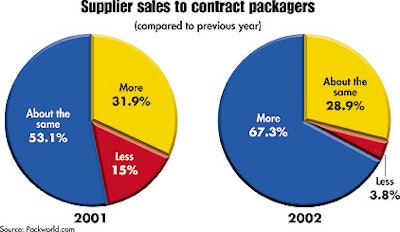

Love ’em or hate ’em, but few packaging suppliers have failed to take notice of how contract packaging companies are altering their business—and their product development and marketing strategies. That’s a summary of 161 respondents to a special survey on contract packaging conducted via Packaging World’s Web site, Packworld.com, last fall. For more details about the companies that participated, see the sidebar on p. 41. Although most of the end users and contract packaging companies reported 2001 sales to be higher than the year before, the margin was far narrower for packaging suppliers. Although 41.3% of suppliers said overall sales were up, nearly a third reported 2001 sales were down from 2000. Another third said their company sales remained the same. Regardless of total sales, supplier respondents said that sales to contract packagers grew last year (see Chart 1). Suppliers were twice as likely to report sales increases vs decreases to CPs last year, although the majority felt the sales level was about the same. When asked to predict sales to CPs this year, the difference was striking, with more than two-thirds expecting increases, compared to fewer than 4% who predicted declining sales to CPs.

CPs force changes When asked about what changes these companies made to accommodate the CP market, a full 75% claimed their companies added products specifically to appeal to contract packagers. When the survey inquired about specific company changes caused by sales to contract packagers, one respondent from a maker of pouch filling equipment said, “We offer more flexibility in machine options.” The representative of a company making form/fill/seal equipment said that his company “has designed equipment specifically to appeal to contract packagers.” The president of a major multiple-type equipment maker said much the same: “They made us focus even more on quick changeover and flexibility.” The representative of a maker of coding and marking equipment said that CPs have caused his company to move more into “e-business.” The marketing manager for a maker of wrapping equipment said his company “attends more trade shows” as a result of business with CPs. Contract packagers “opened up a whole new target market for us,” according to a respondent from a company that makes bundling machinery. “Our machinery is extremely flexible, and we’ve had success with contract packagers because of that.” Several respondents indicated that contract packagers were looking more for systems, rather than single machines. A participant from a maker of palletizing equipment said that “CPs forced us to look at ancillary equipment lines, so we could offer more complete packaging solutions.” Business with contract packagers “increased our product line, our bottom line, and total revenue dollars,” was the positive change reported by a representative of a label converter. It’s not surprising that business with CPs has caused most suppliers to change their sales and marketing efforts (see Chart 2). And, despite the fact that nearly 44% of respondents came from materials suppliers, only slightly more than 10% reported adjustments to their minimum order quantities. Some supplier respondents saw shortcomings in their business with contract packagers. The representative of a company that makes automated packaging equipment pointed to lower profit on sales to CPs. “Our margins on sales to contract packagers are significantly lower” than sales to end user companies, he said.

Not all suppliers pleased The respondent from a smaller equipment maker claimed that CPs “typically buy more on lowest price” than on other considerations. “Pricing issues can be a problem” with sales to CPs, said a representative of a label converter. The sales manager for a major supplier of labels and folding cartons identified both positives and negatives of selling to CPs. “They are a significant opportunity to grow our business,” he said. “But there are many that are not well financed, and we’ve been hurt by contract packagers that have gone under.” The representative from a packaging machinery integrator was even more negative. He sees CPs as representing “lots of work with minimal opportunities.” One respondent from a smaller machinery maker was totally sour on working with CPs. “Contract packagers are more demanding in terms of machine flexibility. They want to buy one machine and expect it to do everything,” he bristled. “My machines will not wipe their [behinds]!”

Flexibility is key That participant certainly wouldn’t be surprised that supplier respondents said that “flexible products” was most often mentioned as the key feature sought by CPs (see Chart 3). This was the leading response to a question posed about suppliers’ most recent experiences, both positive and negative, of doing business with CPs. The balance of good and bad experiences of suppliers with contract packagers manifested itself when the survey asked about whether suppliers had established partnerships with CPs. Just 36% of suppliers responded affirmatively, while 29% said no. The remaining 35% said they didn’t know. These results contrast markedly with end users and contract packagers, a majority of each group saying their companies had established partnerships with the other. It’s likely there are two factors at work here. First, because a substantial number of supplier respondents mentioned financial and pricing issues with CPs, those experiences rarely lead to the levels of cooperation usually needed in partnerships. Second, outsourced packaging is a relatively new strategy in the production lexicon, so many of the companies in this field have short track records, and that may inhibit suppliers from committing to a relationship. But if you listen to some respondents, CPs have been a vital part of their success. “Contract packagers represent 65% of our total sales volume in machinery,” said the participant from a maker of fillers and cappers. CPs “are also good repeat customers because they usually run multiple lines of products,” noted a representative of a large maker of cartoning equipment. The participant from a different maker of cartoning machines sees it in a different way. “Contract packagers are great references for our company because they typically have numerous customers walking in and out that see our equipment,” he said. Nonetheless, the participant from a maker of labelers might have balanced the issue best when he said: “Contract packagers have had a positive effect on our company. But they tend to be more demanding and cost-conscious clients.”

See sidebar to this article: Which companies participated