But findings from PMMI’s recent

“Secondary Packaging Market Research Study” portray secondary packaging in a time of transition.

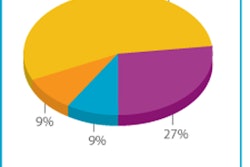

Overall, 50% of survey respondents say that specially designed cases will replace corrugated fiberboard. Another 24% predict that corrugated will remain a transport-packaging staple, as the call for lightweighting versus the need for strength and product protection are a trade-off. Yet, 21% of the packagers see corrugated usage increasing because of Internet sales and retailer-demanded display cases.

Contract packagers, representing 18% of the survey’s total participants, are more likely than the consumer packaged goods (CPG) companies to see usage of regular-slotted cases (RSCs) and corrugated fiberboard staying at current levels or even increasing. Most of the contract packagers noted, however, that CPG companies have the final say in the packaging choice.

In addition, 80% of the surveyed companies currently use RSCs for transport packaging, but half admit they are looking for alternatives. Of the alternatives, trays with overwrap are a top choice, shrink-wrap alone is second, and bliss boxes are third.

Although big-box retailers are mandating shelf-ready display cases, the CPG companies that responded overwhelmingly say they will supply such packaging only when it is demanded.

Alternate materials to corrugated fiberboard clearly are under consideration, but higher procurement costs will stymie widespread acceptance, the survey finds.