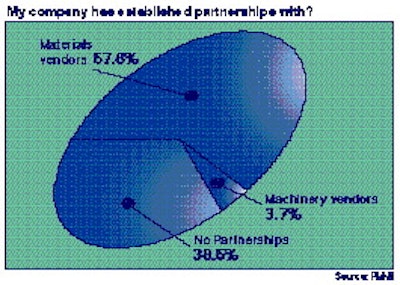

For whatever reasons, most manufacturers don't report that they've established a partnership relationship with packaging machinery makers. Yet a sizable percentage of respondents to a productivity survey say their companies do partner with packaging material suppliers.

So say results fromthe 1995 Packaging Productivity Trends Indicator compiled by the Packaging Machinery Manufacturers Institute (Arlington, VA). The results were first announced last November at the Packaging Productivity Forum in Chicago. (For more details on the survey participants, see the story on controls, page 54.)

In the survey results (Chart 1), a bit over one-third of the 434 participants said their company had not established a partnering arrangement with any suppliers. But more than 61% had worked in packaging partnerships. Of those, just 6% report working with a packaging machinery supplier.

Based on these and other results, it seems likely that this is really a semantic difference. In defining a partnership, many if not most of us consider only ongoing relationships, rather than those based on a project basis. As we analyze those respondents that reported partnerships, the results seem to suggest a linkage between partnerships and the purchasing department.

Purchasing leads way

For example, in the results, packaging and project engineering departments were seldom mentioned as departments likely to initiate partnerships. In fact, purchasing (68%) and manufacturing (12%) were reported to be the departments that were most likely to favor establishing a partnership.

Similarly, when respondents were asked the primary reason to set up a partnership with a supplier, improving productivity in the packaging line was only mentioned by 9.4% of those respondents who were partnering (Chart 2). The most frequent answer was the most general: "to reduce costs" was identified by about one-third.

Close behind, at 30.6%, was to improve the quality of incoming materials, while another 16% cited the establishment of a reliable source of supply. Certainly, those two responses, tallying over 46%, both primarily benefit workers in purchasing. Add in another 3% that said the main reason was to minimize purchasing time and paperwork, nearly half of all the responses cited a purchasing-related reason.

The pattern continued when respondents were asked how their companies monitored results of partnerships (Chart 3). A bit over 13% mentioned production per shift, a measure that's closely tied to productivity. Far more often, scrap and rejects (36%) or on-time delivery (19.3%) were the answer. If you add returns and credits as the measurement (9.3%), nearly two-thirds of the respondents checked an answer with a significant effect on purchasing.

ISO certification not critical

Five years ago, the question that measured incoming quality of materials or machinery would have focused on Statistical Process Control. Last year, the question was whether the manufacturer required vendors to have ISO certification (Chart 4).

Packaging World now receives notification of ISO certification from some five to ten companies each month, indicating that many suppliers have completed programs that were begun six to 18 months ago. Last summer, when the survey was charted, certification announcements just trickled in at the rate of maybe two to five each month. That's why we expected that only maybe 3% would respond in the affirmative.

So we were quite amazed that over 13% reported that their companies required ISO certification of packaging suppliers! Less shocking was the fact that those in the medical/pharmaceutical business led the way with 19.2% saying the certification was a must for suppliers. Still, nearly 10% of the respondents in the food industry claimed that certification was required for packaging suppliers.

Partnerships and supplier certification were just two of the many areas researched in the PMMI Productivity Survey. For a revealing look at packagers and how they view electronic controls, see p. 54. The complete Trends Indicator survey is available for $295; six audio tapes from the Packaging Productivity Forum cost $125; with the survey, $400.