Since the bulk of all purchase decisions are determined at the store shelf, the first priority of your packaging should be to account for the reality shoppers experience there. How well you’ve designed your package to account for what the shopper sees, thinks, and reacts to while in your category can positively or negatively influence your sales performance on a daily basis.

To help you convert more shoppers into consumers through your packaging, follow these eight principles of sales-effective package design.

1. Stand out: You’re doing it wrong

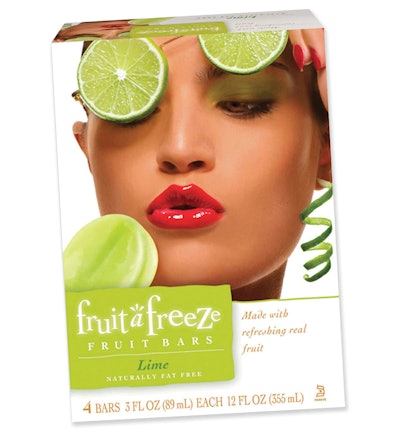

Standing out on the shelves of high-volume retailers amongst a sea of 30,000-plus products requires boldly different approaches than what most brands are taking. Break the rules, break boundaries, and break new ground. You’ll never know your true sales potential if your package doesn’t effectively work to nab the shopper’s attention.

Packaging’s number-one responsibility is to get noticed. All brands know this, yet most of what we see in stores is brands blending in, instead of standing out.

Shoppers fight grocery store attention-deficit disorder with routine and speed. To attract new customers, we have to design to interrupt those shoppers who are on a B-line path to the brand they buy week-after-week. When shoppers survey a category from three- to four-feet out, we have to stop the scanning eye.

Don’t go barging into your design team’s office demanding the loudest, most obnoxious package the category has ever seen; there are tactful ways to stand out. Consider introducing a new package structure that also improves the consumer experience, or utilize colors and symbols, or strokes and borders that are designed to attract the eye from a distance. Do what hasn’t been done, go for it, stand out. To sit quietly on shelf is to leave sales on the table.

2. Present a clear hierarchy of information for hurried shoppers

Hurried shoppers gravitate toward packaging that presents the most pertinent information in the most prominent and organized fashion. Those brands that design with respect for hierarchy are positioned to appeal to shoppers who just want to grab and go. Limiting and prioritizing copy and design elements on your package are 101-level fundamentals, yet it’s so tempting to throw in one more claim or symbol, or introduce yet another font style—but this is an urge that can bring overwhelming disorder to the eye.

Beyond knowing that the eye wants to read top to bottom and left to right, mastering hierarchy involves knowing that shoppers in the canned tomato aisle hardly need to see the word tomato; they are more interested in finding the type of tomato they need—chopped, whole, stewed, diced—faster.

3. Compete: Duke it out on shelf!

Everyone talks about and touts differentiation, but most differentiation is hardly noticeable or meaningful. First, start by abandoning any lazy me-too product strategies; otherwise, this principle will have you racking your brain forever in search of something worthwhile to talk about. If you routinely see two or three other options on shelf that compare similarly (think objectively, judge from the perspective of an uninformed shopper), start thinking about your next differentiator or product line. Pursue differentiation, but make sure it’s differentiation that matters to shoppers in the category. With so few slots available at high-volume retailers, you can’t afford to be replaceable.

How it translates to packaging: Shoppers show up to shelf wanting to compare products on features and attributes, but a cluttered marketplace makes it harder than ever for them to distinguish between products. The number-one and number-two reasons the consumer should buy your product instead of your competitors’ should smack them across the face. These reasons should be differentiated and relevant. They shouldn’t be promises about taste or quality, these are subjective claims—we don’t know or trust the source. What makes your gluten-free, almond-based cookie different than the other brand of gluten-free, almond-based cookie? If it’s price, talk value, if it’s your ingredient source, tell that story—and do it on the front of the package, because most packaging isn’t picked up and turned over!

4. Express yourself: You’re not a corporation anymore

Today, shoppers buy based on what a brand will reveal about them and their worldview almost as much as how the actual product performs functionally. In response, we’re witnessing what we call the counter-corporate movement. This movement involves abandoning the use of stock photography and generic taglines. It’s about expression, about flexing personality! It’s about creating brands that matter and being real, charming, opinionated, quirky, happy, or exceptionally transparent on shelf.

Rather than dedicating packaging space to self-serving corporate-sounding claims, calls-to-action, and promises consumers are tired and cynical of, approach packaging with more of a human mindset. You can connect with shoppers on a deep and connected level when you dedicate space to reflect your core audience’s broader interests around food, causes, or activities, or just by eliciting an emotional response through presenting something likable, unexpected, warm, or inviting.

Share an odd company tale, poke a little fun at a competitor, or transform the label of your high-end bottle of wine into an artistic stained-glass mosaic. Whatever you decide, it shouldn’t feel like contrived marketing or advertising. Make sure you’re collaborating with a team that’s up-to-date on how brands should express themselves today and can filter for your corporate tendencies. In the end, brands, not products, are irreplaceable. The first brand to market never sticks its landing if it’s not first to people’s hearts and minds.

5. Clarify your value proposition: In which mental box do you belong?

Shoppers want to make sense of the pecking order of a category in terms of value. Who’s the Acer, who’s the HP, who’s the IBM, and who’s the Apple?

Knowing how you want to be seen by shoppers in terms of value segmentation can go a long way toward informing not only the overall tone, but also the subtlest details of your packaging. Obviously, if you’re the value brand, you let your price communicate value, and you gear your packaging to suggest a quality comparable to higher-priced options. But if your pint of gelato is priced anywhere above private-label or value brands, you need to continually elevate what premium is and looks like.

Remember, just because you think your product is premium and say that it is, that doesn’t mean the shopper sees it that way. The shopper is deciding the value of your brand based on how your product compares with all the other packages on the shelf next to it.

6. Understand purchase drivers: If you don’t know them, you’re flying blind

It’s startling how many brands cannot name the top four or five purchase drivers consumers use to the shop their category. These are not differentiators; it’s a mental list shoppers bring to shelf to help them identify which products fit their primary baseline qualifications. These drivers should influence not only what you call out on your packaging and the hierarchy you employ, but also how you develop and market your products.

Have you done any research to understand the drivers for your product, and does your package work to address these? Are shoppers choosing a product in your category based on perceived quality? How do they measure quality? Are they looking for specific health-benefit callouts? Are they weary of certain ingredients? Do awards influence their purchase decision? Do they shop by flavor, or by variety?

If you’re uncertain how shoppers in your category buy, hire someone who’ll develop a well thought out, quantitative survey to dig up these insights, then use this information to inform what you feature, and how you feature it, on your packaging.

7. Define the product: Assume the shopper knows nothing!

Too many brands assume the shopper is willing to or capable of connecting the dots to understand what their products are about. If your product category or segment isn’t represented in at least 50% of the population’s fridges or pantries, go out of your way to provide context.

If you sell fruit-based cooking sauces in the condiments section, get down and dirty right on the principal display panel (PDP) and show the consumer what to do with the product. If you sell cassava root chips, tell them about cassava, where it comes from, how it’s processed, what it compares to in taste, and why they’d want it over a potato or veggie chip. In a scenario like this, there’s nothing you could put on a package that would provide more value to shoppers to encourage trial.

8. Design with the store in mind

Sales-effective packaging accounts for the realities of the physical store environment. Frosted-over freezer doors obscure vision, hang-tags intrude upon products stocked on the shelf below, lights cause reflections and shadows, and stocking preferences of retailers vary. It is crucial that you understand these factors, and it is these aspects that should influence what packaging substrates you use, whether or not you utilize dual PDPs, and where you place your most critical messaging.

For example, while shopping the packaged, sliced deli-meat category, I observed a brand whose primary differentiator callout of “more product for your money” was placed in the upper-right corner of the package, which was concealed by the retailer’s sale tags hanging from the shelves above. Without the context of “more for your money,” the brand looked like the most expensive option in the category. How many shoppers are turning away because of this simple oversight?

Adam Spriggs is a strategy consultant at Interact OnShelf. He can be reached at [email protected] or at 419/705-1248.