The data was collected from 369 phone interviews with packaging machinery purchasing decision makers from nine major industries within U.S. manufacturing. The sample consisted of a balanced mix of small, medium and large companies. The research was conducted by Industrial Research Associates, LLC (Madison, CT). This second annual study displays excellent continuity; 82% of the '99 respondents had participated in the '98 study.

The prediction for a 6% increase in spending comes in the face of mixed economic conditions. The positives include the strong domestic economy and the continuing influence of new technology on productivity gains. On the other side, hard economic times in many overseas markets affecting U.S. manufacturers, slower capital spending growth after years of near-record increases, industry consolidations, and concerns about corporate profits were all seen as negative factors.

Overall narrow range

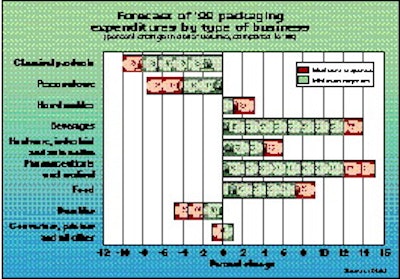

With some business segments reporting gains and others expecting declines from the year-earlier spending figures, the total range is a fairly narrow 25%. The largest increase in spending predicted this year, the 15% top end for the pharmaceutical/medical field, is not totally offset by the 10% maximum decline foreseen in chemical products.

In general, five segments showed increases (see Chart 1). The beverage business was close to matching the gains in spending predicted in pharmaceuticals, food was up a respectable 7% to 9%, and hardware and industrial and nondurables predicted smaller increases in spending on packaging machinery this year. Three industries expect outright declines, but personal care and durable products didn't expect the decline reported in chemicals. One industry, grouping converters, printers and others, cumulatively expects to spend about the same as last year.

To convert these industry estimates to an overall estimate, the research company weighted each industry's historical relative impact on total domestic spending for packaging machinery. So, although the nine industries showed both positive and negative predictions, the 5% to 6% increase will be achievable because the three leading markets for packaging equipment (food, beverages and pharmaceutical/medical) all predicted solid gains. Based on information developed in PMMI's Fourth Annual Shipments & Outlook study, food (38%), beverages (16%) and pharmaceutical/medical devices (9%) collectively approach nearly two-thirds of all packaging machinery shipments.

Expansion, replacement drive

When asked for each company's primary reason for buying packaging equipment in 1999, two factors were most often mentioned (see Chart 2). Leading the way is expansion of production or packaging capacity, apparently reflecting the near 4% domestic economic growth in the U.S. last year. This is being propelled by strong consumer spending.

However, the second cause, machinery replacement, has become even more important in '99. Although cited as crucial last year, more manufacturers in the study are acting on it this year. Nearly one-fifth of all respondents said machinery replacement was at the top of the list.

Similarly, the responsibility to package additional new products played a more important role for '99 than it did last year. Although it may be difficult to explain this across the board, researchers speculated that many new products may require totally different packaging than existing machinery can handle. This response ties in closely with another, "changes in package design, shape or material," that was mentioned by nearly 10% of respondents.

Even when the existing machinery can accommodate the new products or packaging, the report's executive summary points out "the added burden of excessive downtime for changeover. . . has convinced many companies to install new units with quicker changeover capabilities." This answer also relates to "increasing speed and productivity" that was mentioned as the primary reason by 5.5% of purchasers in the study.

Looking back to '98

One interesting feature of this year's survey--especially in light of the number of respondents returning from last year--was an evaluation of '98 budgeting and actual spending (see Chart 3). Of the nearly 300 participants duplicated from last year, a remarkable 70.4% reported that '98 spending did, in fact, match the amount originally budgeted.

Nearly two out of three respondents who predicted a drop in their company's purchases of packaging machinery for '99 claimed it was due to major purchases being completed in '98. Other reasons mentioned included "equipment not yet due for replacement" and "mergers and consolidations," accounting for 8.6% and 7.6% respectively. The balance of respondents cited a variety of factors tied to slower company growth and more scrutiny over budgets.

What makes that even more unusual is that the majority of '99 respondents say that their packaging machinery budgets were estimated, but not fully approved at the time of the interviews. Still, 47.2% of participants said their expenditures were completely budgeted and approved at the time of the interview.

Of the respondents who said '98 spending was greater or less than budgeted, the reasons most often cited were unexpected developments, including higher or lower sales, new ownership or the introduction of products not anticipated when the original budget was created.

Features that attract

About two-thirds of respondents say that purchases are budgeted primarily based on need. Still, slightly more than a third (33.7%) say their decision to order machinery this year was at least in part due to recent advances in machinery (see Chart 4).

This one-third of respondents were asked to identify the machinery features that may have influenced their decision to purchase, and the answers this year were somewhat different from those cited last year. For example, "improved flexibility" (for quick changeover) was the leading answer last year; this year, it traded places with "expanded robotics" which finished third in '98. Ranked second for '99 was "enhanced vision systems." These top two answers, robotics and vision systems, correlate closely to the top trends most observers noted at last year's Pack Expo.

In terms of specific types of equipment ordered or to be ordered in '99, the research company noted few changes from the previous year. As could be expected, the most common equipment found in the highest percentage of packaging lines, conveying and feeding, led the way with 68.4% of respondents planning to order this year. Probably because of the steady increase in requirements for more information on packaging, the next most frequently mentioned type of equipment ordered for '99 will be for coding and printing (62.9%).

However, the third-ranked category was inspection/detection equipment (55.8%), which finished slightly ahead of labeling (53.7%). At the other end of the scale was equipment for specific types of packages, including skin & blister (11.7%) and dry product filling machines (16%).

Mostly added equipment

When respondents were asked if each type of equipment was mostly an addition or a replacement to existing equipment, the answers varied. Fully one-half of bottling lines ordered in '99 were to replace existing equipment, while only 19.8% of inspection/detection equipment being ordered was for replacement.

The opportunity to add capabilities and functions can be seen in the most often cited equipment to be purchased this year. More than two-thirds of conveying and feeding equipment will be additions rather than replacements for older equipment (28.3%). The same is true for coding and printing purchases. Less than a third (32.2%) of '99 purchases are expected to replace existing systems on lines.

The survey also qualified purchases for both new and used equipment. Like last year, the study found fewer than 3% of respondents intending to order only used machinery this year, while 93%, on average, say their companies will buy only new equipment this year. The proportion of companies buying some used equipment will decline in '99.

Companies ordering bottling lines, capping machines and liquid fillers are most likely to buy used machines, followed by conveying/feeding, dry product fillers and cartoners. In comments to researchers, the study reported anecdotal evidence of significant growth in the business of rebuilding and retrofitting equipment, especially with more sophisticated controls and other advanced technologies.

Although this kind of information wasn't specifically studied, the research company says the retrofit anecdotes were offered in greater frequency in '99, compared to last year. A common thread of these examples, is that the basic component design and operational characteristics of the older machines remain unchanged from current models.

Contract packaging may increase

The study also looked at outsourcing packaging with contract packagers. Much like '98, a bit more than half (53.4%) of participating companies report current use of CPs. Of those companies that use CPs, 30% expect to increase use of CPs this year, vs 15.8% that expect to decrease or end their use.

Connecting CP use to equipment purchasing, about 38% of respondents using CPs say they sometimes or always buy the machinery to be used by the CP. The primary reason for buying the equipment is that the cost of the machine is generally included in the contract price by the CP. Thus, manufacturers say they can negotiate a better net cost (including the amortized cost of the machine) by buying the machine. And, for many companies, there's also the expectation that this packaging machine and the packaging project will eventually be brought in-house.

The complete 1999 U.S. Packaging Machinery Purchasing Plans Study covers 164 pages and is available from PMMI for $495.