In the end of line packaging space, the demand for greater product visibility is driven by a combination of regulations, retailer requests, and manufacturer logistics. These three forces are leading to expanded labeling for end of line packaging configurations, allowing for greater efficiency and accuracy in product tracking through the supply chain.

Regulations

In the area of US regulations, the Drug Quality and Security Act (DQSA) and the Food Safety Modernization Act (FSMA) are the primary legislation affecting the pharmaceutical industry and the food and beverage industries, respectively. And the result for both is more visibility of products – particularly bulk bundles and pallets – as they move through the supply chain.

For pharmaceuticals, Title II of the DQSA, the Drug Supply Chain and Security Act (DSCSA), requires the complete serialization of products from the individual product level all the way up to pallets. For food and beverage manufacturers, Section 204 of FSMA requires detailed production and distribution records to be kept in case of a product recall.

Retailer Requests

Retailer requests for increased product visibility in the supply chain impact many CPG manufacturers. In order to plan their own inventory management and distribution systems, the largest retailers can dictate new tertiary packaging arrangements and require additional visibility into the movement of products through their own supply chains.

Retailers are driving changes in pallet configurations, coding/marking visibility, pallet labeling, traceability, and the expanded use of direct printing on EOL packaging.

Manufacturer Logistics

Supply chain product visibility also enables manufacturers to better track shipments and forecast future production needs, or manage e-commerce and direct-to-consumer solutions - especially when setting up channels for online purchasing. Even manufacturers that outsource portions of e-commerce production and distribution must tightly track product inventories to gauge available supply.

All of these drivers require packaging lines to adjust end of line strategies through more labeling on tertiary packaging, which enables more efficient tracking of bundled products through the supply chain.

EOL operations must also be integrated into a larger ERP system to manage production, track shipments, and predict future distribution needs.

Many manufacturers are using enhanced labeling solutions such as QR codes, NFC labels, and RFID markers on tertiary packaging. These smart labels provide reliable and accurate visibility into production and distribution of products, enabling manufacturers to track shipments in the event of a recall and enabling the accurate management of just-in-time delivery systems.

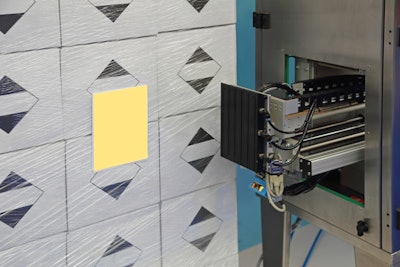

Enhanced labeling requirements have also created needs for labeling capabilities at the very end of the line, such as label application after the accumulation and final securing of products on a pallet. For manufacturers, this means either new labeling equipment, or the integration of labeling capabilities into existing equipment at the end of the line.

To read labels and log them into a centralized, integrated ERP system, manufacturers are turning to vision inspection equipment to fully integrate their packaging lines. And in some cases, they are combining these capabilities into one machine capable of carrying out multiple tasks, such as an integrated robotic palletizer equipped with vision capability to read and log labels.

Contract Manufacturers and Packagers

The expansion of SKUs, surge in e-commerce, and the growth of CPG industries have all pushed brand manufacturers to rely more on contract manufacturers (CMs) and contract packagers (CPs) to manage expanding production levels. Manufacturers also rely on CMs/CPs to access packaging formats and logistics strategies that they do not have the capacity to handle in-house.

For contract packagers, being able to accommodate a variety of pallet configurations and conform to several different labeling requests is particularly important. 80% of contractors interviewed stated that pallet flexibility is being dictated by their retail accounts, while 60% noted that retail customers were requesting greater coding/marking visibility on EOL packaging.

Source: PMMI Business Intelligence report 2021 End-of-Line Equipment Purchasing Trends and Design Insights

Download the FREE report below.