To help justify these multi-million dollar investments to senior management, marketers and packaging developers need to demonstrate a high likelihood of positive return-on-investment (ROI). In other words, they need to show that the functional benefits of a new packaging system actually translate into a strong possibility of increased revenue.

With this challenge in mind, Perception Research Services (PRS) and the Institute of Packaging Professionals (IoPP) recently conducted a study of packaging innovation, which included 800 U.S. shoppers. The primary objectives of the study were to:

1. Guide packaging innovation efforts by uncovering which functional benefits were the most important to shoppers.

2. Better understand the connection between packaging innovation and ROI by gathering shoppers' reactions to a range of recent introductions.

The study was conducted across eight product categories (sugar, body lotion, raisins, peanut butter, detergent, toothpaste, suntan lotion, and potato chips) through in-person interviews, which allowed shoppers to interact with the actual packages. Within each category, the study centered upon a “test” packaging system (a new or innovative system that recently had been introduced in the market) and a “control” package (the previous or “old” package for that same product/brand). Importantly, shoppers never directly compared the “test” and the “control” packaging for the same brand. That's because direct comparisons (of new vs. former packaging) can be misleading, as they are not typically predictive of performance vs. the competition. In other words, the fact that 75% of shoppers favored a proposed package over the current one, or even that the 75% felt it was easier to use than the old package, does not assure the new package will drive sales.

To avoid this problem, each shopper in the study viewed and reacted to one version of packaging (test or control). The focus was determining whether the new package impacted the brand's differentiation and preference vs. competitors. Specifically, the study addressed two components that tied most directly to revenue and ROI:

First, preference and selection vs. competition. Does the brand “win” vs. the competition more consistently with a new package?

Second, price expectation. Does the new package drive higher price expectations, which suggests that additional packaging costs can be passed along to shoppers?

The researchers never asked shoppers directly if they would pay more for a specific packaging feature or benefit (i.e., “Is the better handle worth an extra 10 cents?”), as this approach is also known to drive misleading responses. Instead, researchers presented packages and asked what they expected to pay for the products. The researchers often found that an enhanced package drove higher price expectations than the current packaging.

Do structural improvements translate to a positive return on investment? The answer is a qualified yes, according to a new consumer study of packaging innovation, conducted by Perception Research Services (PRS) and the Institute of Packaging Professionals (IoPP).

Across the range of product categories studied, the most consistent finding was that packaging innovation could significantly impact shoppers' price expectations and purchase decisions. In more than half the cases, new packages drove increases of 20 cents or more in anticipated product pricing.

The study also found that innovative packages dramatically impacted shoppers' brand selections (with packaging and pricing in view) in more than half the categories studied. However, the study also demonstrated that “the power of packaging” could work both ways. In some cases, innovative packages significantly detracted from shopper preference. Clearly, PRS and IoPP conclude, success is a matter of finding the appropriate packaging innovation as opposed to innovating as an end in itself.

By speaking with shoppers about specific packages and functional benefits, this study has provided insight centered around two primary questions:

1. Which packaging innovations are most likely to make a difference?

2. How does packaging innovation link to decision making?

Shoppers state what really matters

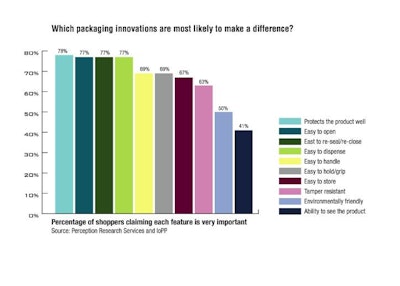

To address the first objective, PRS and IoPP asked shoppers about the packaging features and benefits that are most important to them within the eight product categories. Some trends emerged:

* In food-related categories (such as sugar, raisins and potato chips), product protection and tamper resistance consistently ranked as top priorities. These were typically cited as “extremely important” by more than 75% of respondents to the survey.

* In non-food categories (such as body lotion, laundry detergent and sun screen), product protection was typically secondary to ease of opening and dispensing.

Notably, environmental concerns such as environmentally friendly packaging were nearly always a second-tier or lower-level priority. Typically, fewer than 50% of respondents cited them. While these commonalties were evident, the differences in shoppers' packaging expectations across categories were also notable. For example, in toothpaste and sunscreen, less than 40% of the respondents expressed an interest in seeing the product through the packaging. But the ability to view the product was important to nearly all buyers of peanut butter.

Obviously, category-level “packaging norms” play an important role in driving shoppers' functional expectations.

On a broader level, the survey results show that asking shoppers “what matters to you?” is probably less valuable than identifying unmet functional needs within specific product categories. These unmet needs vary widely by category, and they represent opportunities for new packaging to deliver value.

For example, in potato chips, more than 40% of the respondents claimed that current bag packaging is difficult re-close. They said the bags often fail to protect the chips from spoiling. In toothpaste, there are innovation opportunities in dispensing; 20% of respondents claim that current tube toothpaste packaging is not sufficiently mess-free.

Across categories, product protection and ease or dispensing emerged as consistently important factors. These are primary areas of consumer dissatisfaction with current packaging—and they present opportunities for marketers and designers. However, it is also important to remember that “the rules” are written by category—and that packaging innovation efforts should be rooted in a solid understanding of shoppers' priorities and concerns within a product category. In other words, successful innovation appears to be less about the intrinsic nature of a feature or benefit and more tied to whether the feature addresses an underlying category-specific need.

Innovation and decision-making

The study demonstrates that innovative packaging systems can directly impact shoppers' price expectations and product selections. Thus, if innovation is done properly, it is very likely to provide a positive return on investment (ROI) through increased market share or the ability to raise prices to cover incremental costs. However, the study also identifies circumstances in which packaging innovation can reduce sales, particularly if a new structure fails to meet shoppers' expectations and functional needs.

Thus, packages that “break the rules” by violating category norms and expectations may be most successful when positioned as line extensions and tied to specific usage occasions, rather than as replacements for current packaging.

Clear implications can be drawn from the study in determining how to approach and assess new packaging. First, the study demonstrates the need for upfront research with consumers to understand functional priorities, expectations, and unmet opportunities within a product category. Second, the study illustrates the importance of measuring packaging innovation for impact on price expectation and competitive differentiation—metrics that connect directly to ROI)—rather than on purely functional measures and on preference vs. current packaging.

As the need for packaging innovation and the demand for accountability and ROI continue to grow, marketers will continually need to demonstrate how functional innovations translate into higher price points, growing market share, and increased profitability. Companies with these consumer research processes in place will be positioned best to develop and justify investments in successful packaging innovation.

Results for two brands

The power of packaging innovation is evident in two brands that were examined in closer detail as part of the PRS and IoPP study. The most significant example of the positive impact of innovation is in the sugar category. An analysis of information from respondents indicates that the new packaging structure for the Domino brand addresses an unmet category need for a recloseable package. The survey respondents also say the Domino package provides important functional benefits like improved product protection, tamper-resistance, and ease of opening and closing, relative to the former package. More important, consumer responses indicate a significant evidence that these functional benefits will translate to metrics that are likely to drive revenue:

* Despite a smaller size (only 4 lbs, vs. 5 lbs in the former packaging), the new Domino package drove a significantly higher price expectation ($3.38) than that for the former packaging ($2.96). While Domino had actually lowered pricing by 10 cents when introducing the new package (due to the smaller size), this finding suggested that Domino could have actually raised prices—and been very likely to pass along the costs of the new structure without compromising sales.

When respondents viewed actual retail packages and were asked to choose between the new Domino package and a lower-priced, store-brand competitor's package, packaging structure impacted the purchase decision significantly. Domino went from being selected 55% of the time in the former package to being the choice among 74% of respondents in the new package.

* In peanut butter, the study identifies a dramatic negative example of packaging innovation. Skippy's new Squeez' It packaging failed to deliver an important category-level packaging expectation (the ability to see the product). Squeez' It actually reduced perceived functionality in several key areas (ease of opening, re-sealing, and dispensing), in the study respondents' opinion.

Thus, the connection to return on investment was almost a mirror image of that seen for Domino sugar. While the new packaging was intended to command a slight price premium, it failed to drive any increase in price expectation from shoppers. More importantly, while Skippy won vs. the competition (Jif) 57% of the time in the current packaging, this figure dropped to only 39% with the proposed packaging and its slightly higher pricing.

However, even in this negative case, there was one potential source for optimism: 28% of shoppers claimed the new Skippy Squeez' It packaging allowed them to use the product in new ways or situations. Thus, while the new packaging certainly would be a poor replacement for current packaging, it may hold potential as a line extension geared to specific usage situations, like a picnic pack.

To purchase this study, contact Young at [email protected] or 201-346-1600.

With this challenge in mind, Perception Research Services (PRS) and the Institute of Packaging Professionals (IoPP) recently conducted a study of packaging innovation, which included 800 U.S. shoppers. The primary objectives of the study were to:

1. Guide packaging innovation efforts by uncovering which functional benefits were the most important to shoppers.

2. Better understand the connection between packaging innovation and ROI by gathering shoppers' reactions to a range of recent introductions.

The study was conducted across eight product categories (sugar, body lotion, raisins, peanut butter, detergent, toothpaste, suntan lotion, and potato chips) through in-person interviews, which allowed shoppers to interact with the actual packages. Within each category, the study centered upon a “test” packaging system (a new or innovative system that recently had been introduced in the market) and a “control” package (the previous or “old” package for that same product/brand). Importantly, shoppers never directly compared the “test” and the “control” packaging for the same brand. That's because direct comparisons (of new vs. former packaging) can be misleading, as they are not typically predictive of performance vs. the competition. In other words, the fact that 75% of shoppers favored a proposed package over the current one, or even that the 75% felt it was easier to use than the old package, does not assure the new package will drive sales.

To avoid this problem, each shopper in the study viewed and reacted to one version of packaging (test or control). The focus was determining whether the new package impacted the brand's differentiation and preference vs. competitors. Specifically, the study addressed two components that tied most directly to revenue and ROI:

First, preference and selection vs. competition. Does the brand “win” vs. the competition more consistently with a new package?

Second, price expectation. Does the new package drive higher price expectations, which suggests that additional packaging costs can be passed along to shoppers?

The researchers never asked shoppers directly if they would pay more for a specific packaging feature or benefit (i.e., “Is the better handle worth an extra 10 cents?”), as this approach is also known to drive misleading responses. Instead, researchers presented packages and asked what they expected to pay for the products. The researchers often found that an enhanced package drove higher price expectations than the current packaging.

Do structural improvements translate to a positive return on investment? The answer is a qualified yes, according to a new consumer study of packaging innovation, conducted by Perception Research Services (PRS) and the Institute of Packaging Professionals (IoPP).

Across the range of product categories studied, the most consistent finding was that packaging innovation could significantly impact shoppers' price expectations and purchase decisions. In more than half the cases, new packages drove increases of 20 cents or more in anticipated product pricing.

The study also found that innovative packages dramatically impacted shoppers' brand selections (with packaging and pricing in view) in more than half the categories studied. However, the study also demonstrated that “the power of packaging” could work both ways. In some cases, innovative packages significantly detracted from shopper preference. Clearly, PRS and IoPP conclude, success is a matter of finding the appropriate packaging innovation as opposed to innovating as an end in itself.

By speaking with shoppers about specific packages and functional benefits, this study has provided insight centered around two primary questions:

1. Which packaging innovations are most likely to make a difference?

2. How does packaging innovation link to decision making?

Shoppers state what really matters

To address the first objective, PRS and IoPP asked shoppers about the packaging features and benefits that are most important to them within the eight product categories. Some trends emerged:

* In food-related categories (such as sugar, raisins and potato chips), product protection and tamper resistance consistently ranked as top priorities. These were typically cited as “extremely important” by more than 75% of respondents to the survey.

* In non-food categories (such as body lotion, laundry detergent and sun screen), product protection was typically secondary to ease of opening and dispensing.

Notably, environmental concerns such as environmentally friendly packaging were nearly always a second-tier or lower-level priority. Typically, fewer than 50% of respondents cited them. While these commonalties were evident, the differences in shoppers' packaging expectations across categories were also notable. For example, in toothpaste and sunscreen, less than 40% of the respondents expressed an interest in seeing the product through the packaging. But the ability to view the product was important to nearly all buyers of peanut butter.

Obviously, category-level “packaging norms” play an important role in driving shoppers' functional expectations.

On a broader level, the survey results show that asking shoppers “what matters to you?” is probably less valuable than identifying unmet functional needs within specific product categories. These unmet needs vary widely by category, and they represent opportunities for new packaging to deliver value.

For example, in potato chips, more than 40% of the respondents claimed that current bag packaging is difficult re-close. They said the bags often fail to protect the chips from spoiling. In toothpaste, there are innovation opportunities in dispensing; 20% of respondents claim that current tube toothpaste packaging is not sufficiently mess-free.

Across categories, product protection and ease or dispensing emerged as consistently important factors. These are primary areas of consumer dissatisfaction with current packaging—and they present opportunities for marketers and designers. However, it is also important to remember that “the rules” are written by category—and that packaging innovation efforts should be rooted in a solid understanding of shoppers' priorities and concerns within a product category. In other words, successful innovation appears to be less about the intrinsic nature of a feature or benefit and more tied to whether the feature addresses an underlying category-specific need.

Innovation and decision-making

The study demonstrates that innovative packaging systems can directly impact shoppers' price expectations and product selections. Thus, if innovation is done properly, it is very likely to provide a positive return on investment (ROI) through increased market share or the ability to raise prices to cover incremental costs. However, the study also identifies circumstances in which packaging innovation can reduce sales, particularly if a new structure fails to meet shoppers' expectations and functional needs.

Thus, packages that “break the rules” by violating category norms and expectations may be most successful when positioned as line extensions and tied to specific usage occasions, rather than as replacements for current packaging.

Clear implications can be drawn from the study in determining how to approach and assess new packaging. First, the study demonstrates the need for upfront research with consumers to understand functional priorities, expectations, and unmet opportunities within a product category. Second, the study illustrates the importance of measuring packaging innovation for impact on price expectation and competitive differentiation—metrics that connect directly to ROI)—rather than on purely functional measures and on preference vs. current packaging.

As the need for packaging innovation and the demand for accountability and ROI continue to grow, marketers will continually need to demonstrate how functional innovations translate into higher price points, growing market share, and increased profitability. Companies with these consumer research processes in place will be positioned best to develop and justify investments in successful packaging innovation.

Results for two brands

The power of packaging innovation is evident in two brands that were examined in closer detail as part of the PRS and IoPP study. The most significant example of the positive impact of innovation is in the sugar category. An analysis of information from respondents indicates that the new packaging structure for the Domino brand addresses an unmet category need for a recloseable package. The survey respondents also say the Domino package provides important functional benefits like improved product protection, tamper-resistance, and ease of opening and closing, relative to the former package. More important, consumer responses indicate a significant evidence that these functional benefits will translate to metrics that are likely to drive revenue:

* Despite a smaller size (only 4 lbs, vs. 5 lbs in the former packaging), the new Domino package drove a significantly higher price expectation ($3.38) than that for the former packaging ($2.96). While Domino had actually lowered pricing by 10 cents when introducing the new package (due to the smaller size), this finding suggested that Domino could have actually raised prices—and been very likely to pass along the costs of the new structure without compromising sales.

When respondents viewed actual retail packages and were asked to choose between the new Domino package and a lower-priced, store-brand competitor's package, packaging structure impacted the purchase decision significantly. Domino went from being selected 55% of the time in the former package to being the choice among 74% of respondents in the new package.

* In peanut butter, the study identifies a dramatic negative example of packaging innovation. Skippy's new Squeez' It packaging failed to deliver an important category-level packaging expectation (the ability to see the product). Squeez' It actually reduced perceived functionality in several key areas (ease of opening, re-sealing, and dispensing), in the study respondents' opinion.

Thus, the connection to return on investment was almost a mirror image of that seen for Domino sugar. While the new packaging was intended to command a slight price premium, it failed to drive any increase in price expectation from shoppers. More importantly, while Skippy won vs. the competition (Jif) 57% of the time in the current packaging, this figure dropped to only 39% with the proposed packaging and its slightly higher pricing.

However, even in this negative case, there was one potential source for optimism: 28% of shoppers claimed the new Skippy Squeez' It packaging allowed them to use the product in new ways or situations. Thus, while the new packaging certainly would be a poor replacement for current packaging, it may hold potential as a line extension geared to specific usage situations, like a picnic pack.

To purchase this study, contact Young at [email protected] or 201-346-1600.

Companies in this article