For months, the editors at Packaging World have seen a flood of announcements of price increases for virtually all types of packaging materials and containers, from steel to paper to resin and film costs. But it’s difficult to know how many of these increases have “stuck” and were enforced. In July, PW surveyed manufacturers about higher packaging prices via its Web site, Packworld.com. Information about the respondents to the survey can be found in the sidebar, Who participated in survey, on p. 51.

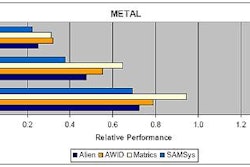

The primary results of the survey are shown here in several charts. In the survey, respondents were given a list of 14 different types of packaging products, including machinery and services. Although the charts don’t display all 14 product types, they do reflect the responses by the largest number of participants.

For example, in Chart 1, we’ve grouped together as “other” seven of the product types that reflected the fewest number of responses. Increased prices on void-fill materials were identified by only about 2% of respondents, and glass, aluminum, and steel container prices were listed as higher by fewer than 4% of respondents, respectively.

It’s interesting to note that the answers changed a bit when the survey inquired about the product categories with the largest price increases (see Chart 2). Although many of the answers corresponded to the earlier list, plastic containers, packaging equipment, and even steel containers were mentioned far more often.

Packaging driving product pricing?

The survey also asked whether packaging costs were driving increases in product selling prices. Although nearly half (49%) of respondents said there had been no change in the selling price of their companies’ products, 45% said their companies had increased product prices modestly, and more than 6% said that packaging costs had caused significant price increases.

However, this upward pressure on prices did not materially affect company sales, most participants reported. About 64% reported no effect on company sales, and 9% reported that company sales had improved. Still, slightly more than 20% of respondents reported a modest decline in sales, while 7% said a noticeable or significant sales decline was due to increases in packaging costs.

When the survey asked about changes in supplier service over the last year, nearly two-thirds of participants said their companies were experiencing declines in service. Half of these participants cited longer delivery and lead times, while 11% said their companies felt product quality had declined.

However, a full third of respondents felt that supplier service had improved with higher prices for packaging. Some 16% reported improved services, while another 12% reported better delivery and lead times.

Converters of packaging materials have seen a slow recovery of the economy and increases in their costs, especially for resin, film, and energy. The energy costs of their suppliers—coupled with more competition from abroad—are major factors in their businesses this year, according to the State of the Industry Report, published by the Flexible Packaging Assn. (see the sidebar below).

Changing package specs

As shown in Chart 3, many respondents said that their companies have changed packaging specifications for products that have experienced price increases over the past year.

This is far less true for buyers of glass, steel, or aluminum containers, void-fill materials, and unprinted label stock than for the packaging components that may be considered more as commodity products.

In addition, survey respondents indicated that more than 42% of their companies have switched from one packaging material to another over the past year. Chart 4 shows that a sizable number of respondents indicated that their companies have switched packaging suppliers in the last year. In fact, some 17% say their companies changed several suppliers of packaging or changed suppliers more than once for the same material.

When the survey asked for the primary reason their companies changed suppliers, 66% cited rising prices. However, 19% reported that reduced services was the reason to change, while 13% cited longer lead times as the primary cause. And nearly 3% said the reason was being placed on allocation programs.

One surprising result was the large number of participants who said their companies purchased packaging materials and equipment under allocation programs over the last year, as shown in Chart 5.

Supply chain dictates use of distributors

The survey also asked respondents whether their companies buy packaging products through distributors or they buy only direct. Here, predictably, the answers ranged from none all the way to 100% of purchases through distributors. Of those respondents who said their companies buy through distributors, many reported their companies purchased from 5% to 30% of their packaging via distributors.

For those participants whose companies buy at least some packaging through distributors, the survey asked them to identify the most valuable service a distributor provided to their company. While “quality,” “customer service,” and “prompt delivery” were mentioned frequently, some respondents were more vocal.

An engineer for a food ingredients company who reported his company bought only about 5% of packaging via distributors, said the distributor provided “availability of little-used packaging components.” A purchasing executive with a major pharmaceutical company who reported a similar level of purchases through distributors, said the distributors kept “inventory on-hand.”

A plant manager at another pharmaceutical company who said his company bought about 20% of packaging through distributors credited distributors for “information about alternative materials.” A buyer for a maker of hand tools said his company buys about 20% through distributors, because they offered “better pricing on some items that we can’t or don’t buy in large quantities.”

Other comments about distributors’ service from a variety of manufacturers included: “Worry-free delivery,” “Just-in-time delivery,” “Ability to buy smaller quantities per order,” “Competitive pricing on short-run work,” “Holding safety stock to reduce lead times,” while “Vendor-managed inventory” was cited several times.

Some respondents weren’t so complimentary about distributors. A purchasing executive for a major medical products company grumbled: “They seem more trouble than they’re worth.”

See sidebar to this article: Who participated in survey

See sidebar to this article: RFID investments

See sidebar to this article: Costs of resin and films primary issue to converters