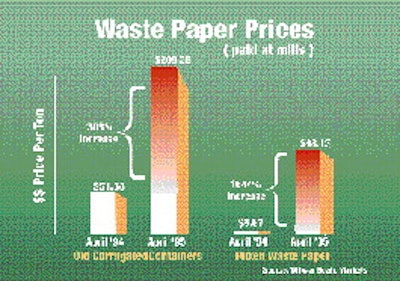

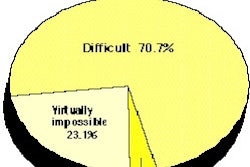

Raw material prices for used paper and plastic packaging have tripled over the last year. While the roller coaster is now on a down slope, experts expect some upward pressure on prices again this fall. Packagers are getting a break on recycled plastics today, but a temporary decline in used paper prices will not be passed along to package buyers. They are now paying about 40% more for corrugated boxes than last year (see p. 98; see PW August '95, p. 62). The factors that affect each market are different. The following is a brief description of the market forces that drive prices for major recycled raw materials for packaging. Plastics: Where's cause & effect? In late 1993, baled bottles of high-density polyethylene brought 0 to 10¢/lb, while bales of polyethylene terephthalate bottles were slightly higher. Last year, China's cotton crop failed, so Chinese buyers in the fabric industry substituted with recycled PET. Before long, they had bid up the price of recycled PET to 40¢/lb, and about 25% of this material left the U.S. market. This happened at a time when there was increased U.S. demand for RPET. This was due to a shortage of virgin resin, increased recycling capacity and long-awaited approval of some new RPET applications. All of a sudden, U.S. recyclers faced a serious shortage of PET bottles for recycling. Meanwhile, in the polyethylene arena, virgin HDPE moved up from its doldrums in the 20¢/lb range to nearly twice that price. That tempted some bottlers to switch to RHDPE because suddenly it didn't carry a price premium compared to virgin resin. The other compelling reason was the state of California's recycled-content mandate was scheduled to kick in by January '95-and it looked like industry efforts to kill the law would not succeed. This law requires that all rigid plastic bottles between eight ounces and five gallons be more environment-friendly. By law, these containers must be source-reduced 10% compared to 1990, reusable five times or contain 25% post-consumer recycled resin. Exempted food and cosmetics companies are permitted to submit reports that show efforts to use recycled plastics in other applications, including pallets, crates or office items. As the demand for waste HDPE began to climb, a number of processors reportedly began buying up all the bottles they could, bidding the price up to the 30¢ range by last fall. Most passed on these higher costs to their customers. But then, the nation's largest packaging users of post-consumer recycled plastics decided to revolt. Companies such as Procter & Gamble, Lever Brothers and Clorox dropped their purchases abruptly-reducing their usage of the material by 20 to 50%. Faced with this softened demand, recyclers grew reluctant to pay the higher prices for waste HDPE. By July '95, the price of baled bottles was down from 30¢/lb, and back around 16¢/lb. This is when the big consumer products manufacturers decided to reenter the market again. "They [the big consumer product packagers] killed the market for high-density polyethylene waste when they reduced their buying," says a buyer for Browning Ferris Industries, a major national waste hauler and collector of recyclables. "Why would they use that stuff at a five-cent or more premium when you can use virgin instead?" Timing of price drop The drop in post-consumer HDPE prices came before the State of California actually begins to enforce its recycled content law. Observers say there were other regulatory factors that reduced market demand for waste HDPE, including: * Florida's advance disposal fee will "expire," as the Legislature decided not to renew the law in May of this year. Industry consultants say there was little evidence that the law affected plastics markets. However, government officials, recyclers and haulers dispute that opinion. They feel the death of the ADF will have a real impact on markets in the future. * Oregon, which had enacted a law similar to the one in California, met the 25% recycling rate for plastic bottles, thus exempting manufacturers and packagers from having to use recycled materials. * California, meanwhile, loosened its definition of "post-consumer recycled plastic" because of complaints there was a shortage of feedstock. The California Integrated Waste Management Board allowed the use of many pre-consumer scrap-type products in figuring recycled content. Now that prices of collected plastic waste are closer to what product packagers consider "reasonable," the companies have resumed buying again. Levels may shift According to Tom Rattray, associate director of environmental quality for Procter & Gamble, that company is again buying about 50 million lb per year of recycled plastics, most of which is RHDPE. However, even this pioneering company admits that some habits are changing. Companies no longer have much interest in using 100% recycled content in some bottles. "That's too hard," Rattray says. "It's like getting all As on your report card." Terrence Bedell, environmental manager at Clorox, apparently agrees. Clorox is using enough recycled plastic to stay in compliance with the "25% average" across all product lines in California. This means the mass balance of all regulated containers needs to average out at 25% (i.e., 100% recycled content in one container, 0% in three others). Clorox is buying about 32 million lb of recycled resin; 90% of purchases are RHDPE. The company buys the recycled resin in pellet form and blends it with virgin resin. Bedell says the company is shifting from 100% to 50% recycled content on some PET bottles. Jim Hiltner, a buyer with Owens-Illinois, says he hasn't seen any new surge in demand for the recycled material from his customers. Many customers, he says, have opted for alternative compliance strategies. These customers reacted to the market, and they're now leery of any dependence on recycled materials. PET prices still strong Prices for recycled PET remain strong at press time, even though China halted the purchases of most recycled plastics in July. Chinese officials declined to comment on their market withdrawal. But U.S. experts on Asian environmental law predict the Chinese may have temporarily withdrawn from the market for a couple of reasons: supply and demand for material in China, or because of new regulations on imports and licensing. Although RPET is expensive, it's still about 10¢/lb less than virgin PET, most observers agreed. And the price of virgin resin is being propped up by the shortage of virgin PET resin that many buyers have experienced over the last several months. [Editor's note: PW didn't identify specific resins in its pricing survey (p. 98). But it was apparent by many comments from buyers that higher prices and limited supplies of PET were causing at least some of them to consider alternatives.] The shortage, however, isn't expected to last long. A number of new production factories, mostly overseas, are being built that will bring more resin to the market. Nonetheless, the heavy demand for PET shows little signs of subsiding. It's being driven in part by new technologies for making bottles, growing use of PET containers in overseas countries and by the steady numbers of conversions from glass and other plastic containers to PET. Paper: Mills scrambling As a raw material, paper is in a different situation, mainly because customers don't usually specify recycled content very often on packaging (although mills must specify virgin content). Mills have used the recycled paper as a dependable, inexpensive source of fiber, just as steel mills use a high percentage of recycled steel in their feedstocks. The average corrugated container may use 20 to 30% recycled fiber, and most nonfood boxboard contains up to 75% post-consumer fiber. Until this year, only corrugated packaging was typically being recycled in much volume. However, the prices of old corrugated containers (OCC) and other waste papers skyrocketed in '94. Once again, buyers from the Far East apparently tired of the shorter fiber European OCC and decided to buy American OCC. This caused the price to temporarily shoot up from $20/ton up to $250/ton. Meanwhile, million of tons of capacity for recycled fiber came on line last year, increasing the demand for waste paper. An expert on kraft paper with the American Forest & Paper Assn. says the industry will need about 140 million more tons of waste paper over the next few years to feed the mills that use recycled paper stock. No new "greenfield" plants are being planned at present. Feedstock changes Paper mills have increased the prices of all paper grades while they are making some switches in their feedstocks. Packagers have seen prices of corrugated and recycled boxboard increase about 40% to 50% in the last 18 months. Along with these factors, the higher prices are being fueled by a strong economy and global markets, according to Mark Arzoumanian, editor of the newsletter Official Board Markets in Chicago. Mills are now asking for what is called "mixed paper" grades, for which there had been very little market in the past. Boxboard mills that are able to use mixed paper as a feedstock are finding keen competition from linerboard and corrugating medium mills, according to a boxboard seller at Browning Ferris. This will translate into higher prices of boxboard until the economy slows down, he says. The price of OCC has fallen to about $140/ton, but mills are now paying $90 to $110 for mixed paper. Collectors are offering long-term contracts to cities, and enjoying some success. Observers agree that prices will go up again this fall, although not to the record levels experienced recently. The new "demand pull" means that consumer boxboard is now being collected in dozens of communities across the country in residential "mixed paper" collections. None of the experts contacted for this report had any numbers of how many communities are participating, but Browning Ferris says it's "growing at a fast pace." Thus, while it appears there may be some price relief for PET by 1996, only a real recession will drive down prices for plastics or paper-either virgin or recycled.