In September 2013, UPS reported that changing regulatory environments, new customer demands around the globe, challenges around product security, and increasingly complex products are driving healthcare executives to make strategic supply chain investments.

That was according to the sixth-annual UPS "Pain in the (Supply) Chain" survey. In this interview, Healthcare Packaging (HCP) talks with Robin Hooker, Director of Global Strategy Healthcare Logistics at UPS, about the genesis of the study and what supply chain issues are most important to survey respondents in different global regions.

HCP: When did the UPS “Pain in the (Supply) Chain” survey begin, and why?

Robin Hooker (RH): This is the sixth year of the survey. We did a five-year recap last year. This year we have taken a deeper dive into some of the top supply chain challenges and strategies. Our main interest in conducting the survey is to better understand healthcare supply chain executives’ views and perspectives right now and to determine where things are going in the future. We are interested in tracking supply chain concerns and strategies for addressing those concerns, and from respondents that feel they have been ineffective in addressing some of those concerns, what are their main headwinds? By tracking the data points over time, we get a feel for the shifts in the industry. It allows us to stay very connected to issues transforming the healthcare supply chain and learn how we can more effectively meet the demands changing this exciting marketplace.

HCP: Is this survey distributed electronically? How does that process work?

RH: The Pain in the (Supply) Chain survey represents a significant investment. It is a blind telephone survey, and the respondents are not necessarily UPS clients. We are seeking to capture the broad market perspective. The survey is conducted by TNS Global on behalf of UPS. They provide the sources for the survey and they only interview respondents based on predetermined criteria. It’s also a global survey and is filtered so that it focuses on medical device, pharmaceutical, and biotech manufacturer logistics decision makers. For the latest survey we had 441 respondents, with 239 in pharmaceutical and biotech, 202 in medical devices. Annually, we try to achieve similar response distribution. For example, last year, we had 377 respondents, 212 were in pharmaceutical and biotech, and 165 were in medical device.

HCP: With this recent survey, what details most stood out to you or surprised you?

RH: Year after year, the top three supply chain concerns have been regulatory compliance, managing supply chain cost, and product security. We have seen a flip-flop this year where product security moved up to the second issue and supply chain cost was pushed down to the number three position. Frankly, that surprised me and I think that surprised a few others, too.

We thought with the economic downturn, the concept of cost would be very close to being a top concern in healthcare supply chains, but it actually was pushed down to third. One reason for this change came from respondents in the Asia-Pacific region who tracked strongly toward product security as their number-one concern. When we collect the data from a global perspective, we are seeing concern over supply chain costs being pushed down as a top issue, with Asia-Pacific respondents interested in both product security and product damage and spoilage.

It is very interesting to look at the data from a global perspective and understand some of the nuances of what’s going on but I think what’s happening in the Asia-Pacific is that there is more concern over the integrity of the supply chain and that can run the gamut from in-transit disruption to counterfeiting to product damage and spoilage on the temperature excursion side. It may be because the market growth rate is more robust and they are more concerned with meeting client demands than with cost containment. In a lot of cases, what we see is that the growth tends to sometimes mask the need for running efficiently or maybe even deprioritizes it.

HCP: Please define what you mean by product security.

RH: When we look at product security, it has to do with everything related to the integrity in the supply chain. It can mean the introduction of counterfeits; or it can mean risk and loss related to pilferage or diversion on the dock, and different types of theft that can occur. Some of this can be related to in-transit monitoring and intervention solutions. The other side of product security might be just risk mitigation with insurance.

HCP: The survey said 84% of global healthcare executives will invest in new technologies. What are some of these technologies are or what you are referring to?

RH: The strongest activity we see is related to order management—systems that allow their clients or their distributors to interface or interact with their materials’ planning and distribution systems. This is their order fulfillment and management technology. It’s resource planning and staging.

The second technology is web ordering systems, or portals that allow for orders to be easily entered and accessed.

Following that, if we look at the current investment the next highest area would be cold chain and temperature-sensitive technology investment. These could be data loggers and portals to archive the data logging information because these shipments move and transpire, and a lot of this information has to be stored and referenced. E-pedigree and serialization technologies are growing as well. We support initiatives and organizations that look for standards that can be applied to a lot of the supply chain and manufacturing processes in a more universal manner.

HCP: The survey also said that 78% will enter new global markets. Can you tell me what the key growth markets are globally?

RH: When we look at the top markets for expanding companies, we are tracking China at 27%, the U.S. at 21%, Brazil at 18%, and India at 13%.

HCP: We touched on this earlier, but what are some of the top issues by global region?

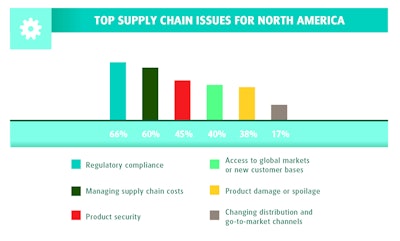

RH: When we look at North America and Western Europe, regulatory compliance is the top concern. In the U.S. and Canada specifically, the number-two concern is managing supply chain costs. That’s followed by product security, and then global market access. Product damage and spoilage is also a top concern, along with changing distribution and go-to-market channels.

Back in the U.S. again, regulatory compliance and managing costs are key, and the Affordable Care Act is probably creating the impetus, along with a slower economy. Yet from what we are seeing from Medicare and Medicaid in terms of projections into 2014 and beyond, things should improve in terms of demand uptick.