Until recently, the topic of buying used or rebuilt packaging machines was considered too controversial to be covered in a packaging magazine largely supported by companies who make and sell new equipment. However, a Packaging World survey removes any doubt that used and rebuilt equipment is an option that more and more companies are both considering and trying. Based on 286 participants, the survey shows that more than half of all respondents said their companies have bought used packaging equipment or had packaging machines rebuilt. Among these respondents, some have had their own packaging machines rebuilt. Also worth noting is that many of these respondents say their companies have had multiple experiences with used or rebuilt machinery. The survey was conducted on PW’s Web site, Packworld.com, late last year. The results reported here include only those participants at end-user companies that buy packaging machinery or materials. Respondents from packaging suppliers or distributors were not included in the 286 survey responses studied for this report. Although participation on the Web site could not be limited to PW’s readers, the demographic profiles provided by the respondents indicate a strong similarity to the magazine’s readership (see sidebar, p. 54).

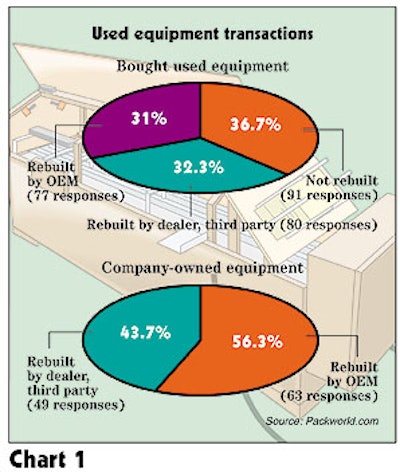

55% with experience Some 42% of all 286 respondents said their companies had not purchased used or rebuilt packaging machinery. Nor did they report having company-owned equipment rebuilt. The survey asked if their companies had used any of five methods of buying or rebuilding used packaging equipment: (1) buying used equipment that had not been rebuilt; (2) buying used equipment that had been rebuilt by the original equipment manufacturer (OEM); (3) buying machines rebuilt by a third party; (4) having company-owned packaging machines rebuilt by either the OEM or (5) a third party. A total of 168 participants, or 55%, said their companies had engaged in one or more of these methods. Because respondents were able to indicate that their companies had used more than one method of buying or rebuilding used packaging equipment, the 168 respondents to this question reported 360 individual used or rebuilt equipment transactions. The answers were quite evenly spread over the five methods of buying or rebuilding equipment the survey inquired about (Chart 1). It separately shows the percentages of respondents whose companies bought used equipment and the percentages of those companies that had their company’s equipment rebuilt. When all responses are combined: • slightly fewer than 23% of all these respondents said their companies purchased used machines that had been rebuilt or refurbished by a dealer or a third party • 25.3% said their companies purchased used equipment that had not been either rebuilt nor refurbished • 21.4% said their firms had bought equipment that had been rebuilt by the original equipment manufacturer • 17.5% of responses reported they had the OEM refurbish or rebuild their company’s packaging machines, and • 13.6% said their companies had used a third party or dealer–instead of the OEM–to perform the rebuild on the firm’s equipment. Because this subject was uncharted territory for both the magazine and Web site, two separate readings of the results, one about halfway through, confirmed the continuity of the results. There are only marginal statistical differences between the results at 188 responses, compared to the results of 286 responses. Of the respondents who indicated that their company’s equipment had been rebuilt, the survey continued by asking whether temporary equipment had been provided while their machine was being updated. Of the 102 respondents who answered, 29 said their companies had been provided with a temporary machine. But a surprising 73 respondents indicated their machines were rebuilt in their own plant to speed up the process.

Upgrading controls The survey asked respondents to specify what types of components had been upgraded on the newly rebuilt equipment. Multiple answers were often provided. Still, controls systems and motors and drives were among the components that had been most frequently upgraded. All together, respondents who said their companies had machines rebuilt identified a total of 435 controls/components upgrades (Chart 2). The graphic separates the responses by those clearly designed for machine controls systems and others that are not specifically controls oriented. Easily the three most frequently mentioned components that had been replaced were programmable logic controllers, machine sub-assemblies like seal jaws or conveyors, or other non-control components like drive belts and pneumatics. Each of these categories logged about 17% of all responses. Other popular parts that were replaced include sensors and machine vision components and upgraded drives and motors to servo-type versions. Touchscreen HMI control panels were also frequently added. Survey participants that reported rebuilds of packaging machines were then asked about the types of capabilities the rebuilt equipment now provides to the plant. Multiple answers to this question totaled 365, and not surprisingly, the most frequently gained benefit was increased speed; more than one-quarter of all responses related to improved speed (Chart 3). Accuracy was cited by another 21% of all responses. Shorter, more automated changeover logged 17.2% of responses. Better integration into the rest of the packaging line was cited in nearly 14% of responses. At the other end of the scale, only 3.3% said the rebuild included an internal device-level network for simplified diagnostics and just over 8% said the packaging machine had joined a line or plant-wide network.

Reasonable costs Although rebuilding major machines like vertical form/fill/seal equipment often comes to mind, it’s obvious that many of the participants in the survey either had smaller machines rebuilt or the upgrading of the equipment was more modest. That’s the obvious conclusion drawn from the 132 responses that specified the cost of the rebuild (Chart 4). Slightly more than a third said the rebuild had cost $25ꯠ or more. On the other hand, some 31% of the respondents reported their company’s rebuilding project cost $10ꯠ or less. Another third of the rebuilds were priced between $10ꯠ to $25ꯠ. By correlating these figures with some of the comments about the high cost of rebuilt equipment (see story, p. 56), there seems a relatively large number of respondents who thought the cost range was excessive. Or perhaps it’s fairer to say they felt the cost wasn’t commensurate with the results they’ve experienced from the rebuilt equipment. Regardless of the economic issue, the numbers of respondents offer a significant validation that used or rebuilt packaging machines are being considered by many manufacturers, and not just the small to medium-size firms. In fact, more than 45% of all respondents said their companies employ more than 500 people.