In the next five years, fresh produce, pet foods, meat/poultry/seafoods, snack foods, and medical/surgical end-use markets will demand greater use of flexible packaging materials. That prediction comes from the The State of the Industry Report 2001, published annually by the Flexible Packaging Assn. (Linthicum, MD). The 132-page spiral-bound publication focuses on flexible packaging in the United States, which it says employs 89ꯠ people.

Flexible sales are expected to grow 3.5% this year to $19.7 billion (see Packaging World, Aug. ’01, p.4, or packworld.com/go/fpa2001). That figure is just under the association’s estimate of 3.6% growth last year.

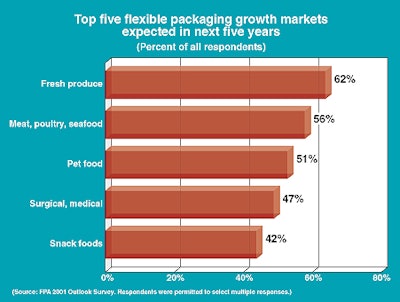

The end-use market projections (Chart 1), as well as the overall report, come from the FPA 2001 Outlook Survey of member converters and suppliers, as well as information from the U.S. Departments of Labor and Commerce and other sources.

This story focuses on end-use markets for flexibles; the accompanying sidebar looks at converter issues.

Produce to build sales

The report credits the freshness and convenience of prepackaged produce such as fruit as a market factor that will help build flexible sales. Survey respondents pointed to an aging population, better shelf-life characteristics, technical innovations, and product-line expansions as reasons for increasing use of flexible materials in produce.

While 62% of respondents selected fresh produce as a top-five end-use market for flexible packaging, 56% also voted for meat/poultry/seafood. Drivers for this market included the development of case-ready meats and better shelf life. Reasons given for the growth in seafood included portion packaging, improved graphics, an emphasis on point-of-sale merchandising, and differentiation.

Another 51% of respondents predicted gains in pet food material sales. They cited the movement of such products, particularly treats, to stand-up pouches instead of composite cans. The report also cited the more recent conversion of pouches replacing cans. “It already is a significant market in Europe, and the U.S. is just beginning to recognize the potential,” says the report.

Rapid growth in new technologies, biotech products, disposable devices, implants, as well as an aging population, served as reasons why 47% of respondents project solid growth in the surgical/medical market. Another 42% listed snack foods as a top-five growth segment, mentioning that packaging design innovation and functionality, and “on-the-go” consumers, will continue to boost demand.

Meat beefs up sales

While survey respondents projected which markets would be strong in the next five years, the State of the Industry report provided figures on flexible packaging purchases in 32 specific end-use food areas, based on the North American Industrial Classification Standard’s (NAICS) U.S. industry groupings. These numbers represent 1998 figures, the latest data published by the Census Bureau.

These 32 markets were grouped into 12 larger market categories, led by the meat and poultry segment with $1.83 billion in sales (Chart 2). In the column to the right of the purchases is the percentage of packaging identified as flexible. In other words, 62% of the meat and poultry market specified flexible packaging, so rigid packaging would account for the remaining 38%.

After meat and poultry, markets most frequently specifying flexibles were confectionery at 58.1%, followed by snack foods at 56.5% and pet and animal food at 50.3%.

Among the 32 more specific markets, the poultry processors were the top buyer of flexibles, purchasing $766 million worth of material. Next came a category called “animal slaughtering (except poultry)” at $704 million.

That category was followed by snack food ($571 million), dog and cat food ($377 million), meat processing ($363 million), and confectionery from purchased chocolate ($345 million). The last category refers to chocolate confectioneries that make product from chocolate produced elsewhere.

Among the 32 NAICS categories that showed the strongest sales growth in ’98 compared to ’97 were chocolate and confectionery from cacao beans (up 17%), creamery butter (14.3%), tortillas (13.9%), cheese (12%), and “other” snack foods (11.5%). Flexible sales declined primarily in the areas of animal slaughtering, flour milling products (-5.8%), and dry pasta (-5.7%).

Survey respondents were also queried about packaging and the environment. Asked if customers are requesting source-reduced packaging, 36% said yes. Among converter respondents, 44% answered affirmatively, while only 29% of suppliers said yes. Not surprisingly, those responses indicate that source reduction is more of a concern to end-user firms looking to meet consumer requests.

The 44% of converter customers requesting source-reduced packaging is up from last year’s 29% rate, and even tops the 42% figure from 1999. But while source-reduced packaging requests are up, the percentages of customers specifying recycled content continues to be weak, at only 4%, with a whopping 96% saying no.

As it does every year, the FPA’s annual report also looked at larger trends and issues pertaining to flexible packaging materials. Among the most notable is the issue of consolidation among packaging end users. This has helped create a record volume of mergers and acquisitions in recent years, according to FPA. The trend is projected to continue and to increase “as converters expand their operations to follow end users into international markets or to concentrate their efforts on local and regional niche markets.”

Although the forecast is for end-user company consolidation to continue, the State of the Industry Report says the pace of converter consolidation slowed to 19 completed transactions last year, down from 25 in ’99.

In its 11th year of publication, the report is available free to FPA members; $3귔 to non-FPA members.

See sidebar to this article: Mixed bag for converters