While virtually all purchasing executives report that the packaging materials they buy have gone up considerably in price, their companies deal with the issue in a wide variety of ways. As this report shows, some reduce the size of their products, many increase their product's selling price, and some practice source-reduction in packaging.

Among the highlights from this second part of our exclusive survey:

* While over half the respondents said they were satisfied with vendor communication about packaging price increases, purchasers expected more material options, and they sought long-term contracts as protection.

* Nearly half said their companies had increased product prices, but most said the increases didn't cover the packaging hikes.

* Over half of the companies that raised their product prices saw their sales drop.

* Much like the candid comments that accompanied their questionnaires (see sidebar, left), these purchasing people also talk about the negative effects of higher prices within their company, including some cutbacks in packaging research and development.

Packaging World's survey of package purchasing executives was conducted by mail in early summer. It was done with the assistance of Market Research Support Services (MRSS), a consultant based in Roselle, IL. As mentioned last month in Part One of this report (see PW, August '95, p. 62), the results are based on nearly 220 responses, or about 18% of the 1겨 questionnaires that were mailed.

Surveyed were purchasing executives who subscribe to PW. Of the 220 responses used for this report, 55% came from individuals working for food packers, 35% were purchasing people for pharmaceutical and chemical companies, and about 6% came from individuals with companies that make medical and dental instruments and supplies.

When the questionnaires were mailed, PW guaranteed the respondents of complete confidentiality. Despite the assurances, the subject of packaging material prices is so highly charged that several purchasing people returned questionnaires without the address label that qualified each respondent for a chance at a handsome prize.

Even so, Bob Burns, president of MRSS, says that the results can be considered statistically valid to within ±3%, based on PW's circulation to executives who identify themselves as purchasers of packaging and materials.

As we reported last month, half of the respondents say that increased packaging prices will have a noticeable or significant effect on their company's sales this year and next. Of those, over 92% say the effect will be negative. How have their companies dealt with these price increases?

Looking long-term

Last month, our report showed that over half the respondents had changed the vendor for at least one material in the last six months, mostly for corrugated packaging. But a significant number of purchasers also changed suppliers for plastic containers, plastic films and paperboard, all types of the two packaging materials, paper and plastics, that have seen the biggest run-up in prices.

In fact, nearly 20% of respondents reported changing vendors more than once in the last six months for one material or another. And over 5% changed vendors more than once on more than one material! So it's obvious that packaging price increases have severely cut into customer loyalty with suppliers. At least they have for half of our respondents. The other half, it should be emphasized, didn't switch sources in the past six months. Some of these did indicate a change was likely in the next six months, however.

Has playing the field become the best way to secure materials at the best price? PW's purchasing executives don't appear convinced of that. When asked how their company responds to packaging cost increases (Chart 1), the majority say they are seeking long-term contracts with vendors to mitigate price increases. Score one for partnerships.

Of course these answers came before they read a comment from one participant last month. In essence, this purchaser complained that contracts for corrugated containers had simply been voided. With a healthy dose of sarcasm, the participant noted that the corrugated paper contracts weren't worth the paper they were written on!

Other ways to save

While 54.1% said their companies were seeking long-term contracts, 34.3% were actively seeking other suppliers. The second most-often mentioned tactic was to look at alternative materials. Source reduction, searching for additional supply sources and increasing product prices all received significant percentages of responses.

One category, those purchasers that have experienced significantly higher prices for aluminum cans, runs a bit counter to the overall tactics. Of these, 65.7% are looking to shift to other materials, and 42.9% are looking to switch suppliers. Some 57.1% are actively trying to reduce material usage. Similarly, those experiencing higher prices for glass are significantly less likely to increase product prices (16.7%).

Giving purchasers an opportunity to sound off, PW asked purchasers if they were satisfied with vendor communications about increases in material and container pricing. Given the hard feelings evident in the comments to vendors, we were surprised by the results. Over half, 53.2%, said they were satisfied. Virtually the same percentage was reported by those who had experienced big increases in corrugated prices. In fact, 60% of those that have seen higher aluminum prices were satisfied with price communications from suppliers.

Not so with those experiencing higher prices for glass containers. From a smaller sample, 92.9% reported they were not satisfied with the way they were informed about price hikes.

Improved communications

When asked how vendors could help improve communications about price hikes (Chart 2), PW's purchasers were definitely looking for more material options to avoid increases, and also wanted more advance notice of increases. Similarly, most of the purchasing executives polled wanted more documentation about the amount of price increases. In fact, over half of those who reported higher steel container prices (55%) wanted more specifics.

An improved allocation program was mentioned by only a small percentage of all respondents. But of those paying significantly more for glass and aluminum containers, 18.2% and 13.3% respectively asked for improvements in allocation programs.

Regardless of which materials had increased, "fairness to all customers" was mentioned by between 10% and 15%, with one exception. Those experiencing higher glass container costs indicated they were unhappy with how the increases were apportioned among all customers. This was an issue for 35.4% of the respondents experiencing higher glass container costs.

The price strategy

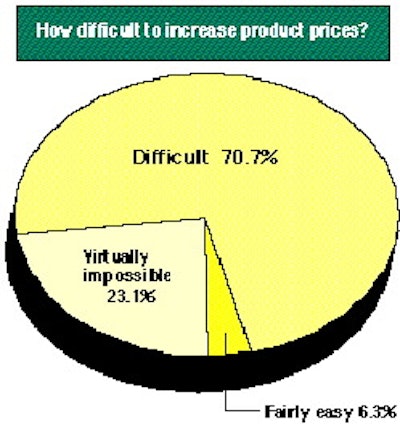

Before we look at raising finished goods prices to deal with packaging cost hikes, note how purchasers responded when asked how easy it would be to raise product prices (Chart 3). Surprisingly, not one of the more than 200 respondents said it would be very easy to raise their finished goods prices.

Of all participants, nearly 94% reported it would be somewhere between "difficult" and "virtually impossible" to increase product prices. Of all the questions in the survey, this one elicited the most uniform answers, regardless of which packaging materials they are paying much more for now. Those who answered "virtually impossible" ranged from 17.1% (aluminum containers) to 26.1% (paperboard). Those who said raising prices would be "difficult" were in a narrow range of 64.3% (glass containers) to 77.1% (aluminum).

A higher percentage of participants that have seen higher prices for glass and steel containers felt it would be "fairly easy" to raise product prices. Some 14.3% (glass) and 9.1% (steel) responded that way. That compares with only 4.3% of those dealing with higher paperboard prices.

As difficult as the purchasing people claim raising prices is, a surprising number of their companies have been forced to do just that.

Half of prices up

When we asked respondents if their companies had increased product prices to offset packaging cost increases, the purchasing agents reported that more than half (54.5%) had not raised prices for their products. Those that report paperboard and corrugated cost increases were no more likely to have raised product prices. Respondents dealing with higher paperboard costs did not raise prices 55.6% of the time; 55% for those dealing with corrugated cost hikes said the same.

Those seeing higher costs for plastic, steel and aluminum containers were more likely to have raised product prices. Two-thirds of those seeing increases for steel cans had moved prices up, 53.1% of more costly aluminum users, and 50.4% of respondents using more expensive plastic containers had done so.

Of the nearly half of respondents who reported higher product prices, more than half (52.3%) say the price increase did not completely cover packaging cost increases. In fact, only those who report higher prices for products packed in metal cans say their price increases were able to offset higher costs (53.8% for steel, 52.9% for aluminum).

On the other side, only four in ten reporting higher costs for glass were able to recover the costs through higher product prices. Those using plastic containers were just slightly better; 43.9% say the price hikes didn't completely cover increased packaging costs.

Prices affect sales

If, as reports suggest, the U.S. economy has experienced a slowdown in growth, increased product prices caused by higher packaging costs may be a contributing factor. Over half of all participants who said their companies had raised product prices to offset packaging cost hikes report a negative effect on company sales (Charts 4 through 10).

The good news is that 40.7% say the higher prices had no effect on sales. The better news is that 7% say sales went up in spite of higher prices.

More than with most questions, however, the results vary widely between the various materials used. Every one of the companies that use glass and raised prices to offset packaging cost hikes found that it depressed sales. Thirteen of the 17 companies that raised prices of products in aluminum cans lost sales. Is this a direct correlation? No one can be sure what role the higher prices played in declining sales.

At the same time, we asked respondents that reported declines to track the percentage. For most, the sales declines were under 5%. Nearly 83% of respondents say the decline was 10% or less. And fewer than 3% reported sales down more than 20%. Keep in mind, however, that the numbers of respondents reporting these sales declines is relatively small, compared to the 220 total purchasing executives surveyed.

Other changes, too

Of the 91 respondents who reported making product price increases, nearly 41% say their companies made other changes at the same time, as shown in Chart 11. Most often, the product size or quantity was changed, while many also offered improvements in delivery and other services. Increases in advertising and promotion were fairly common, as was a reduction in the number of the company's stockkeeping units.

However, even for those companies that didn't increase their product's price, a significant number of all respondents (44.4%) say they've changed packaging to add benefits for the retailer and/or wholesaler. In fact, 57.1% of those who pack in steel containers say they've made improvements, compared to 40% of the companies that pack in aluminum. A slightly higher percentage, 46.2%, say they've added consumer benefits to their packages.

Like lost sales, sometimes the dynamics caused by higher packaging costs can create negative changes inside the company too. The PW survey asked the purchasing executives whether higher packaging prices affected internal operations.

Havoc for the companies

The purchasing people were asked their opinion whether higher packaging prices affected their jobs in purchasing, overall plant operations or packaging operations (Chart 12). In some larger companies, the question may not have been totally fair. Quite often, the purchasing department is physically distant from production and packaging operations. However, even in the largest companies, few departments work in a vacuum, and the word gets around.

In the easiest question to answer, an overwhelming number of PW's purchasing people, 82.8%, said that higher packaging prices have had a negative effect on their departments. Another 10.8% said the higher costs have had no effect on their departments, while a bit over 6% said the impact has been positive.

As you might expect, the answers to this question were quite uniform. Depending on material, those reporting a positive effect ranged from 4.5% for steel containers to 7.7% for aluminum. Those who said the higher costs had a negative effect were in a narrow band from 77.1% for aluminum users to 92.3% of those packing in glass containers.

When asked about overall plant operations and packaging operations in particular, the range wasn't as great. Higher packaging prices had no effect on 43.6% of respondent's plant operations and a positive effect on 9.2%. However, that still left 47.2% who claimed a negative effect.

The numbers and ranges were similar when PW asked about packaging operations. The negative effect registered at 49.2% of all respondents, although 43.1% said the prices had no effect. Just 7.6% said the impact was positive. Those packing in glass and steel containers showed the strongest negatives, at 69.2% and 54.5% respectively, while half of those that pack in aluminum admitted that prices had no effect on packaging operations.

Some cutbacks too

Finally, the survey asked whether the higher packaging prices had specifically caused cutbacks to the participant's company packaging departments. Frankly, the results seem to suggest a modest effect at the most. We asked about cutbacks in three different packaging areas: engineering, research and development, and package development. (Charts 13-15).

More than 80% of all respondents said that packaging prices had not caused cutbacks to each of these functions at their companies. Considering all the dire consequences attributed to higher packaging prices throughout the rest of this report, that's very good news indeed.

However, for those who see that the glass isn't full, it means that 13.2% say there were cutbacks in packaging engineering, 16.7% in package development, and 13.6% in packaging R&D.

In examining the responses by material, 23.1% of those who have experienced price increases in glass containers say their companies have cut packaging R&D. But only 7.7% of those same respondents say their packaging engineering staff was cut. Despite the well-documented cost increases for aluminum cans (see PW, July '95, p. 60), 90% or more of the users of aluminum cans report no cutbacks in any packaging function.

No matter how your company stacks up to these statistics, it's obvious that the higher prices for packaging materials have created some major waves for purchasing people across all industries. By examining their comments to vendors, it's apparent that many of them are angry and feel betrayed by vendors. Still, we applaud the participants in the survey for their frank and candid assessments of how their companies are responding to higher costs for packaging materials. c