even as a share of all the survey’s respondents (13.5%), that tally indicates that brand owners will likely increase their use of color digital presses.

Chart B describes the respondents who say their brands have some use of color digital presses and who also say that they themselves are familiar with the main packaging and label printing technologies. The question asks “For what applications does your company use color digital printing?”, with multiple choices permitted. As seen in Chart B, prime labels is the top choice, at 71.8%, followed by flexible packaging and folding cartons at 28.2% each, and shrink sleeves at 20.5%. Color digital printing is thus a regular tool for many brands, even in applications where it is not well known, such as flexible packaging. Based on other research, though, InfoTrends believes that for color digital presses such as HP Indigo and Xeikon, over 90% of the print volume is attributable to labels, of which we would describe shrink sleeve as an important and growing sub-set. By comparison, folding carton and flexible packaging are tiny uses of color digital presses today. Although these adjacent uses are clearly growing, for now their volumes on color digital presses are comparatively limited, with narrow digital web width and specialized finishing being the biggest constraints.

Sustainability is a big factor for print

The survey asked brand owners about sustainability—how important is it when making decisions about the purchase of packaging or labels? On a scale of 1 to 5 for importance, with 5 being most important, sustainability rates 3.7 on average. The biggest companies ($1 billion or more in sales) give the highest importance, a 4.0 average. It terms of its importance to the choice of print method, our project’s personal interviews indicate that the importance of sustainability is more variable. A representative of a national brand of condiments, for instance, explained that within his own operations, sustainability is a top concern, one that spurred the installation there of waste-to-energy generating capability and advanced technology for waste water treatment. Meanwhile, he notes that when choosing a print vendor, job pricing is more important than whether or not the vendor’s operation is “lean” or environmentally responsible, adding “We don’t get credit for the print company’s being green.”

According to director of marketing David Lunati at Monadnock Paper Mills, a longtime supplier of sustainable packaging materials, “green”-oriented brands often also have a strong interest in strategies to cut waste throughout the supply chain. For some brandowners, he notes, one strategy is printing with color digital presses, in particular because they support a just-in-time approach to inventory and manufacturing.