Most future signs are positive for users of flexible packaging materials. But the converters that supply those materials may face some troubling internal issues in the years ahead. That’s according to The State of the Industry Report 2000, published by the Flexible Packaging Assn. (Washington, DC).

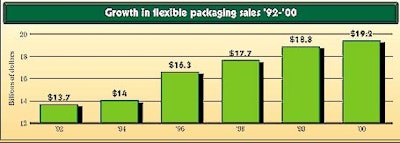

Most of the good news concerned overall sales of flexible packaging and the production index that FPA members report. Sales of flexible materials (Chart 1) were estimated to have risen 3.9% in ’99, compared to the previous year, and were predicted to be up by 4.8% this year. The index of production (the number of companies reporting production gains minus those that report declines) reached 67% in ’99, the highest rate since ’96. In ’99, these companies were eight times more likely to report increased productivity than to report a decline. Converter profits, too, continued strong at 7% in ’98 and at 6.4% through half of ’99 (more details about converters’ concerns can be found in the adjacent Upstream story, p. 33).

On the downside, shortages of hourly workers affected nearly nine of every 10 converters in ’99, and this problem is expected to continue this year. Less troubling, about three of every 10 converters say they face a shortage of salaried employees, too. But this number is actually down a bit from the year before. As well, converter exports dropped in ’99, the first decline since ’92. This was attributed both to economic conditions overseas and to the strong U.S. currency.

In terms of markets, fresh produce packaging regained its position as the largest growth market predicted for the next five years (Chart 2), according to respondents. About three of every four FPA members see produce packaging as the top application for growth through the year 2005.

The medical/surgical market ranked second in projected growth over this period. Drug packaging and pet food applications were the next markets ranked for growth potential. Snack foods rounded out the top five growth markets, as predicted by converters.

Replacing rigid containers

Probably the most common market application for flexible packaging was in replacement of rigid packaging materials. Some 63% of all converters participating in FPA’s Outlook Survey reported new business designated to replace a rigid container of some type. Nearly two-thirds report these conversions were for consumer food packs, while more than 40% say they had business replacing rigid packs for consumer nonfood products. Obviously, many converters handled both types of markets.

Overall, converters reported that, in about 80% of the cases, the prime motivation to switch to flexibles was cost reduction by end-users. Flexible packaging was used for new product introductions 42% of the time, while repackaging of products that are already established in the marketplace occurred 37% of the time.

Even though new applications seem to appear daily, the number of converters that offer stand-up pouches has increased modestly from the previous year, 49% to 52%. However, this is still a threefold increase over the 19% of converters that reported they offered stand-up pouches in ’94.

Unlike elsewhere in the world, the issue of packaging source reduction continues its decline in importance in the U.S. Although this was a primary factor in the switch to flexible packaging that began in the mid-’90s, customer requests for source reduction has reached a new low. For year 2000, only 29% of converters report requests for source-reduced packaging. This figure is down from about 42% in ’99. From ’94 through ’96, about 60% of converters said they had customers that wanted to reduce their use of packaging materials by using flexible rather than rigid packaging.

Similarly, interest in materials with recycled content is weak. Only 3% of converters say they have received requests for recycled content in flexible packaging, and all of those requests are for post-consumer recycled resin.

Biggest markets

Of the total of $19.2 billion estimated to be spent on flexible packaging in 2000, the food industry will claim a major share. Based on U.S. Department of Commerce statistics for ’97, well over $7.12 billion of purchases were made by food manufacturers.

Of specific segments of the food business, the meat and poultry market combined for the largest share, at just under $2 billion. Next was bakery and tortilla products, at $1.06 billion. Dairy ($867 million) and confectionery products ($723 million) followed. Other markets that each recorded more than $500 million in sales included processed fruits and vegetables, pet foods and snacks.

Still, great volumes of flexible packaging are used in nonfood applications. This is borne out by converter predictions about hot markets in the next five years. Along with pet food, pharmaceuticals and medical/surgical packaging, converters also rated highly two large categories: agricultural products and industrial chemicals, and a combination of cosmetics, toiletries and household cleaning products.

These two markets are expected to grow faster than many parts of the food business.

Copies of the FPA report are available for $25 (for FPA members); nonmember price is $1꿃. Along with a more detailed look at the converter information detailed here, the report also includes substantial coverage of FPA’s supplier members.

See sidebar to this article: Converters worry about labor, materials