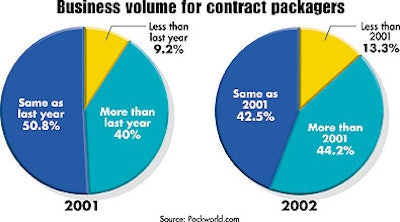

Although many in the packaging community are wringing their hands—and their workforces—over slowing investment, contract packagers (CPs) are busy shaking hands over new contracts with manufacturers. It appears that alliances between manufacturers and CPs remain relatively unaffected, despite efforts to cut costs by many companies. That’s the conclusion of a research project by Packaging World last fall. PW surveyed the state of contract packaging via surveys of end users (see sidebar for details), contract packagers, and the suppliers that sell to them. The surveys were conducted via PW’s Web site, Packworld.com. Of the 120 end users who participated, more than 90% said their companies will be doing the same amount or more business with CPs in 2001, compared to the previous year (see Chart 1). In fact, just 9% reported their companies will reduce the amount of work outsourced in 2001. This optimism is particularly striking because the survey was conducted largely in the aftermath of the Sept. 11 terrorism. While the overall economy has faltered, business with CPs is bucking that trend. It’s possible that survey participants represented companies that had been less affected by the economic downturn; slightly over half (53.3%) reported their companies’ sales increased in 2001, compared to 2000. The optimism continues for this year too. More than 86% of end-user participants said their companies’ business with contract packagers would stay the same or increase in 2002. Only 13.3% predicted a decline in business with CPs. There were some interesting differences, depending on company size. Fewer than 12% of respondents with large companies predicted a decline in business with CPs, but 22% of small companies felt their volumes with CPs would drop this year. Gareth Walters of bicycle maker Bellsports, Santa Cruz, CA, said his company’s sales were flat last year. However, he reported that overall bike sales were off 12%. As a result, the company consolidated two divisions and cut about 35% of its workforce. Still, he said that the company will do more package design, while doing less packaging. “Until about three months ago, I designed about three boxes in my entire life,” Walters tells PW. That’s changing as the company moves to “design in-house the best possible packaging, especially for our accessories.” However, the repetitive work of loading the packages and shipping will be contracted out. The company also operates a plant in Rantoul, IL, that focuses on custom packaging. For a new order for bike helmets with a major club store chain, Walters said, the helmets will be largely made in Asia, then shipped to Rantoul for final assembly, packaging, and shipping. “Most retailers are following the Target brand-name approach. They want to sell brand names, but they’re demanding their own packaging,” Walters explains. “So we plan to strengthen our brand and get away from commodity-type, high-volume merchandising.” Packaging will play a big role in that change.

Broadened product lines Although there are many reasons why companies outsource their packaging, one prominent one is to broaden their product line. Nearly six of every 10 end users in the survey said their companies introduced new products that are packaged by CPs. However, this also was dependent on company size. Almost 71% of respondents from large companies said their companies introduced outsourced new products, whereas 55% of participants from small companies said their companies did not introduce new products packaged by CPs. A packaging R&D worker for a manufacturer of industrial products said that the use of CPs has allowed her company to add products to its line that it can’t manufacture in-house. A marketing executive for a Midwest distiller said much the same. “We can offer a larger variety of products and packages through the use of co-packers,” she said, “since we’re limited by our existing bottling equipment and space.” A packaging buyer for a major consumer products maker said his company primarily uses CPs for promotional and lower-volume products. “They provide an effective way to bring promotional items to the marketplace and allow us to respond quickly to marketing opportunities,” he said. “Plus we use CPs for low-volume products that are constantly changing.” A quality control executive at a major brewery said that his company uses CPs for the flexibility they offer to introduce new packaging. “They permit us to more quickly respond to market opportunities for niche packages” without affecting in-house high-volume packaging lines. In fact, almost 75% of respondents agreed that CPs help a company bring a product to market faster than doing it in-house. Surprisingly, the decision to outsource packaging isn’t solely the province of management or production executives at manufacturing companies (see Chart 2). Virtually every department appears to be involved in the decision to shift packaging to outside firms.

Technology a major driver Survey respondents say that technology or capacity unavailable in-house is the primary reason (35.9%) their companies outsource packaging to CPs (see Chart 3). However, nearly a third point to minimizing upfront investment, and about 12% outsource because their companies don’t have in-house the appropriate worker skills. Tom Tompkins, a parts packaging executive for American Honda Motors, Marysville, OH, said the skills issue is crucial at his company. “Our primary reason for using contract packagers isn’t so much technology. We’re not a packaging company, so contract packagers provide a skill we don’t need to have in-house,” he said. Technology is definitely important for Welch Foods purchasing executive Bill Hendricks. “A lot of our work with contract packagers takes advantage of that company’s capability that we simply don’t have. Often it’s equipment that we don’t employ in our plants,” Hendricks said from Welch’s Concord, MA, headquarters. “Sometimes, we outsource to determine whether that technology is a direction we need to look at. So, often these arrangements are really kind of tests to gauge the market,” Hendricks added. Much the same is true for the Mexican subsidiary of a major U.S. food manufacturer. The company’s marketing executive said his company “has been able to enter new markets that require technologies that we don’t have in-house.” Two executives at major corporations see a combination of factors in outsourcing of packaging. “Contract packagers provide flexibility, speed to market and reduced capital investment when we launch a new product,” said a packaging R&D worker for a major household chemical maker. Nearly the same words were used by a packaging executive for a national personal care maker. One surprise here: More large companies (39.2%) said they used CPs primarily to minimize upfront investments than did small companies (33%). Economics not always favorable Not all the survey participants are positive about using contract packagers. A packaging executive for a large Southwest poultry company said “contract packagers are sometimes a necessary evil.” A purchasing official for a Southeast pharmaceutical company said that the use of CPs “is more costly” and added that his company “is stuck with them.” The issue of economics was also on the mind of a buyer for a Midwest beverage producer. He conceded that CPs offer “flexibility to ramp up quickly, allowing your own plants to catch up.” But, he said, “the cost always turns out higher than what we could do internally.” Welch’s Hendricks doesn’t agree. “We think that contract packagers are often more ‘aggressive’ about costs. There’s certainly a motivation from outside companies to retain your packaging volume,” he said. A purchasing executive for a Midwest nutritional products maker is ambivalent. The use of CPs cuts “total dollar outlay, and we don’t have to hire additional employees or buy more equipment,” he said. However, he growled, CPs rarely deliver on time “and we always seem to have inventory issues with them.” A packaging executive for an industrial products maker experienced similar problems. The use of CPs “reduced our ability to respond to surges in demand because we eliminated in-house packaging personnel,” he reported. “Contract response times are too slow to respond to market opportunities.”