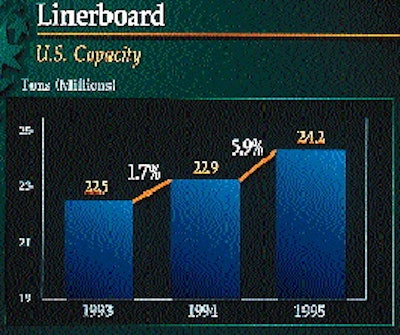

Gestrich, vp, bleached board, Inter- national Paper (Mem-phis, TN). Gestrich presented capacity and demand forecasts during the company's Direction 97 meeting, held last month in Chicago. During '96 and '97, linerboard capacity is expected to average 4.6% growth, he said. Regarding U.S. box shipments, IP forecast average annual growth between 1997 and 1999 of 3% to 4%, with U.S. linerboard exports growing at a 6% to 8% rate. In the bleached liquid packaging segment (below right), IP reported that the U.S. market grew 1.7% last year, with growth in the fresh juice and specialty segment more than offsetting a slight decline in the milk segment. This internationally dominated Bleached Liquid Pack-aging segment is expected to fuel 3.5% annual growth worldwide in the next four years. The company also reported that global demand for bleached packaging board set a record last year, with international growth leading the way. World demand is expected to grow 2% to 4% annually through the remainder of the decade, with plant operating rates averaging over 95%.