Flexible packaging shipments were expected to increase 4.7% to $21.4 billion in 2004, according to the Flexible Packaging Assn.’s recently released 2004 State of the Industry Report. Better yet, flexible packaging material converters surveyed for the report forecast revenues to rise 5.7% annually during the next three to five years.

The optimism may be attributable, in part, to a return to the focus of more conventional business concerns. Unlike previous years, where accounting scandals and the war in Iraq (see packworld.com/go/c121) created extraordinary business pressures, converter concerns expressed for the 2004 report focused on more traditional issues, such as escalating costs, pricing pressures, industry consolidation, and plant closings.

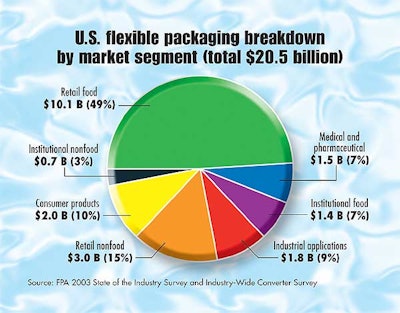

The report says the total flexible packaging industry in 2003 accounted for $20.5 billion in annual sales. Excluding retail shopping bags, consumer storage bags, wraps, and trash bags, the market represented $16 billion in sales. Among end-use markets, the retail food segment accounted for the largest share (49%) of flexible packaging sales (see Chart A).

Survey includes nonmembers, too

Major sources used for FPA’s report is FPA members’ State of the Industry Survey and the nonmember Industry-Wide Converter Information Survey, both conducted in early 2004. FPA says the surveys “represented the first-ever initiative to reach out and gather meaningful information beyond FPA’s membership base.”

Results did show some interesting differences in FPA member and nonmember responses with regard to end-use markets (see Chart B). The most notable dichotomy: FPA member converters were much more involved in retail food packaging than retail nonfood packaging compared to nonmember converters, who were more involved in nonfood and industrial applications, as well as in institutional packaging materials for food and nonfood use.

When compared with other packaging materials, flexibles trailed only “misc. rigid and plastic bottles” in growth during the 1996-2002 period (see Chart C). With an average annual growth rate of 3.5%, flexibles outpaced corrugated, paperboard, glass, and metal cans.

Future visions

Flexible packaging converters and suppliers were asked to provide a vision for the flexible packaging business over the next five years. Among the key expectations and challenges cited were the following:

• Future growth will be driven by packaging solutions for enhanced consumer convenience and safety in food packaging, more novelty packaging to enhance shelf appeal, increases in barrier packaging, and further modified-atmosphere packaging advances.

• Increased competition caused by customer and competitor consolidations, technology-driven manufacturing efficiencies, and the potential for high energy costs (and resin prices), as well as higher labor and insurance outlays.

• Top candidates for strong market growth include pharmaceuticals (driven by aging baby boomers), beverages, pet food, fresh-cut produce, refrigerated retail meat (including case-ready meats), and lawn-and-garden packaging.

The 2004 report represents the 14th year FPA has issued a “State of the Industry.” This volume includes sales and utilization levels, current profit trends, capital spending plans, a map of U.S. flexible packaging converting plants by state, industry mergers and acquisitions, U.S. exports and imports, projected growth markets, end-use information from the survey findings, and a list of flexible packaging converters and locations.

In its appendix, the report offers North American Industry Classification System and Standard Industrial Classification code information; an FPA publications list and order form; a list of FPA member companies; lists of industry analysts, organizations, and contacts; and a list of packaging schools. The 209-page, spiral-bound report is free to FPA members; $3귔 to nonmembers.