“Soaring demands, shrinking resources” would be as apropos a headline for Packaging World’s second exclusive salary and job satisfaction survey as it was for our first survey published in late 1997 (see PW, Sept. ’97, p. 52 or packworld.com/go/salsur).

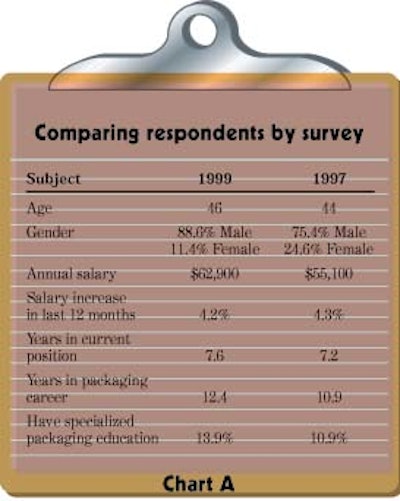

In the two-year period between the surveys, packagers reported mean annual salaries climbing to $62꽤 from $55걄 in ’97. Packagers are earning that pay by meeting ever-growing daily challenges. The pay increase isn’t surprising given the combination of two additional years of experience and a sizzling national economy.

In 1999, nearly two-thirds of respondents earned $55ꯠ/yr or more. That compares favorably to fewer than half of respondents who did so in ’97. While salaries have risen, the level of annual increase slipped ever so slightly to 4.2%, from 4.3% in ’97. That indicates that not all of the comparative figures favor the ’99 results.

On the contrary, more respondents experienced packaging-related staff or budget cuts in ’99 than in ’97. At the same time, only 15.7% of respondents to the most recent survey said they were promoted to a new job. That’s down from the 20.1% figure given in ’97. For a capsule comparison of survey results, see (Chart A). Other notable differences between the surveys were:

• Male respondents rose to 88.6%, up from 75.4% in ’97. Conversely, females accounted for a mere 11.4% of this survey’s respondents, down from 24.6%.

• More responses came from production supervisors/managers, plant managers and engineers. Fewer responses came from purchasing agents and directors of packaging than in ’97.

• Packagers reported greater satisfaction with their salaries this time than in ’97, and less dissatisfaction with advancement potential, though that job aspect fared poorly in this survey as well.

• Overall job satisfaction declined slightly, with more respondents feeling neutral about the topic than in ’97, while fewer were very satisfied with their current position this time around.

• Geographically, the latest survey saw responses increase significantly from packagers located in the Midwest, while decreasing responses were received from the Northeast and Southwest.

• Responses increased from packagers working at locations that package chemicals, while the opposite happened among those packaging pharmaceuticals and cosmetics.

Current results

The mean annual salary for respondents to the 1999 survey was $62꽤 (Chart B). One in four (25.1%) indicated yearly earnings ranged between $55ꯠ and $69ꯠ, while 24.4% made $40ꯠ to $54ꯠ. Another 20.8% received $70ꯠ to $84ꯠ. Next was our highest category, those earning $85ꯠ or more, with a 16.9% response. Fewer than 13% of respondents earned less than $30ꯠ.

The mean salary increase during the past 12 months was 4.2% (Chart C). More than four in 10 respondents revealed that their salary increase in the past 12 months ranged from 3% to 4.9%. Another 19.2% reported their increase between 5% and 7.9%, while 18.6% saw an increase less than 3%. Another 3.9% reported no pay hike in the past 12 months.

The 1999 survey was mailed to 2ꯠ readers late last summer. We received 307 responses, for a 15% return rate.

‘Firefighting’

In general, respondents were satisfied with their salary levels. However, they voiced many concerns. A plant manager for a Midwest food/beverage manufacturer, for example, explained that because the company is “understaffed, it requires me to spend too much time on functions that I would generally delegate to others. That does not allow...time to improve operations and plan for future growth.”

Putting out “daily fires and [working on] validation requirements [limits] long-term operation planning and development,” added a manager of industrial engineering for a Northeast pharmaceutical firm. A packaging engineer at a food/beverage operation in the Mountain states lamented there’s “not enough time to get out and see and [price] equipment to improve systems and lessen labor hours.”

Nearly six in 10 respondents worked in food or beverage operations (Chart D). Locations packaging chemical products were the next most frequently mentioned, followed by pharmaceuticals, cosmetics and medical products. Slightly more than one in 10 worked for companies that made other products or services.

The most prevalent title among survey respondents, at 26.1%, was packaging, production or project engineer (Chart E). Production supervisor or manager was cited by 15.2% of our respondents, followed by plant manager, purchasing agent, packaging research and development, packaging department manager and director of packaging.

Nearly half of all respondents worked for companies employing at least 1ꯠ people worldwide. Companies employing 250 to 1ꯠ accounted for 25.3% of respondents, while 25% worked for companies with fewer than 250 people on the payroll.

Satisfying salaries

How satisfied were survey respondents with their salary levels? Those most satisfied were in the highest salary level, $85ꯠ and above. Another group of respondents who were very satisfied were those in the $40ꯠ to $54ꯠ range. The same response was given by just 17.4% of those earning $55ꯠ to $69ꯠ/yr.

On the surface, the groups that would seem most likely to beef about their earnings would be the lowest three salary levels, ranging from less than $25ꯠ to $39ꯠ/yr. Yet, only 15.8% of respondents from these salary ranges responded with dissatisfaction.

While many in the $40ꯠ to $54ꯠ range were very satisfied with their salaries, there were many others that were not. In fact, dissatisfaction was strongest in that range, where 29.4% rated overall job satisfaction poorly. Only six of the 307 respondents said they were very dissatisfied with their salaries.

Salaries ranked third among the five categories rated for job satisfaction (Chart F). The highest ranking went to decision-making autonomy; the lowest went to advancement potential.

In between, packagers were pleased with overall job satisfaction; neutral about number of hours worked.

Advancement potential clearly “earned” the lowest rating, thanks in part to more than one in three respondents who scored it low. Only 6.1% rated it highly. Why this category ranked so low isn’t clear. Fewer than three in 10 respondents listing themselves as “middle management” rated advancement potential highly.

Those designating themselves as “top management” (only 11 respondents) gave the category a slightly higher score.

Based on that information, we can speculate that the low mean score for advancement potential can be attributed in large part to those at the lower salary levels.

Long on experience

The preponderance of salaries at the higher levels indicated that our survey respondents were long on experience. That was true both of age and years in packaging. The mean respondent age was 46, with nearly half in the 40- to 54-year-old range, 18.9% 55 and older, 25.1% between 30 and 39, and a mere 6.8% younger than 30. In ’97, our survey included more respondents in the 30- to 39-year-old category, and fewer in the 55 and over group.

A majority of respondents indicated they have more than 15 years invested in their packaging careers. Another 18.2% say they have six to 10 years of experience, and only 5.5% have worked in packaging fewer than two years.

When it came to longevity in their current position, an amazing 29.6% reported more than 11 years in their current position. What made that figure all the more remarkable is that the apparent loyalty contrasted with respondents’ dissatisfaction concerning advancement potential.

At the other end of the longevity spectrum, nearly half of those responding reported five years of experience or less in their present position. That could indicate that they’ve switched jobs recently. When asked about job events over the past 12 months, 28.1% reported they were promoted or switched to a new company in that time.

But the most common occurrence, listed by 63.6% of respondents, was the old story: adding more responsibilities without more pay. This increased workload may be caused by the next most frequent job events: packaging staff cuts (25.8%) and packaging budget cuts (23.5%).

Education pays

Nearly two-thirds of the survey’s respondents had a four-year college degree or a post-graduate degree. One in five had a high school or GED education, while 15% noted they had a two-year technical degree.

It’s no surprise that readers with packaging-specific education earned more than their counterparts without such a background (Chart G). Respondents with packaging-specific education earned $68걄/yr (mean), higher than the $62꽤 for those without. Of those without the packaging education, 12.6% earned less than $40ꯠ/yr. Only 2.4% of respondents with packaging education fell into the lower income level. Conversely, those with such education were more strongly represented in the upper salary categories than were their counterparts with a general education.

Education levels showed differences in salary level, but they paled in comparison to the disparity between male and female survey respondents. Women earned $55괌/yr, $8귔/yr less than men. It should be noted, however, that women represented only 11.4% of this survey’s respondents. We don’t know how men and women compare at age or experience levels. With that in mind, only 10.8% of men earned less than $40ꯠ/yr, compared to 28.6% of women in this category.

Geographic comparisons

Income inequities also appeared geographically. First, though, it’s important to note that 47.6% of survey respondents came from the Midwest. The Northwest, Mid-Atlantic and Mountain states regions each represented 5% or fewer of survey respondents. In between, 16.6% of respondents were from the Northeast, 13% from the Southeast and 11.4% from the Southwest.

Annual salaries were highest in the Northeast, at $66꽤 (Chart H). Only salaries in the Northeast and Southwest topped the survey’s overall $62꽤 annual mean. While salaries varied among the different regions, packagers commiserated on several issues.

Lack of time

Packaging pros from around the country shared time concerns and the negative influence lack of time has on company planning, evaluating and training. “Fighting the daily fires keeps me from working on cost reduction as much as I need to,” said a purchasing agent from a Southeastern pharmaceutical manufacturer.

“Responding to crises prevents me from negotiating new contracts properly, as well as developing alternate sources of supply,” said a Midwest purchasing agent at a food/beverage concern. A production/project engineer at a pharmaceutical facility in the Northeast added, “putting out fires prevents me from concentrating on machinery improvement.”

Some respondents admitted that the daily fires were self-inflicted. [We have] “too many teams and red tape,” said a production supervisor/manager at a Midwest “biotech” firm. He says the company needs to “speed up the decision-making process.”

“Firefighting is a deterrent to continuous improvement efforts,” added a packaging department manager for a pharmaceutical company in the Northeast. “The lack of money and executive support continues to delay revisions that can save money in the long run.”

Many packagers cited too many meetings, as well as governmental, legal or union issues as stumbling blocks to progress. An engineer at a food/beverage company in the Midwest said his company has “too many meetings, which cut into the time we have to do our job.”

A project engineer for a Midwest manufacturer of personal care products illuminated other irritations: “Paperwork, and having to redo projects due to marketing not having a clear understanding of what they want.”

Financial situations also put a premium on time. “Budget cuts have forced me to cut corners on labor in order to complete a project on budget,” shared an engineer with an automotive parts company in the Midwest.

Training issues

After “firefighting,” the most frequent reader concern dealt with training—or more accurately, the lack of training. “Training new people due to turnover rate doesn’t allow time for technical and personnel issues to be addressed,” said a production manager with a Southwest food/beverage plant. “We have too much turnover in maintenance,” added a maintenance manager for a Northeast food and beverage company.

“The lack of technical people available in the meat industry requires you to babysit, to oversimplify and to miss technological advancement opportunities,” grumbled an engineer with a Southeast food concern.

A packaging department manager in the Midwest said there’s “no time and no budget for formal training of line mechanics and operators.” At a Midwest chemicals manufacturer, a plant engineer agreed that “technical training of operators” is important. However, he believed, “upper management does not feel it’s necessary.” Several respondents said that more computer training would benefit their company.

The survey also produced comments addressing the work/family relationship. We won’t attempt to tackle that complex subject, but some of our readers were willing to share their views on it.

“My current position requires about 60 hours a week at work,” pointed out a packaging department manager with a Midwest cosmetics business. A quality control representative with a Southeast food company listed, “learning how to love my wife and children and neighbors,” as priorities in this new millennium.

Trite though it may sound, packaging personnel long for more time to improve their environments both at work and at home. That age-old balancing act can be vexing. Perhaps packagers can walk that wire by taking advantage of more sophisticated equipment, advances in computer control and enhanced materials that combine to improve productivity. Ideally, those productivity benefits would enable packagers to achieve more in less time.

While there’s no denying that packagers have their share of complaints and concerns, the survey results show that when it comes to salary and many other key job factors, readers are satisfied with their packaging careers.

A refreshing conclusion came from a director of contract manufacturing/packaging services for a Midwest pharmaceutical firm, who wrote, “I am near retirement. I wish I were starting all over.”