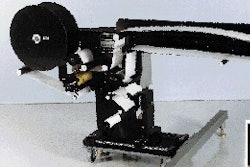

Rising product demand and the desire to build export sales led Mexico City-based La Coste"a to open a more modern chili pepper cannery two years ago. Late this summer, the plant's 15th canning line was up and running, matching the number of lines operated at the former factory. The previous factory's capacity, however, was no match for the new location. During the same 10- to 12-hour daily shift, the factory is now able to can up to 900 metric tons of peppers during the peak summer production season, about 50% more than was possible at the previous plant. Peppers are canned for both retail and foodservice customers. "We are constantly working to lower our costs and improve our product quality so we can offer a better value to our customers," says owner and general director Vicente Lopez. Automated equipment at the newer facility is largely responsible for lowering costs and boosting capacity. One prominent example of this is the can end handling equipment from Fleetwood Systems (Romeoville, IL). La Coste"a uses nine Rotofeeders that automatically deliver can ends to the 15 lines. Several of these Rotofeeders are equipped with a dual-discharge feature that permits them to handle two lines. Reduced labor costs The Rotofeeders replaced a manual delivery process at the former plant that required a full-time worker to deliver boxes of can ends from canmaking areas to seamers on each of the 15 canning lines. Juan Carlos Lopez, the owner's son and assistant, confirms that the former plant needed 15 workers to supply can ends. "Now we only need two or three. Between these end feeders and our automated equipment downstream, we estimate that we're saving 70 percent in labor costs and improving our plant efficiency." Not only was the former process labor-intensive, it also required workers to maneuver forklift trucks and other vehicles within cramped spaces between the lines, which wasn't always the safest practice. And maintaining can end quality and cleanliness was difficult considering the ends were exposed to the corrosive vinegar brine steam that's inherent in the chili pepper canning process. To alleviate these conditions, the new plant houses the Rotofeeders on a mezzanine level where they feed can ends as needed through the floor to seaming equipment on the first-level filling lines. "Locating the Rotofeeders on the mezzanine takes all that handling off the production floor, which helps us create safer working conditions," notes plant manager Juan Carlos Olavarria. He also says that by not exposing the steel ends to the brine steam, "the ends don't begin to rust, and that means we have more consistent quality." Dedicated lines The new plant runs six days a week, 50 weeks a year, producing jalape"o, serrano, chipotle and tomatillo products. The primary growing season in July, August and September demands peak production. The rest of the year, the plant operates at about 60% of capacity. Overall, the plant produces roughly 60% of La Coste"a's chili pepper production. Each of the 15 lines in the new plant is dedicated to a specific can size. That's done to maximize efficiency by eliminating the need for changeovers. Five lines produce 208 x 300 cans that hold approximately 7.7 oz of peppers, at rates up to 350 cans/min. Four lines handle 603 x 700 cans at 100 cpm. These hold 5 lb, 13 oz of product. Two lines each are used for 401 x 411 cans holding 28 oz, and filled at 220 cpm, and 202 x 204 cans holding 3 oz that are filled at 450 cpm. One line each is used for 303 x 304 cans holding 12 oz, and 307 x 409 cans holding 20 oz. Both of these are filled at about 300 cpm. Approximately 85% to 90% of these products are sold at retail, with the two largest sizes, the 603 x 711 and the 401 x 411, marketed to foodservice accounts. Efficient process The chili pepper cannery is one of three "plants" located on the same site in Mexico City. Besides serving as headquarters, the 216ꯠ square-meter location also houses a newer plant that produces "smashed" beans, as well as marmalade, jam, tomato paste, ketchup and salsa. The third plant contains seven lines that produce cans and can ends. For chili peppers, cans are delivered via conveyors. Ends are nested, stacked and placed in large wooden crates and delivered by forklift truck to the mezzanine area of the canning facility. Ends are easily loaded into the sides of the open vertical "pockets" that make up the Rotofeeder. These pockets hold large stacks of can ends to minimize replenishment. For example, the Rotofeeder that accommodates the smaller-size cans has a capacity of 40ꯠ ends within its 70-pocket "carousel." The feeders bottom-discharge ends through the mezzanine floor to the Angelus (Los Angeles, CA) seamers that apply the ends to cans filled on rotary/vibratory fillers from Solbern (Fairfield, NJ). After seaming and pasteurization, cans destined for retail markets are automatically labeled with a colorful wraparound paper label. Downstream automation Next, these cans are efficiently handled downstream via an integrated system of case erectors, packers, sealers, palletizers and automated guided vehicles. This equipment was sourced through Stork Food Machinery (Chicago, IL). Previously, these tasks were accomplished manually. The end-of-line packaging system "has helped us increase our production line efficiency to as much as 95 percent," says Olavarria. The equipment resulted in "reallocating 75 people from our packaging to other operations in the plant," he adds. The effectiveness of the machinery prompted La Coste"a to use similar equipment at the plant that produces the non-pepper products. Meanwhile, the gains in line efficiency and reduction in labor costs for chili pepper production bode well for La Coste"a's future. It's reported that the company currently has captured a 65% share of the chili pepper market in Mexico. Building sales in exports will play a substantial role in determining payback for the new plant and automated equipment. So far, exports have grown dramatically. Production assistant José Manuel Lara Arriola estimates that exports now represent 20% of the company's overall sales volume. About 90% of exports are to the U.S. (thanks in part to the North American Free Trade Agreement), with the balance spread among 19 other countries. The automated packing process deserves kudos for much of this growth. As Olavarria concludes, "We operate our packaging line at a level of automation that is unique in Mexico, and unusual even worldwide."