Case-ready meat and poultry packaging is alive and thriving in retail supermarkets and club stores across the nation, according to results from the recently released National Meat Case Study 2007. Conducted for the third time since 2002 by Cryovac/Sealed Air, with support from the National Pork Board and the National Cattlemen’s Beef Assoc., the study is beginning to establish itself as a solid source of trend information on the fresh meat case.

Among the study’s major findings are that: 1) case-ready meat is continuing to take over the fresh meat case; and 2) that some case-ready packaging formats—modified atmosphere packaging (MAP) and vacuum, in particular—have been increasing in use, at the expense of others.

But while this data may be an accurate indicator of current technology, it may not tell the whole story. Current forces, such as the rise of sustainable packaging, consumer concern about product safety, and a growing interest in products sourced regionally, are gathering. These forces may change the future composition of the retail fresh meat case.

MAP, vacuum grow; overwrap takes a hit

In the context of this article, “MAP packaging” will be used to refer to the deep-drawn, rigid trays covered with film lidstock that are typically flushed with a mixture of gases, including carbon monoxide, to extend the product’s shelf life and red color. These are often referred to as “low-oxygen” packages.

“Overwrap trays,” often called “high-oxygen” packages, refer to case-ready packaging that uses an expanded polystyrene tray covered with a permeable, polyvinyl chloride overwrap to present the product. These trays are multipacked in a barrier master bag that is back-flushed with a mixture of gases that maintain freshness until the bags are unpacked at the retail location.

Similar to overwrap tray packaging is a format used for fresh poultry. Represented by Cryovac’s SES and SSD branded products, it consists of an EPS tray with a film overwrap that uses either a flap seal or a three-way beaded seal on the back of the package. The film for this poultry packaging is typically printed to provide attractive, point-of-sale graphics.

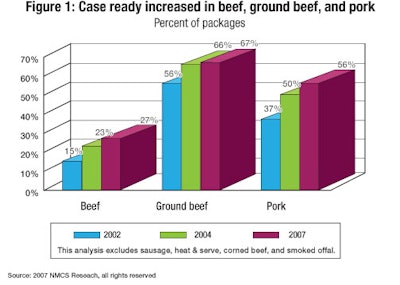

Delving into the study results, figures show that since 2002, case-ready meat as a percent of the total fresh meat case has increased from 49% to 64%. For primal cuts of beef, that number has grown from 15% in 2002 to 27% in 2007; for ground beef, 56% to 67%; and for pork, 37% to 56% (see Fig.1). Chicken and turkey, which rapidly increased their case-ready share from 83% to 95% and from 85% to 95%, respectively, from 2002 to 2004, showed moderate change in 2007 (see Fig.1).

Regarding the types of case-ready packaging used, the study points to a rapid rate of decline for overwrap trays, while MAP and vacuum have gained in overall share of the market. In 2002, overwrap trays represented 51% of the case-ready packaging in the fresh meat case. In 2007, that number dropped to 39%. During the same time, MAP packaging grew from 9% to 17%, and vacuum packaging increased from 10% to 16% (see Fig. 2).

As mentioned earlier, however, these trends, while consistent since 2002, may be set for a change of course, with Wal-Mart at the ship’s helm.

Wal-Mart reacts to consumer perceptions

Last August, Meatingplace.com reported that Wal-Mart had begun testing fresh beef and pork in new overwrap tray packaging in 76 southern U.S. stores served by its Brundidge, AL, distribution center. The program has since spread to stores across the country, replacing the low-oxygen MAP tray package that Wal-Mart had so publicly committed to in 2001. The change, which represents “multi-millions of dollars at least of equipment investment” for each facility supplying meat to Wal-Mart, according to one packaging machine representative, appears to be a response to consumers’ desire for more traditional, back-of-the-store-style meat packaging.

According to Wal-Mart spokesperson Deisha Galberth, the change affects Wal-Mart’s Genuine Steak House Brand USDA Choice and Select fresh beef offerings and USDA certified, case-ready fresh pork, and corresponds with the introduction of new cuts in the Choice beef category. Galberth declined to provide details to Packaging World on why Wal-Mart had transitioned to the shorter shelf-life overwrap tray, but she did say, in general, that “Wal-Mart is always looking for new packaging to meet consumers’ needs.”

A number of packaging machinery and material suppliers, who would only speak with PW off the record due to confidentiality agreements, say they believe the change was made to address poor meat sales and the stiff competition Wal-Mart has been facing from large supermarket chains still employing overwrap tray packaging.

Says one equipment supplier, “Well, I don’t know what Wal-Mart’s official story is, but the fact is that most of their competitors remained with the traditional overwrap foam tray, and Wal-Mart lost business.

“The consumer saw the overwrap tray as something that was done in the back room of the store, even though, in this case, it was not. Consumers were going for a form of packaging that was familiar to them and that they were comfortable with. Wal-Mart’s packaging, with the deep tray and film lid, had an industrial look. So Wal-Mart was losing business, while its competition was maintaining and gaining business. It’s that simple.”

Speculates another, “My feeling is that they are doing this to compete head-to-head with the large supermarket chains, like Kroger and Albertsons. When Wal-Mart began using MAP packaging, they went into it like gangbusters. I think, as a result, some of their competitors continued to go with the overwrap packaging just to differentiate themselves.

“I am sure that Wal-Mart is making this change because the consumer connects the overwrap tray with a back-of-the-store-type, butcher-shop approach and views it as being better quality. I have to believe that for Wal-Mart to make such a radical change, they weren’t happy with the sales of their meat.”

One material supplier agrees, saying, “The MAP tray is a good-looking package, but the reality is that the consumer wasn’t buying it.”

This supplier also believes another factor motivating the change was Wal-Mart’s realization that the overwrap tray is more space-efficient than the MAP tray and is less likely to result in freezer burn of the meat during storage. MAP trays are designed to be deep to prevent the meat from making contact with the film lid, which can cause meat discoloration. “Because there is a lot of headspace, you get a lot of freezer burn occurring when you put the meat in the freezer,” says the supplier, “but that is not true with the overwrap tray.”

Package particulars

From discussions with a number of industry observers and packaging suppliers, PW has determined that the new package being employed by Wal-Mart consists of an EPS tray—black for beef; pink for pork—covered with a clear, PVC overwrap. Trays are placed in a master bag and are back-flushed with a low-oxygen, tri-gas mixture of nitrogen, carbon dioxide, and a small amount of carbon monoxide.

Traditionally, master-bag applications use a high-oxygen gas mixture of 80% O2 and 20% CO2, which ensures freshness in the bag from seven to 10 days, and a shelf life of two to three days once the trays are removed from the bag. Wal-Mart, vendors say, is using a low-oxygen mixture, most likely in combination with some type of oxygen scavenger, to extend the time that meat stays fresh in the master bag. “Wal-Mart is a huge distribution company,” notes one supplier. “Meat processors are shipping the meat to locations all over the country.”

Some industry observers see the switch to the overwrap tray as a step backward in that its shorter shelf life once it is placed in the meat case—two to three days versus the 10 to 16 days possible with MAP packaging—will inevitably lead to greater shrink rates. “Looking at it strictly from a distribution and shelf-life point of view,” says one equipment supplier, “Wal-Mart had that format [the MAP package] nailed down. While the tray may have been more expensive than the overwrap format, from a transportation point of view, I think it was easy for them to justify the cost.”

Other counter-intuitive aspects to the transition include the tremendous new equipment investment it represents to meat suppliers already equipped to produce MAP packaging and the significantly greater manual labor required to produce the master-bag format. At present, overwrapped trays must be manually placed in master bags before gas-flushing. But so far, say packaging vendors, Wal-Mart suppliers, the largest of which include Cargill Meat Solutions, Tyson Foods, Smithfield, and National Meat, among others, “have made the change without too much grief.”

“It’s like you or I or anyone else,” says one vendor, “you pretty much have to do what your customer wants. So if Wal-Mart wants to go that way, then I am sure the suppliers are willing to do it.”

One packaging machinery vendor that is greatly benefiting from the change is Ulma Packaging, which supplies equipment for both MAP packaging and master-bag applications. “Ulma is very happy about the change,” says Bill Chastain, Ulma vice president. “I had forecast selling some 18 of the stretch-wrap machines last year, and I ended up delivering 65 of them.”

Other machinery and equipment suppliers said to have been tapped by meat suppliers include M-Tek, Omori, and AEP Industries.

Chastain says that the next step for cost-efficiency is to automate the master-bag process—a technology that he says Ulma should have perfected for Wal-Mart’s low-oxygen format within the next month to two months. “The technology is available now,” he relates. “It’s just a matter of proving it out as far as test packing and shelf life.”

Sustainability disconnect

One of the biggest conundrums related to the transition, however, especially to those who have been following Wal-Mart’s highly publicized sustainability efforts over the last several years, is the company’s choice of PVC overwrap for the new trays.

Wal-Mart has been very public in its stance against PVC. In fact, in the February issue of PW, Sam’s Club director of packaging Amy Zettlemoyer-Lazar said, “Wal-Mart made a commitment two years ago to replace PVC in our private-label packaging where possible. So far, we have been able to replace PVC packaging with alternate materials for 72 items. We will continue to do that as materials are available that perform at parity with PVC.”

This about-face has not gone unnoticed by packaging material vendors, who have spent the last several years working with consumer packaged goods suppliers to eliminate PVC from their packaging in order to meet Wal-Mart’s Packaging Scorecard initiative. “The only explanation I have,” says one vendor, “is that it comes down to what Wal-Mart has to do to sell its product.”

The vendor adds that while there are biodegradable films being used in Europe for overwrap applications, its use is still fairly limited due to its high cost and inconsistent machinability. “PVC is what is available in the market right now for Wal-Mart to do what it needs to do,” he concludes. “They have to push forward with it.”

When PW asked Wal-Mart about the apparent disconnect, spokesperson Galberth replied that she could not confirm that PVC is being used for the new overwrap tray package.

Will suppliers of PVC packaging materials—including Reynolds Flexible Packaging and Klöckner Pentaplast—have a field day with Wal-Mart’s tacit “endorsement” of PVC? These suppliers have been saying all along that PVC is no more harmful to the environment than the handful of alternative materials that are out there. Now, they have the sultan of sustainability switching to PVC.

Constant change is assured

So far, observers say it is still too early to judge if the change in Wal-Mart’s meat packaging will affect its sales, but one vendor says the program “seems to be moving forward pretty good.” Galberth relates that “consumers are responding very positively to the new packaging.”

Whatever the results, there is no doubt that, due to Wal-Mart’s sheer size, its decision could reverse what has been an upward trend for MAP and vacuum packaging at the expense of overwrap trays—until the company changes direction again. “I think that when they are ready to make the next step, they will probably look at some type of vacuum packaging,” says one machinery supplier. “It’s hard to say when they will make the change, but one thing is for sure, everything will change eventually, so you always have to be ready.”