Private-label brands could reap the benefits of this massive shift in dollar volume—at the expense of national brands—if retailers emulate en masse the successful private-label strategies of several large U.S. chains, and if national brands continue the status quo.

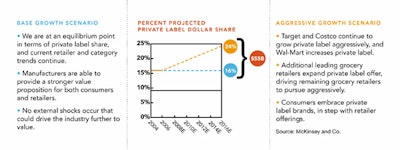

If that happens, McKinsey & Co., a consultancy, says in its report, private label’s dollar share would be 24% within a decade. At most retailers today, retailer-brand share varies between 11% and 15%.

McKinsey laid out those projections in a new report called “Competing in the New World of Brands: The Next Wave of Private Label” after studying the private-label capabilities of more than 70 retailers and interviewing trading partners for both national and retailer brands. McKinsey summarized its findings at the Private Label Manufacturers Association’s 2007 Private Label Trade Show in November in Rosemont, IL.

The success of European retailers’ private-label programs—share of market exceeds 50% in several countries—has already inspired a few U.S. retailers to introduce more sophisticated retailer-brand programs. The McKinsey report cites Safeway, Wegmans, and Kroger among the top-tier retailers that are driving the highest levels of private-label dollar share—22% of their total sales, on average. That compares with 15.6% for the bulk of the other retailers. However, McKinsey identifies a bottom tier of retailers that focuses extensively on national brands. This group’s private-label share barely exceeds 10%.

Retailers in the top tier have mastered using private label as a key differentiator to build consumer loyalty. They report higher levels of private-label growth (5.3%) than other retailers (3.4%) during the past three years.