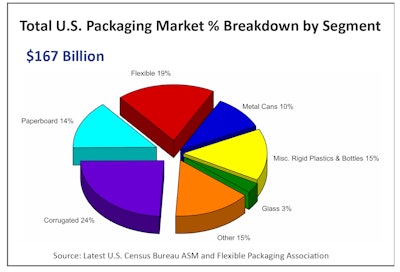

Factors such as sustainability, digital printing, and e-commerce would all seem to bode well for the future of the flexible packaging materials market. Flexibles represent approximately 19% of the total $167 billion U.S. packaging industry, according to the just-released Flexible Packaging Association’s (FPA) “2018 State of the Flexible Packaging Industry Report.”

Although FPA’s report is not a trends report, the association does report that flexibles rank as the second-largest packaging segment, behind corrugated paper but ahead of bottles and miscellaneous rigid plastics packaging.

“Flexible packaging’s solid, long-term strength, coupled with flexible packaging replacing other packaging formats, resulted in the growth of flexibles from 17% in 2000 to the current level of 19% in 2017,” notes FPA.

That steady growth is reflected in the total flexible packaging industry, which FPA estimates at $31 billion in annual sales for 2017, up from the $30.2 billion in 2016 noted in the association’s 2017 report. The $31 billion includes packaging for retail and institutional food and non-food (including medical and pharmaceutical), industrial materials, shrink and stretch films, retail shopping bags, consumer storage bags, wraps and trash bags.