Chances are you’ve heard of packaging take-back obligations and recovery fees, but only as a European phenomenon. That’s about to change. Beginning in late 2003 or early 2004, companies selling packaged goods in Ontario, Canada, will be required to register and pay packaging fees. A similar program will start in Quebec a few months later.

As a result of the Waste Diversion Act of 2002, producers are responsible for 50% of the cost of collecting and recycling the packaging and printed paper materials they place on the market in Ontario, with municipalities bearing the remaining 50%. A compliance organization called Stewardship Ontario (www.stewardshipontario.ca) will manage this obligation on behalf of industry, charging material-based fees to offset the recovery costs. This model is similar to the one used in most European countries and several Asian ones.

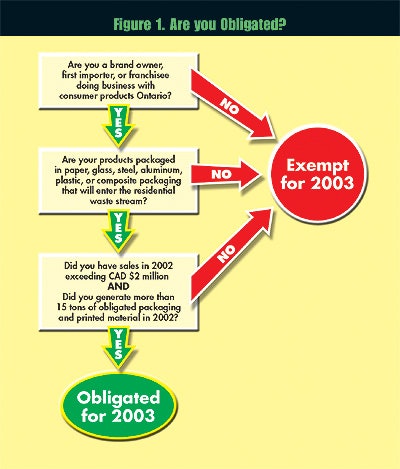

Are you obligated?

If you are a brand owner, first importer, or franchisee with Ontario sales in excess of CAD $2 million (US $1.4 million), you are obligated to pay fees on the “sales packaging” of products that are distributed to households in Ontario (“sales packaging” is nearly synonymous with “primary packaging;” it refers to packaging materials that go home with the consumer, as opposed to the corrugated shipper, for example, that stays in the store after its contents are displayed in a store aisle). However, you are exempt if the total weight of the sales packaging and printed paper is below 15 metric tons (see Fig. 1). As an alternative to paying fees into a collective recycling system, you can also manage an individual system for recycling the packaging and printed paper you put on the market.

Ontario’s regulations will require a shift in the way U.S. companies approach packaging compliance. Until now, packaging fees have only concerned corporations selling in Europe and Asia, most of whom have been able to delegate compliance with packaging fee requirements to their overseas subsidiaries. The regional headquarters or local sales offices report packaging data and sales figures to compliance organizations in each country and pay fees according to the total packaging material quantities. Often, these subsidiaries maintain detailed packaging databases to meet the reporting demands.

To comply with the Canadian requirements, any company that classifies as “obligated” must register with Stewardship Ontario by October 1, 2003, determine the amount of obligated packaging, report the material quantities placed on the market, and pay fees based on the total weight of each material (fees for each material are provided in Figure 2). This compliance process will entail gathering the necessary packaging, product, material type, and sales data to fulfill reporting requirements. In 2003, producers will be allowed to report estimated figures based on a data sample (representing 10 to 25% of their products) or using a “quick calculator” that Stewardship Ontario has developed based on sectoral averages. However, fees using the quick calculator are generally 50% to 100% higher than fees calculated using actual data. For 2004 and all subsequent years, full data will be required.

How much will this cost?

Figure 3 shows the 2003 fees on several sample packaged products and provides a comparison of these fees with those in Germany and France. If you plan to use the “quick calculator,” you can assume that your fees will range from about $1ꯠ per $1 million in wholesale sales for pharmaceuticals and OTC drugs to $2꼀/million for packaged food and $3꽤/million for cleaning and maintenance products. While reporting based on detailed data results in lower fees, the biggest challenge (and greatest cost) for companies with a wide range of packaging systems and SKUs will be in the data collection itself.

For companies whose product lines and packaging formats in North America closely match those in Europe or Asia, packaging databases maintained for existing reporting needs may be nearly sufficient for compliance in Ontario. However, companies will need to collect data on printed paper materials sold or distributed in Ontario—this includes informational inserts within the packaged product as well as sales brochures, catalogs and other promotional literature, bills and invoices, and magazines, none of which are covered in other programs. These materials are subject to fees regardless of whether they are sold or distributed free of charge.