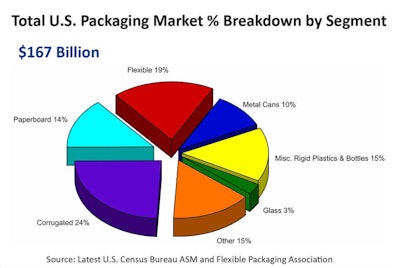

Factors such as sustainability, digital printing, and e-commerce would all seem to bode well for the future of the flexible packaging materials market. Flexibles represent approximately 19% of the total $167 billion U.S. packaging industry, according to the just-released Flexible Packaging Association’s (FPA) “2018 State of the Flexible Packaging Industry Report.”

Although FPA’s report is not a trends report, the association does report that flexibles rank as the second-largest packaging segment, behind corrugated paper but ahead of bottles and miscellaneous rigid plastics packaging.

“Flexible packaging’s solid, long-term strength, coupled with flexible packaging replacing other packaging formats, resulted in the growth of flexibles from 17% in 2000 to the current level of 19% in 2017,” notes FPA.

That steady growth is reflected in the total flexible packaging industry, which FPA estimates at $31 billion in annual sales for 2017, up from the $30.2 billion in 2016 noted in the association’s 2017 report. The $31 billion includes packaging for retail and institutional food and non-food (including medical and pharmaceutical), industrial materials, shrink and stretch films, retail shopping bags, consumer storage bags, wraps and trash bags.

Referring to itself as the voice of the U.S. manufacturers of flexible packaging and their suppliers, FPA points out that the 2018 report provides industry converters, suppliers, investors, and analysts with insight into the performance of the U.S. flexible packaging industry over the past year, such as growth, revenue/volume expectations, profitability, and capital spending. The data and information resource also examines the following flexible packaging factors:

• Materials and processes (printing and expected material usage)

• End uses (end-use forecast and U.S. Census Bureau retail segments data from 2016, noting Census Bureau data for 2017 is not expected to become available until late fall 2019 or early 2020)

• Structure and consolidation (mergers and acquisition activity)

• Imports and exports (trade outlook)

• Industry vision, challenges, and critical issues

The FPA 2018 State of the U.S. Flexible Packaging Industry Report is a benefit of FPA membership and is available in the Members Only section of the association’s website. The report is available to non-members of FPA for $4,000.