In PMMI’s second Virtual Town Hall, held April 2, a panel of consumer packaged goods (CPG) professionals from the OpX Leadership Network Executive Council convened with PMMI members to discuss a host of ways they can work better together. They covered a range of topics, the full complement available on this page. But one topic in particular was how to navigate sourcing in an era of potential supply chain disruption. After all, the two sit next to one another on the chain.

Moderator:

Tom Egan, vice president, industry services, PMMI

Panelists:

Adam Pawlick, vice president, engineering, Blue Bunny Ice Cream (food manufacturer)

Greg Flickinger, senior vice president operations, GTI (cannabis product manufacturer and retailer)

Tom Ivy, president, F.R. Drake, CV-TEK and RapidPak (OEM)

Ryan Edginton, president & CEO, All-Fill Inc. (OEM)

Supply chains hanging on, but careful planning is required

According to CPG panelists on the call, the current supply chain environment is mixed, but so far is generally holding up. A Packaging World survey reveals the biggest questions to come may lie in the ongoing shift from foodservice to retail production, but people are still eating--that won't change.

Still, lags in production that are happening now may take some time to make their way downstream to manufacturers, requiring advanced supply chain planning.

“We feel the real impacts may be further out,” says Flickinger. “We’ve tried to set ourselves up so we have two to three months of materials—packaging and raw materials—in-house and on-shore. We’re working on a four to five-month time horizon to project and figure out how we’re going to manage our way through.”

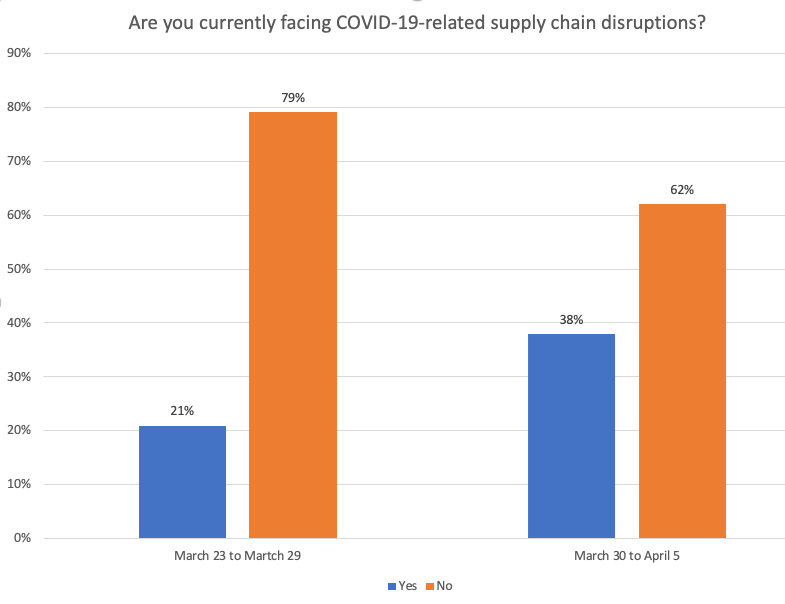

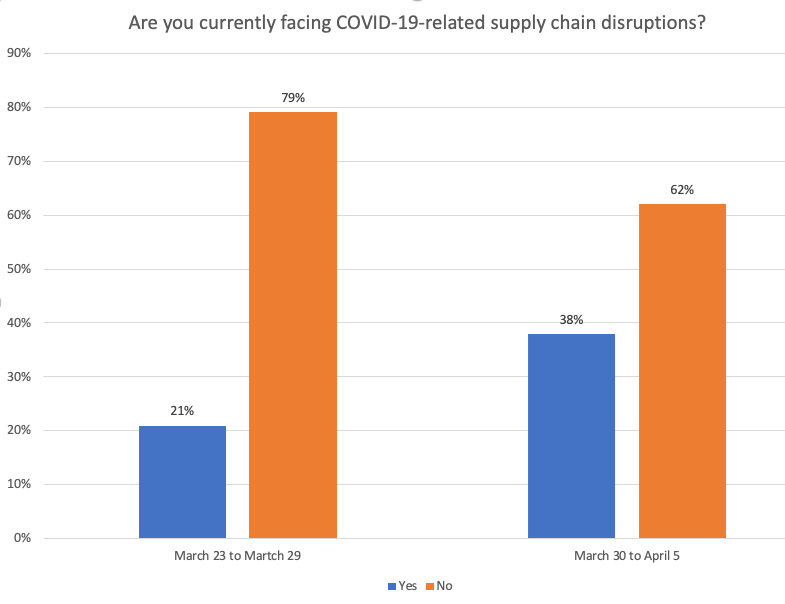

According to week-over-week data reflecting PMMI members' survey responses, more OEMs/machine builders are experiencing supply disruptions now than in the previous week.

According to week-over-week data reflecting PMMI members' survey responses, more OEMs/machine builders are experiencing supply disruptions now than in the previous week.

That’s because ingredient and raw material production in locked down countries—India and China especially—has in cases been completely shut off. While inventories here in the states are holding out, that stretch of zero production will eventually catch up to American manufacturers, after some lag. Even as places like China appear to ramp back up, and hopefully India will before long, a lot of thirsty manufacturers will be waiting when those faucets are turned back on. COVID-19 response teams at CPGs are thus planning for that eventuality, and communication among teams seems to be the primary method of problem-solving.

“We have weekly calls with all of our site operations general managers and other stake holders,” Flickinger says. “We're constantly looking at the current inventory position of materials, how much is available within a day or on-shore, and then looking at the projection going forward. We're now working and projecting out into the four-month-plus segments.”

Pawlick at Wells Enterprises relies on close and frequent communication as well, with daily pandemic response team calls across roughly 26 critical areas. Supply chain stabilization is one of those 26.

Says Pawlick, “100% of this team’s time is now dedicated to ensuring that ingredients are showing up, packaging is showing up, people are showing up, and trucks are showing up. We've put a laser like focus on making sure we've had minimal interruptions here.”

Absenteeism's role in supply disruption

It’s interesting that Pawlick listed “people showing up” in a supply chain discussion. The panel revealed that workforce attendance/absenteeism and supply chain interruption are closely linked, and this is particularly visible just upstream of manufactures at the machine builder or OEM level.

According to both Ivy and Edington, both coming from an OEM perspective, worker absenteeism is a danger for future supply chains. Ivy, for one, believes that there was enough in the distribution pipeline to cover his supply needs for at least a month. Companies had enough inventory in warehouses that up to now, they could ship, and to a certain extent, maintain regular production.

“But I think you're going to see, and what we're starting to see now, is interruptions to the supply chain and overall supply do worker absenteeism is going up at the [parts] factories. As this goes on longer, and workers get more worried, you get more absenteeism,” he says. “That will definitely affect OEMs. I think you're going to see a drastic change in the next three weeks, as to disruptions in supply chain. That’s because now the warehouses are depleted, all inventory stock is gone, and everything we had in our plant is depleted.”

Ivy is taking a similar tact to his CPG and food manufacturer panelist counterparts in doing a daily supply chain health check call with his team but goes a step further in including their own upstream suppliers, particular mission critical suppliers.

That’s because many of Ivy’s suppliers also work on other essential or critical businesses, healthcare for instance. Some prioritization is given to medical facilities in need of personal protection equipment (PPE), “over supermarkets wanting ham steaks,” he says.

“We're doing calls with our own suppliers daily, and we're finding it changes daily,” Ivy adds. “It's getting pretty dynamic out there.”

While simply avoiding COVID-19 is causing the absenteeism that stands to disrupt supply chains, Greg Flickinger says not to forget the disruptive capability of COVID-19 positive cases, either in your own facility or in that of a direct, primary supplier.

He gave an example of a supplier, one with a single point of distribution in the U.S., that had two people test positive for COVID-19. Being a distribution location, it was warehouse. GTI had an essential, time-sensitive construction shipments that needed to come out of that warehouse. But the warehouse had to shut down, quarantine, and clean. It was down for three or four days.

That forced Flickinger to reposition materials from another state into that project until the affected supplier could get the warehouse back up and running.

This case study brings several supply chain considerations. Are you coming from a single point of reference? Is there a sub-supplier that is the only source of what your direct supplier needs? If a sub-supplier is coming from a single sourcing point, that becomes another danger area; another critical potential choking between a CPG and the equipment and materials it needs.

“The fact is we’re also going to see internal disruptions that could be a couple of days here and there, or they could be very impactful in the supply chain when all of our local inventories are depleted,” Flickinger says. “It's not a question of if COVID-19 infections are going to affect us. We have to think that all of our suppliers, even us, we're going to get hit with a positive. The question is, are we prepared, and how do we react to keep the rest of our people safe from risk? Secondly, how do we try to keep our operations flowing under those circumstances?”

According to week-over-week data reflecting PMMI members' survey responses, more OEMs/machine builders are experiencing supply disruptions now than in the previous week.

According to week-over-week data reflecting PMMI members' survey responses, more OEMs/machine builders are experiencing supply disruptions now than in the previous week.