"Pallet-impact" has taken its place alongside shelf-impact in the thinking of packagers, thanks to the club-store growth juggernaut.

Now, more than just a material handling device, the pallet is a merchandising tool. In reaction, packagers strategize on designing pallet displays that communicate in 360-deg fashion and that incorporate minimum disposable materials. Club stores want pallet loads that can be received, stored, taken to the floor, and made ready for sale—all with minimum labor—and lastly, the stores want those pallet loads to be consumer magnets.

Yes, within the club store environment, the wood pallet is an unglamorous workhorse; a high-impact display on a wood pallet is analogous to a spiffy suit of clothes matched with scuffed shoes. The typical club store layout is Spartan, even drab by conventional retail standards, and the store heavily relies on packaging to provide sensory stimulation. To that aim, it’s good business sense to consider every packaging-related component, including the pallet. So, enter the plastic pallet, as a show horse.

More than just a pretty face

A plastic pallet is more attractive and colorful than a wood pallet. No argument there. However, beyond aesthetics, the plastic pallet offers other benefits to the club store.

A plastic pallet can’t damage the product, having no nails to protrude or boards that break or splinter. Not only is the product rescued from such hazards, but consumers and store workers are protected also. Furthermore, store personnel who manually handle the pallets after they are empty benefit ergonomically, because a plastic pallet is 30% lighter in weight than its wood counterpart.

Another aspect of protecting the product—and by extension, the consumer—is that plastic pallets are more sanitary, capable of being cleaned without the use of harsh chemicals. Plastic pallets are not subject to moisture-induced rot or infestation by insects or bacteria. Such characteristics are especially important for agricultural produce.

Manufacturing processes (injection molding, thermoforming, structural foam molding), resin formulations, and design features can be chosen to yield plastic pallets that not only are extremely durable, but also that hold tolerances that wood pallets cannot achieve. This translates to superior stacking and stability.

On sustainability

Among retailers, club stores have been at the vanguard of the sustainability movement, and plastic pallets are compatible with those initiatives. Plastic pallets are recyclable; when damaged beyond utility, they can be ground and reformed.

Plastic pallets spare trees that absorb carbon dioxide. There’s a counterargument that there's a carbon offset by the plastic manufacturing process; even so, an additional benefit is that landfills will be less clogged by discarded wood pallets.

As previously mentioned, a plastic pallet is lighter in weight than wood. The resulting savings in transportation fuel costs will become increasingly impressive as the price of crude oil continues to climb. More to the environment, however, is that with plastic pallets accounting for less of the weight of a vehicle load, more product can be transported in fewer vehicles, reducing the carbon footprint.

RFID benefits

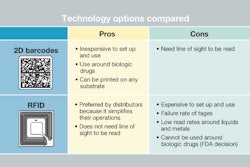

Club stores are among the biggest promoters of radio-frequency identification (RFID) technology for its inventory control accuracy that can eliminate stock-outs. For proof, one need look no farther than Sam’s Club’s recently implemented (Feb. 1, 2008) $2 fee assessed for each non-RFID-equipped pallet load received by the store (see Analyzing Sam's Club's RFID Fee).

Plastic pallets are more compatible with RFID technology. Tags can be embedded during the pallet manufacturing process to eliminate the possibility of tags getting separated and lost. With multiple tags placed variously throughout the plastic pallet, scanning is facilitated, with less interference from the composition of the load.

Pooling: Come on in, the water’s fine

If club stores were to switch to plastic pallets, it most likely would be done through a pallet pooling system. The participants (product manufacturers and channel intermediaries, including retailers) rent the pallets, which are owned by the pooling company. It’s a closed-loop system, wherein the pallets circulate through the channel and are eventually returned to the owners, to be inspected, repaired, replaced, or returned to service. Pooling frees channel members from the expenditure required of purchasing, as well as the various expenses and overhead associated with ownership.

Let us digress momentarily to a discussion on purchasing and ownership by channel members. In the past, cost analysis started with the observance that a plastic pallet carried a higher unit price than a wood pallet, but too often, the analysis stopped there. Such analysis was inadequate, failing to factor in service life, repairs, trips per pallet, and payback period. Under a systems analysis, plastic pallets emerge competitive, if not superior.

Another thing about the price of a manufactured item: it reflects economies-of-scale and their related quantity discounts. Price, therefore, will become even more favorable as the plastic pallet industry grows, despite the fact that the material is a derivative of petroleum.

Returning the discussion to pooling, club stores are familiar with the concept, already using it for wood pallets. Those 9-block “blue” wood pallets, ubiquitous throughout club stores, are owned by CHEP (Commonwealth Handling Equipment Pool), an international company that's the largest of its kind.

Meanwhile, what’s a packager to do?

All of the aforementioned benefits of plastic pallets also accrue to packagers. They need not wait for adoption on the part of the club-store industry. In fact, for years, plastic pallets have been employed in a variety of industries and companies. Some of that use has been captive, in other words, limited to in-house use or horizontally among sites within the same corporation. In those instances, the pallets are an owned asset and must be tightly accounted for and controlled.

On the other hand, a growing number of companies—notables in such industries as food and beverage, pharmaceuticals, and consumer nondurables—are utilizing plastic pallets for benefits throughout the supply chain. Those companies, for the most part, are members of pooling. Among the companies proving the service, an aggressive niche is being carved out by iGPS (Intelligent Global Pooling Systems).

Regardless of a packager’s present stake (or absence thereof) in plastic pallets, part of strategic planning is scanning various environments for relevant trends. In that regard, what the club stores do bears monitoring. For one thing, the club store industry has demonstrated that it has the clout to dictate to other members of the supply chain and to enforce those dictates. If the club-store industry ever issues the edit that, Thou shall use plastic pallets, it would send many packagers scrambling, but not those who have exercised strategic foresight.

That foresight should include supply-side projections. Presently, the plastic pallet industry cannot accommodate a wholesale conversion from wood. Now is the time to identify present members of the supply industry; become acquainted with their capabilities, plant capacities, and expansion plans; forecast new entrants; and form the basis for future relationships.

Commerce is about product moving through channels, and competition imposes constant pressures to streamline, reduce costs, and increase efficiencies of those channels and the movement of product therein. As the central element common to that flow, the pallet, in all its particulars, should be evaluated for all of its potential.

Before becoming a packaging consultant, Sterling Anthony worked for Fortune 500 food, healthcare, and automotive companies, and has taught packaging at the university level. He welcomes your comments by phone, 313/531-1875 or by e-mail, [email protected]. His Web site is www.pkgconsultant.com.