Tomorrow’s product distribution may sway toward direct-to-consumer (D2C) channels, and complexities within that structure open opportunities for automation.

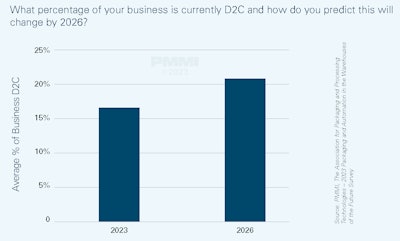

That’s according to PMMI Business Intelligence’s 2023 report “Packaging and Automation in the Warehouses of the Future.” The proportion of CPG product distribution going through D2C channels is expected to increase by 25% in the next three years, a survey of 156 U.S. CPG VPs, CEOs, and engineers conducted for the report says.

These company representatives say the current average amount of their business that uses D2C is 16.5%, and they expect an increase to a 20.7% average by 2026. CPG product distribution through D2C channels may increase by 25% in coming years.PMMI Business Intelligence: 2023 Packaging and Automation in the Warehouses of the Future

CPG product distribution through D2C channels may increase by 25% in coming years.PMMI Business Intelligence: 2023 Packaging and Automation in the Warehouses of the Future

Some smaller companies are already shipping a large proportion of their products through D2C channels – with companies that have 1-9 employees sending 41% of their products straight to consumers.

Interestingly, this may not be the case in the future, as the predicted growth in D2C by 2026 seems to be primarily coming from larger companies. The largest average predicted increase in D2C from 2023 to 2026 (+11%) was from respondents employed at the largest companies.

Complexities of D2C Increases Opportunity for Automation

Online fulfillment tends to be more complex than store replenishment because individual items are handled instead of pallets and cases, which often leads to a greater need for automation.

While it seems unlikely that CPG manufacturers will ship individual packages to traditional brick-and-mortar retailers, PMMI Business Intelligence researchers expect pack sizes will decrease as retailers adopt e-commerce-friendly packaging. Researchers also expect the larger CPGs to develop in-house split-case picking operations for their own D2C operations.

Smaller pack sizes allow retailers to ship smaller quantities on a regular basis in response to online peaks in demand. Furthermore, a reduction in pack sizes means an increased SKU variety has less of an impact on inventory space, according to Interact Analysis’s 2022 Warehouse Automation report.

During discussions with Walmart, it was revealed the company expects some CPG producers to generate upwards of 10% of their revenues from D2C channels, which will require significant volumes of split-case picking.

Business Intelligence researchers are already seeing companies start to build in this infrastructure. PepsiCo, for example, has piloted an automated hyperlocal micro-fulfillment center with Dematic in the Chicago area.

One mid-size CPG sees the move toward micro fulfillment as inevitable, as demand grows from customers to provide mixed and layered pallets, with this driving more D2C activity.

“I see micro fulfillment taking place and automation of micro fulfillment driven by e-commerce,” says a representative from the mid-size CPG. “As we continue to see that evolve at the customer end of the supply chain, I think we are going to get pressure internally to make their process more efficient, and full pallets of single product loads are inefficient for them. […] I think over time we’re going to see pressure to create more efficiency for them in a micro fulfillment space, that naturally drives mixed pallets and layered pallets internally.”

Source: PMMI Business Intelligence, 2023 Packaging and Automation in the Warehouses of the Future

Download the FREE executive summary below.