Small investment, big return. Those words describe the experience of Dan McNair, materials manager, Levolor Home Fashions Canada, Toronto, with the www.corrugatedprices.com Internet site earlier this year.

McNair handles all of the purchasing functions of the Toronto facility that services the eastern half of Canada. That includes buying corrugated packaging used to ship the blinds via courier to stores such as Home Depot or directly to customers.

When he heard about CorrugatedPrices.com, he was intrigued. And when he checked it out, he was convinced that there wasn’t too much of a risk in paying the $200 (annual) subscription fee. It allows him to access the site’s corrugated pricing software and input data on his specific containers.

The timing was especially good as he’d felt boxed in by seemingly arbitrary price increases in corrugated: three 13% increases in corrugated prices within a year’s time that included one after he subscribed. “It was a hot topic among purchasing managers since no one budgeted for a 40% increase in any material during this time,” McNair states.

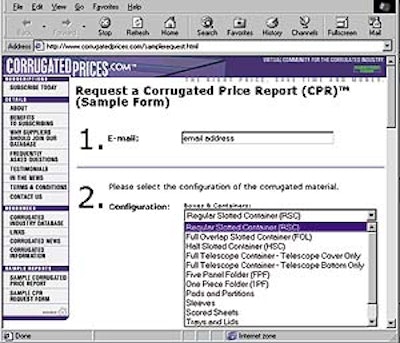

McNair keyed in the specifications of his corrugated containers—20 different ones—into a form on the site. A question-and-answer format prompts input in seven areas. The questions include selecting container type such as regular slotted container or other among 13 different styles; dimensions; board texture; closure method; fluting; specifications (ECT, burst strength, etc.); and printing. There’s an area for other details or special requirements. As an option, subscribers can fax in drawings.

As he was unfamiliar with the format, McNair says 30 minutes was needed to key in data on the first corrugated box he submitted. Once familiar with the format, McNair says he spent only about 10 minutes each to key in the information on the remaining 19 boxes.

“The output is no better than the input,” he notes, underscoring the need to provide thorough, accurate information.

Booking savings

The site guarantees a two-day turnaround, but McNair has received feedback within 24 hours, sent via e-mail in a form of a pricing quote that lists expected prices according to volume. The pricing equation is based on customized, proprietary software, according to site officials. It includes ongoing industry monitoring of benchmarks of raw materials costing data. It also takes into account pricing differences due to location as well as order volumes.

“For each form submitted, you’re informed that you should be paying, for example, 50 cents a box for your corrugated,” explains McNair. “If you’re paying 60 cents, then you need to talk to your vendor. This provides a benchmark for each type of [corrugated] container.

“It’s about that easy to use, yet it’s such a great tool. I’m impressed,” says McNair. It’s the equivalent, he says, of tapping into insider information that he can use as a negotiating tool with vendors.

And a powerful tool it is: Armed with the Corrugated-Prices.com information, McNair says he was able to negotiate with his corrugated vendors in a manner he described as assertive, not aggressive.

“I relay to vendors factual information I’m intimate with, so they can’t say I’m being unreasonable,” he says. “They can’t refute facts. The fact that they immediately lowered the prices for me tells me the numbers I have from CorrugatedPrices.com are damn close to the truth.” He admits that sometimes, vendors are merely passing along raw material increases from a paper mill. “But even then, a 10% price increase by a mill shouldn’t equate to a 10% increase in my corrugated costs,” he points out.

Bottom line results

He says he was able to lower pricing for almost all of his 20 different corrugated boxes; vendors adjusted the pricing for the next shipment. In a period when corrugated suppliers were passing along the third 13% price increase in about year, McNair was able instead to decrease his pricing by 5%. “That’s an 18 percent savings swing,” he enthuses. “Based on our initial spending US$300ꯠ for corrugated, we’ll be saving US$54ꯠ of that amount.” That’s an amazing 270-fold return-on-investment on his $200. “These are real, hard numbers of what we would have otherwise paid,” he emphasizes. “The savings go straight to the bottom line. And since vendors know I’m smarter [about pricing], they are going to act differently when broaching me about price increases next time as well, so I don’t have to go through the [negotiating] exercise.”

He plans to recheck the pricing on his corrugated boxes quarterly or anytime he has a new box requirement. He also receives industry updates from CorrugatedPrices.com via an e-mail newsletter. He is also automatically informed via e-mail of any pricing changes.

“I wish I had a tool like this for other commodities. If I could do this with my other materials purchases, I’d be promoted to president pretty quickly,” he jests.

No matter what the future holds, McNair and Levolor Canada won’t be blind-sided by arbitrary corrugated price increases anymore.