It may take us a few years to responsibly determine how deep a recession manufacturing in the United States experienced in 2001-2002. That’s probably a decision that will be made by economists. What packaging people said is “yes, the recession affected our department and our company,” but the effects since June 2001 may not have been as dramatic as some of us had thought.

To measure how the recession affected packaging, Packaging World magazine conducted a survey on its Web site, Packworld.com. Although the results can’t be directly attributed to PW’s 90ꯠ readers, it’s probably safe to say that the respondents’ views are at least representative of the impact the recession had on the companies that make up PW’s readership (see sidebar on survey respondents).

Survey participants told PW that the recession had some effects on their companies, but those results did not appear as disastrous as many in the packaging business had feared. In fact, if the survey respondents are accurate, the 2001-2002 overall business recession has been rather mild in its effects on packaging operations. However, as the second part of this report will reveal, the effects of the recession on packaging professionals personally was more obvious in terms of reduced travel, wage freezes, and other cutbacks.

In the survey, conducted in June 2002, respondents reported modest effects on packaging staffing, on packaging projects, and even on packaging purchases for the period since mid-2001.

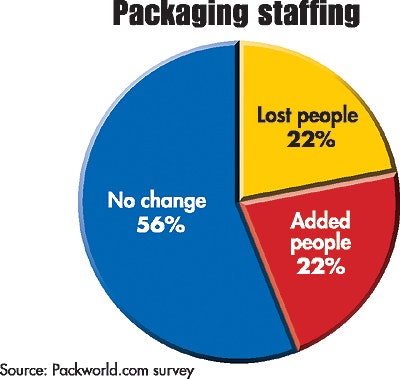

For example, in staffing of packaging departments, the vast majority of respondents (56%) said their companies had no change (Chart 1). Of the balance, the percentage of respondents who said their companies reported losing people was only slightly larger than those companies whose participants said their companies added people. But, packaging staffs were being asked to do more work.

So, though many news reports focused on companies cutting back employees during this period, the overall effect on packaging department employees appears modest. When asked about packaging projects (Chart 2), nearly half the respondents reported their companies had created more packaging projects. Or to express it another way, some 73% of respondents claimed to have the same number or more projects than before. Just slightly more than one in four participants said their companies had cut back on packaging projects in the period. What this may mean—and a number of comments would bear this out—is that more projects were handled in-house that previously might have been outsourced.

Much the same was true for respondents who said their companies were changing their purchases of packaging (Chart 3). Just 27% of respondents reported that packaging purchases had suffered cutbacks, but 32% of participants said their companies had been making more packaging purchases. In addition, respondents reported that cutbacks in packaging purchases were not completely limited to small companies.

Outsourcing less

Retrenching became a little more obvious when the survey asked about outsourcing—one of the dominant trends of the period since 2000. Somewhat more than half of all participants said their companies had cut back on outsourcing (55%), whereas 38% reported that their companies were outsourcing more work to suppliers.

Not unexpectedly, smaller companies were cutting back on outsourcing. Of the companies that cut back on outsourcing packaging projects, 59% were from respondents who said their companies employed fewer than 500 employees. At the same time, some 43% of respondents in larger companies said their companies were doing more outsourcing to suppliers. Only the smaller firms, those with fewer than 500 employees, reported an increase in outsourcing to consultants.

A sizable number of engineering respondents said that outsourcing at their companies had increased in the past year. In contrast, a much higher percentage of management officials said just the opposite. And nearly two-thirds of participants with packaging titles reported fewer functions being outsourced.

Optimism—then

The survey also asked participants whether their companies were optimistic about company results for year 2002. Given the June 2002 survey time period, it’s not unexpected that 83% responded that their companies were optimistic about their 2002 results. Most of those participants who said their companies were optimistic for this calendar year came from smaller companies (57%).

The same overall optimism of respondents continued when respondents were asked about packaging purchases in the year ahead. Overall, 86% of all respondents said their companies had made plans for packaging purchases beyond simple replacement. However, some 65% of respondents who said their companies had no plans to purchase packaging beyond replacement were from companies with fewer than 500 employees.

Much the same was true when the survey asked about packaging-related capital expenditures for the current year (2002-2003) compared to the previous year (2001-2002) (Chart 4). Slightly more than two-thirds of participants said their companies would increase capital expenditures in the year ahead, compared to 15% who said next year’s packaging capital expenditures would be less.

As might be expected, the negative results were much higher for smaller companies, some 22% of which didn’t see capital expenditures rising in the year ahead.

An engineer at an international leisure products maker said his company is restricting packaging expenditures: “Everything is on a ‘hold the line’ basis. Break/fix is being done, but very few new capital projects will see the light of day.”

“Our capital spending has been significantly reduced. Packaging material purchases are based on orders in hand, not to build inventory based on anticipated orders,” said a packaging executive with a major household products maker.

Despite these critical comments, other companies had more legitimate reasons, including one from an engineer at a mid-sized candy producer: “My company is in Chapter Eleven.”

The survey also asked about adding packaging staff over the next year. Slightly more than half of the respondents didn’t expect their companies to hire more packaging staff, but more than 29% felt their companies would add more new hires. About one in five participants said they didn’t know.

All of these results need to be leavened with an understanding of the time frame. When the survey was created and put in place in June 2002, many economic prognosticators were then predicting a recovery in the third or fourth quarter 2002. Although this may be true for some companies and even some business segments, a broad-based economic recovery looks to be farther in the future. So when considering the comments of the survey respondents noted above, they may have been more prescient than the economic gurus of the time. A separate report will focus on the second part of this recession survey: how the respondents were personally affected in terms of compensation, benefits, and the like.

See sidebar to this article: Who participated in survey

See sidebar to this article: 2002 a lean year, many said