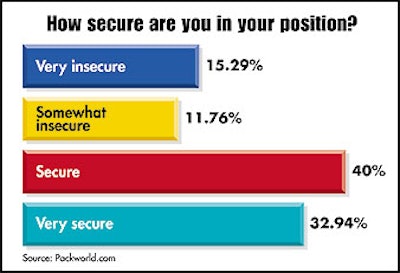

Last month, the U.S. Department of Labor reported that the unemployment rate rose to 5.8% in December 2001, with manufacturing jobs declining in nearly every industry that month. That translated into 8.3 million people out of work. How secure are jobs in packaging? To find out, Packaging World conducted a survey on packaging job security in November on the Packworld.com Web site. Although more than 100 people answered survey questions, this report includes responses from 86 people at end-user firms in North America, about 90% of whom work in the United States. (See sidebar, “Who participated in survey,” p. 56.) So just how secure are packagers in their positions? On a scale with 1 meaning “very insecure” and 4 “very secure,” nearly 73% optimistically responded with either a “secure” or “very secure” rating (see Chart 1). Only 15.2% indicated they were very insecure.

Consumer influence With so many negative economic factors influencing employment, it’s understandable why some packagers felt insecure in their positions. More than 60% of respondents to the question, “What do you think is the primary reason for potential layoffs in packaging?” believed job losses would be due to the softening of the economy (see Chart 2). Since consumer spending drives roughly two-thirds of the economy, according to the Department of Commerce, it makes sense that consumer purchases will have an impact on employment. “Layoffs will occur as a direct result of consumer spending through the fourth quarter,” predicted Carl Justis, special projects coordinator for Sparks, NV-based Critical Claim Packaging, a maker of flexible bags used by consumers in the home to keep foods fresh. “Companies normally release employees due to low or no cash flow.” “I believe packaging professionals are fairly secure now, but should the economy not improve in the next six months to one year, their security may be different,” said an engineer working at a food company in the Midwest. Andrew Kerr, packaging technician with a Northeast-based nonfood consumer goods company added, “Downsizing and cuts will be across the board, wherever a company sees more workers than sales create a demand for. Costs will be the target wherever they can be found.”

Packaging less vulnerable? Several respondents believed that packaging-related jobs are somewhat insulated because the packaging function is required in food and beverage markets that tend to be less volatile than other industries. In fact, “the demand for good people is growing and I don’t see it stopping soon,” said an engineer with a West Coast firm. “In the biotech market, there seems to be no decline in job security.” However, a packaging professional with a beverage firm in the Southwest said, “The packaging [function] is just as at risk for layoffs as any other [business].” He added, “the smaller corporations are unfortunately going to feel this more.” Despite these comments, survey results showed job security highest among respondents in smaller companies employing up to 100 people. Although the survey’s numbers are limited, nearly 83% of respondents at small firms answered that they felt secure or very secure. Companies with 101 to 500 employees showed the least security, with only 61% delivering a 3 or 4 rating. And a whopping 27.7% in this group felt very insecure, answering with a 1. Respondents from larger companies posted numbers in line with the responses shown in Chart 1. Those were the primary differences in responses based on company size. For the most part, however, company size revealed only minor differences. The likelihood of outsourcing packaging projects was one, where respondents from firms employing 100 or fewer people said their companies were more likely to outsource packaging projects. Companies of this size also were more likely to defer equipment purchases until their business climate improved. Furthermore, the only respondents who said their firms planned to increase equipment purchases were from small companies; and these numbered only three. Respondents from larger-sized companies looking to trim spending indicated they would do so in large part by investing in line automation to reduce long-term labor costs. Beyond the “soft economy,” the next most frequently mentioned reason for potential packaging layoffs was “mergers, acquisitions, and consolidation,” cited by 18.6% of respondents. “Mergers among suppliers will create redundancies and thus cause further layoffs,” believed a packaging rep for a Midwest industrial products maker. Softening demand for the company’s product(s) was the other primary reason for potential layoffs, according to 12.7% of respondents. Many respondents said that layoffs at their companies would relate to normal cost-cutting measures such as using more efficient equipment.

Specific layoffs Asked where in the distribution chain layoffs are most likely to occur, 44.1% anticipated job losses among packaging machinery makers (see Chart 3). Another 24.4% expected employees at end-user firms would be likely pink-slip candidates. Material suppliers were the next most frequently mentioned group at 12.7%. Interestingly, there were few respondents who answered the question, “Has your company laid off (or will lay off) other people in packaging-related positions?” Forty-four respondents accounted for 78 total answers to the question. Of the 78 answers, 30 listed production as the most likely department targeted for layoffs (see Table 1). Less than half that number (14) mentioned middle management, whereas nine predicted engineering. The limited number of responses to the question is curious. It’s unclear if it’s the result of packagers not wanting to discuss the sensitive issue of layoffs at their company, or if many respondents’ companies simply had not laid off personnel or made public plans to do so.