Case-ready meat, fresh-cut produce, novelty packaging, convenience food packaging, and medical and pharmaceutical products used by aging baby boomers will likely trigger future growth for flexible packaging materials.

That’s according to the State of the Industry Report 2002 from the Flexible Packaging Assn. (Linthicum, MD). In the report, FPA forecasts 2002 shipments of flexible packaging materials to grow at a 5.5% rate to $21.2 billion this year.

“Many of the same trends driving the market in 2000 - 2001 will continue through 2002,” FPA projects. “Rollstock, primarily multiweb combinations, except paper-paper, will add strength. Trends contributing to the increasing demand include an aging population, end-users’ drive for reducing costs, new product introductions using flexible packaging, and growth in stand-up pouches.”

FPA’s growth forecasts are impressive considering recent economic woes. “The year 2001 was a tremendously trying period both in terms of the business environment and on a personal and professional level,” admitted FPA in the report’s executive summary. “Capital markets were tight, there was a slowdown in the manufacturing sector, and the U.S. economy was soft.” Fortunately, forecasters envision a stronger year this year, though it’s uncertain how robust the recovery will be.

End-use markets

According to data from FPA and the Census Bureau’s Annual Survey of Manufacturers for 1999 (the latest available), flexible packaging accounts for 17% of the $114 billion packaging “industry” in the United States.

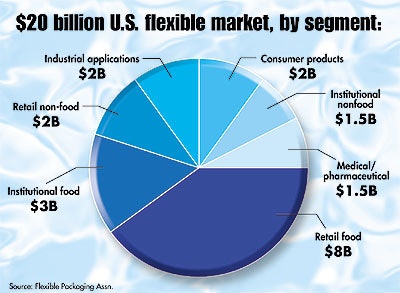

Currently, flexible material sales total $20 billion, with 40% in retail food applications (see Chart 1). Retail and institutional food applications accounted for $11 billion of the total sales. According to the report, flexible packaging converters were most often involved in supplying materials for producers of snacks, cookies and crackers, confectionery, and beverages for the retail food market.

On the institutional side, converters participated primarily in materials used for condiments, baking and mixes, frozen products, refrigerated meats, breakfast products, and refrigerated dairy goods.

For nonfood retail products, converters were most involved in materials for pet foods, health and beauty items, lawn-and-garden supplies, and home chemicals and cleaners.

Disposable products, medical supplies, medical devices, and pharmaceuticals led the way in converter participation in the medical and pharmaceutical market.

FPA also broke down the $20 billion in current sales by “industry,” with plastic bags accounting for the majority of flexible materials sales (see Chart 2). The category includes single-web and multiweb specialty bags, pouches, and liners.

Comparative factors

At 17% of the $114 billion packaging pie, flexible materials trailed only corrugated, which represented 24% (see Chart 3). Its market share topped paperboard, metal cans, “miscellaneous” plastics, plastic bottles, and glass, according to the report.

Flexibles also showed the second-highest compound annual growth rate between 1996 and 2001, at 4.3%. Only the 6.8% CAGR for bottles and miscellaneous plastics showed stronger growth during the same timeframe. Corrugated showed a 2.9% CAGR; paperboard, 1.3%; glass, 0.2%; while metal cans declined by 0.7%, according to figures supplied by six different organizations that track these materials.

Among the other notable findings from the FPA study were the following:

• Some areas for future flexible packaging growth are based on increases in barrier packaging and advancements in modified-atmosphere packaging technology.

• Conversions to flexible materials will be fueled by advances in printing technology and higher fill rates for stand-up pouches.

• Intense competition among flexible packaging converters will be attributable to customer and competitor consolidations; technology-driven advances in manufacturing efficiencies; and expected higher costs for labor, energy, and insurance.

Gazing into their crystal balls, converters responding to FPA’s survey were optimistic about the next five years, projecting growth in the 7% to 10% annual range.

Completely revised from previous reports, this year’s State of the Industry Report included information from surveys answered by FPA-member suppliers and converters. Data from several other organizations were also incorporated, including FPA End-Use Market Research, Esse Technologies Inc., and the Census Bureau. The 2002 report is free to FPA members; $3귔 for nonmembers. —JB