A relatively recent phenomenon, membership warehouse club stores are the fastest growing of all general merchandise retailers, posting sales of $127.8 billion in 2007—a figure expected to grow to nearly $200 billion by 2012. That’s according to a report by consultant James Degen, “Membership Warehouse Clubs,” published in 2008.

At the heart of the club-store model is a system of high-volume sales, low-cost purchasing, and efficient distribution, all of which are dependent in varying degrees to product packaging. Reports HHC Publishing, Inc., “Packaging is one of the single most important components of a warehouse club program.” While each of the top three club stores, Costco, Sam’s Club, and BJ’s, are constantly evolving their specific expectations for supplier packaging, there are several elements that have come to define the club-store pack. These include retail-ready designs, outstanding graphics communications, innovation, and most recently, low environmental impact.

Club store depends on retail-ready

As defined in a report by consultancy Pira International, retail-ready packaging (RRP) is a system of packaging and merchandising that allows goods to be moved direct-to-shelf with minimal in-store handling, enabling products to be displayed effectively within a secondary packaging medium.

One of the earliest implementers of RRP in the U.S. has been the warehouse club store, where the store doubles as a warehouse, stocking pallets of RRP. This reduces the costs for space and for product transport and restocking.

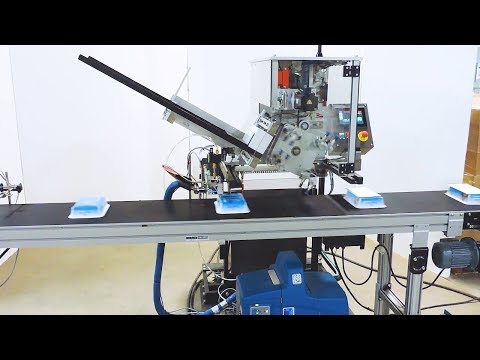

Among the first companies to develop a retail-ready secondary package design was converter Mid-Atlantic Packaging of Montgomeryville, PA. In 1994, Mid-Atlantic introduced a two-piece display-ready package comprising a self-contained shipper covered with an HSC that, once removed, reveals an appealing, multicolor display. The package was made possible by the company’s use of specialty folder-gluers customized in-house. This included the addition of a secondary feeder that made it possible to combine two sheets into a single, glued product.

“We were the first company to run what was at the time called a ‘two-piece display-ready package,’” explains Mid-Atlantic president Andrew Pierson. “That has evolved into a number of other various forms of display packaging and now is moving forward into retail-ready packaging.

“From a marketing standpoint, the package certainly allows you to have a powerful selling tool because we employ a lot of graphics. It helps consumers make those kinds of decisions that they make roughly in 30 seconds from 15 feet. The package is also structurally very sound. In addition, most of the designs of the package can be run on automatic case-erecting and sealing equipment, so there is minimal labor associated with the package.”

One of Mid-Atlantic’s biggest customers is The Hershey Co., which uses nearly 2,500 different RRPs to serve its club-store and high-volume customers, according to Hershey’s former director of Global Packaging Procurement, Bruce Fair. He recalls that the move from secondary RSCs to RRPs began around early 2000. “Our retailers didn’t want their folks spending a lot of time pulling the bags out of the cases and putting them on the shelf,” he says.

“With the onslaught of display-ready, we had to make the packaging shoppable, but still get it through our channels of distribution,” Fair adds. “The two-piece case allowed us to have a display-ready case but yet make it retail-ready for our customers.”

One of the biggest changes in RRP that Fair says he has seen in recent years is the explosion of high-quality graphics—“from a 100-percent brown box to where 60% of cases are now multicolor,” he relates. A normal corrugated case from Hershey that uses graphics employs up to four to five colors, with some having as many as seven or eight. “The graphics business has just grown tremendously for us,” Fair says. “It’s definitely the norm now.”

As for the varying package size and style requirements from the “Big Three” club stores, Fair says Hershey accommodates them as best as possible, but is limited by equipment designed for mass production. “We really try not to customize a lot of product,” he says. “We try to keep our case counts pretty much the same across the board, but there are times when we will do perhaps special flavors or varieties for certain customers.”

Own-brand innovation escalating

To differing degrees, all three of the warehouse club stores have developed private-label brands that compete with national brands in a range of categories. Notes the February 27, 2009 edition of “Warehouse Club Focus,” from HHC Publishing, “Private-label merchandise offers the clubs the ability to generate higher gross margins while still offering its members quality and value.”

Nowhere is the use of private-label brands growing at a greater pace than at Costco. Since 1995, the club store has offered its Kirkland Signature brand, with the aim that “all Kirkland Signature products must be equal to or better than the national brands and must offer a savings to Costco members.” Currently, 10% of the products sold at Costco are Kirkland Signature, “and that percentage is gradually increasing,” relates an article in the October issue of Costco’s monthly magazine, “The Costco Connection.”

According to Brian Sharoff, president of the Private Label Manufacturers Association (PLMA), retailers such as Costco that have strong store-brand programs have become very sophisticated in their procurement practices. “There’s no doubt they are placing new demands on the manufacturers that supply them,” he says. “They’re looking for innovation that often doesn’t have a national brand equivalent.”

A perfect example of this trend is the Kirkland-brand sliced luncheon meat in innovative resealable packages. West Liberty Foods initiated this particular packaging innovation. But Ed Garrett, CEO of the West Liberty, IA-based meat producer, makes it pretty clear that the successful launch of this package sprang from a close working relationship among the retailer, the meat packer, and the packaging materials vendor, which in this case was Cryovac.

“I’ve worked with Cryovac Sealed Air for a long time,” says Garrett. “At one of the shows a year or so ago, they told me that this Multi-Seal concept was in development and asked me what I thought about it. I told them I thought it could really be attractive in the retail world if they could make it work. I also stayed close to them, and when they told me they were close to making it go, I asked Costco to go with me to Cryovac headquarters to get more familiar with the technology. A couple of Costco buyers joined me, Cryovac showed us the package, and the buyers agreed it was what they wanted. It was rolled out nationwide, first ham then turkey, beginning first quarter of this year. We’re hearing a lot of good vibes from Costco.”

Philadelphia-based Dietz and Watson was the first to commercialize the Multi-Seal concept when it launched with an own-brand item. But West Liberty put a club-store twist on that package by producing a three-pack where a perforation separates each 14-oz unit. “We placed a perforation station right after the sealing station,” says Garrett. “We can dial in the number and the length of the perfs.”

The packages are produced in West Liberty’s Tremonton, UT, plant on a pair of Multivac thermoform/seal systems purchased specifically for the project. “At this point, they’re maxed out,” says Garrett. “So we’re looking at buying more capacity soon.”

Loading of meat into thermoforms is currently done by hand, but robotic insertion is being explored. Garrett is also looking at producing a perforated three-pack where one cavity holds ham, one turkey, and one beef.

Pack provides less waste, more eye appeal

Retail-ready shoppability, high-impact graphics, innovation, and sustainability are all elements of a new trapped-blister package designed by MSL COPACK + ECOMM, Indianapolis, in cooperation with CardPak, for multipacks of L’Oréal brand personal care products. The package recently underwent a redesign from a standard, fully enclosed Radio Frequency-sealed clamshell to a new three-piece trapped-blister design that minimizes package materials while enhancing package graphics.

Explains Jeremy Bunce, principal and CMO of MSL, “The transformation from clamshell to blister eliminated the vast majority of the petroleum-based products, reducing harmful contaminants from the waste stream, reducing packaging costs, increasing equipment-based productivity, and offering a secure, high-graphic visible foreground and background for marketing to enjoy.”

Components of the new package design originally included a front- and back-printed SBS card with a specially designed inner heat-seal coating, a 100%-recycled e-flute insert for stacking strength and tear-resistance, and a two-sided rPET blister with flange. The next progression of the package eliminated the recycled insert and replaced it with a one side-printed e-flute stiffener, thus creating a two-piece package.

The trapped-blister packs are displayed in a 100% recycled tray, with size and quantity guidelines provided by the club stores. According to Bunce, the shelf tray has also been used as a freestanding pallet display.

For maximum graphics impact, MSL offers eight-color printing. “As club stores become more mainstream, I believe we will continue to see major brand retailers promoting high-graphic packaging to attract the eye of the consumer to make the commitment to buy,” says Bunce. “Make no mistake about it, club stores are no longer generic bulk-product distributors with ugly packaging.”

Club stores consider environmental footprint

As with most retail environments today, club stores are becoming increasingly conscious of the environmental footprint of the products they offer. In fact, club stores may have an even greater stake in ensuring that their suppliers minimize packaging waste.

“All of these stores are very much aware of the interests of their members,” says consultant James Degen of J.M. Degen & Co., Inc. “If you look at the average shopper at all three of these clubs, they are high-income, highly educated consumers. Typically, these types of customers are going to have more interest in packaging that is more sustainable and more recyclable.”

While the efforts of Sam’s Club to reduce packaging waste have been highly publicized, Costco and BJ’s have also been encouraging their suppliers to eliminate extraneous packaging, Degen relates.

Says Hershey’s Fair, “We take the responsibility [for reducing packaging materials]. ... We are trying to light-weight our packaging as much as we possibly can while still getting the product to our consumer in a salable fashion. So in working with our suppliers, we make sure that the case is still going to hold up to our distribution network.”

“There is a lot of work being done right now with light-weighting of liners, with high-compression liners,” he continues. “With almost all of our products today, we use ECT versus the old model. Years ago, we had a 69-pound liner. Now we are using all 56-, 57-, and 58-pound liners. We’ve definitely reduced the fiber in our corrugated.”

When asked if he feels suppliers are being pushed by retailers to reduce packaging, Fair says, “Absolutely. I mean there is no question, especially with Walmart’s whole sustainability effort.” Whether the push comes from retailers or from inside Hershey though, Fair says, “it’s the right thing to do for the environment.”

Mid-Atlantic’s Pierson sees the increased move toward sustainability, as well. “This is gathering quite a bit of speed,” he says. “We see this as absolutely continuing because you’ve got so many commitments out there to continue to reduce fiber and reduce the cost associated with packaging without compromising the sales empowerment.

“The first thing we do when we talk to a customer or potential client is show them upfront the sustainable advantages of these various [two-piece, retail-ready] designs.

“The most important job we have is to protect the customer’s product to the end of the supply chain. We can show how these various designs do that. We show how they can fit into the footprints that are required, and we also show them that because of the design strength, they can protect the product.”

MSL has met the challenge of reduced packaging through its EcoLogical line of blister packaging, with the L’Oréal pack being one example. The line is said to reduce up to 85% of the plastic typically used for clamshell packaging. Says Bunce, “As we move forward in our efforts and processes specific to the club stores, we are continuously challenging ourselves to reduce point-of-sale packaging wastes, where waste is inevitable.

“We attempt to make environmentally sound decisions in utilizing recycled or recyclable materials and to protect the customer’s products by developing secure packaging while minimizing handling damage, and at a cost that fits within each retailer’s parameters.” •