In 2018, the world produced about $36 trillion worth of manufactured goods, almost all of which was packaged, protected, and shipped in some form of industrial packaging. These industrial packaging products are key to the safe, efficient, and economical transport of manufactured goods in local, regional, and global commerce.

In Smithers’ latest market report, “The Future of Industrial Packaging to 2024,” it forecasts steady growth in demand for industrial packaging across the next five years, with market value rising from $56.2 billion in 2019 at a CAGR of 3.3% to reach $66 billion in 2024.

Says Smithers, overall demand in this sector will always closely follow international trade flows; however there are other far-reaching factors that may facilitate greater product innovations and evolutionary restructuring of value chains and business models. With shifts in end-use demands across the five years to 2024, the report identifies the following five key drivers and trends for the industrial packaging industry today:

1. Ongoing migration to developing regions: Manufacturing economies and demand for industrial packaging products will continue to migrate to China, India, and the emerging and developing nations of Asia, Africa, and elsewhere—especially among lower-value, less technically-demanding manufactured goods.

2. Potential trade and tariff disputes: Industrial packaging consumption growth is driven by the state of the global manufacturing economy, and by the state of global and regional economies and trade. While overall forecasts point to a relatively stable global and regional business environment, ongoing trade and tariff disputes—Brexit, NAFTA, and China vs U.S. protectionism, for example—have the potential to impact future industrial packaging use.

3. Safety, health, regulatory: No major changes in the regulatory environment for industrial packaging are expected. Manufacturers in developing regions may face challenges in adapting to international standards, such as those regarding transport of dangerous goods. Industry will continue to implement evolutionary improvements in durability and fire safety of plastic drums and IBCs.

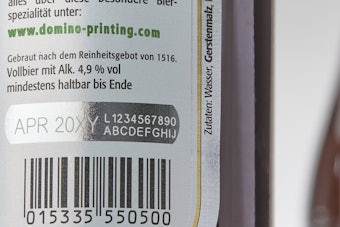

4. ‘Smart packaging’: The integration of packaging materials with sensor and communications technologies, logistics functions, and management information systems will allow real-time monitoring and analysis of the status and condition of valuable shipments.

5. Package innovation: Suppliers of materials, especially plastics, will continue to provide evolutionary improvements to key raw materials, including greater puncture, cracking, and abrasion resistance; greater strength and rigidity to support downgauging; improved chemical resistance; and barrier properties.