Manufacturing companies often think of themselves in isolation. They believe that their processes are unique, except perhaps for those of their competitors. Since they avoid sharing ideas with competitors, they turn inward and reinvent automation strategies or just accept what comes through their doors.

And while manufacturers are viewing themselves as unique, organizations that offer products and services to manufacturers tend to paint with too broad of a brush. They generalize. Schools, for example, claim to have “manufacturing programs” designed to serve the universal needs of manufacturing. But these programs tend to be too general or poorly focused, resulting in customer dissatisfaction. The same may be said for software companies.

A good manufacturing automation strategy should include architecture, standards, and implementation practices. It should be fully aligned with business strategy, operations, IT, maintenance practices, and training and human resource plans. For a manufacturer that views itself as unique, this becomes a daunting task. For the service providers who view manufacturing homogenously, they fail to understand why customers are dissatisfied.

There are solutions to this dilemma. It needn’t result in a standoff.

Manufacturing is not well understood

Manufacturing is not well understood in America. We might all agree that manufacturing somehow involves making stuff. But then we’d likely get into an extended debate about the meanings of the words “making” and “stuff.” An illustration of this point was the report on a meeting held between members of the OMAC Machine Tool Workgroup and the OMAC Packaging Workgroup to explore common technical interests. One would think that these two groups would find a lot of common interests. But the short version of the report on the meeting was that “we spent a lot of timing asking each other what do you mean by that?”

Another example comes from a project team meeting within a major manufacturing company. Team members included representatives from marketing, sales, finance, manufacturing, logistics, procurement, engineering, etc. Each representative commented on what group he or she was representing. After the meeting, one of the finance types commented to one of the engineering types (from the automation & controls group) that he did not understand what engineering had to do with cash management, because to him, a controller managed the corporation’s cash position.

If those of us intimately involved with manufacturing have problems with our vocabulary and understanding what we mean when we speak about manufacturing, how much more difficult must it be for the general public? Someone once described manufacturing to me this way: ‘It is something that takes place inside a windowless building located behind a dike that you can only pass through with the guard’s approval.” When I grew up, summer vacations involved stopping to tour manufacturing plants; and in Europe today, major trade fairs include family days where parents can walk through with youngsters in strollers to see all of the latest machinery innovations. But in America today, most plants are closed to the public and trade fairs admit no one under the age of 16. Our schools neither promote manufacturing as a career nor educate students in the necessary technical skills, preferring instead to push everyone toward a college degree in an economic society where less than one-third of jobs require a 4-year degree and where only 56% of 4-year college students finish within six years. Is it any wonder that we have become so uninformed about and unprepared for manufacturing?

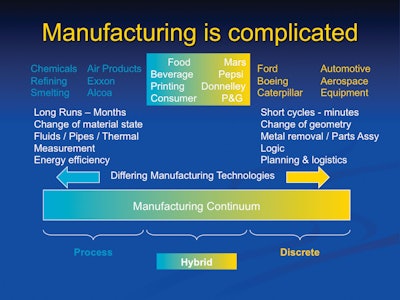

Manufacturing is complicated

In seeking clarity, I set out to find out how the government defines manufacturing. This led to the census bureau and the North American Industrial Classification System, known as NAICS Codes. The census bureau says, “The manufacturing sector comprises establishments engaged in the mechanical, physical, or chemical transformation of materials, substances or components into new products. The boundaries of manufacturing and the other sectors of the classification system can be somewhat blurry...”. The NAICS codes for manufacturing at the six digit level run from 310000 to 339999 within which there are 10,537 types of manufacturers identified.

So, are we to seek to understand manufacturing as one thing or as 10,000 different things? When we develop automation and control architectures, should one size fit all? Or should each company be free to develop its own unique architecture? We hear calls for new architectures—but will they apply everywhere? We hear calls for new training, education, and certification programs. Should there be one standard for manufacturing, or should there be multiple standards?

Whether it is control architecture, operating strategy, training, or certification programs, manufacturing is too complicated for one-size-fits-all solutions that are really lowest-common-denominator answers satisfying no one. On the other hand, despite the many claims that one may hear from plant technical staff that their needs are totally unique, 10,000 solutions are not the answer either.

How can we come to grips with this monstrosity in a way that helps us to better communicate, create operating strategies, develop automation and control architectures, and prepare the workforce?

A useful sub-division

A useful way of viewing manufacturing is along a continuum, which may in fact include 10,537 different types. Manufacturers are placed along the continuum based upon some chosen set of attributes and the continuum is then divided into a limited number of named sectors. In the simplified model to be proposed here, there are three sectors identified as Process Manufacturing at one end, Discrete Manufacturing at the opposite end, and Hybrid Manufacturing in the middle.

Process

The prototypical process manufacturer will operate with long runs that could extend 24 hours per day 7 days per week with just one startup and shutdown per year. There will often be a change of chemical state of the material in a vessel or reactor and the material may be captive within pipes or other conveyance. Control will be of a continuous nature and depend upon measurements of physical properties such as temperature, flow rate, density, and chemical composition. Process control is frequently hierarchical and distributed with large operator interface systems in centralized control rooms that display operations that may be miles away. Systems may be redundant with automatic failover to backup processers and locations. Control may be based upon complex mathematical algorithms using feedback, cascade, and feedforward strategies. Money is made or lost based upon fractional improvements in operating quality and energy efficiency. Think about bulk chemicals, refining, or smelting operations that might be done by companies such as Air Products, Exxon-Mobile, or Alcoa.

Discrete

The prototypical discrete manufacturer will operate with short cycles that might be measured in minutes. An operation may turn out many identical but individual parts during the course of a shift or there could be very frequent changeovers to differing parts with order quantities as small as one discrete unit. There will be changes of geometry involved through material removal, material addition, bending, or assembly. Control will be largely of a sequential nature using logical operations based upon sensors thar feed back position and other physical attributes. Machines will often employ electro-hydraulic systems or dedicated CNC. Robot controllers may coordinate half a dozen motion axes, or PLCs may oversee sequential operations and interlocking between adjacent operations. With frequent changeovers the rule, the primary operator interfaces tend to be local to individual machines. Money is made or lost based upon planning and logistics. Think about machined parts, aircraft assembly, electronic equipment, or automobiles that might be made by small machine shops, Caterpillar, Boeing, Dell, or Ford.

Hybrid

The prototypical hybrid manufacturer will have continuous operations that start off looking like process and end up looking more like discrete with an intermediate level of changeover. Raw materials may be continuously blended and cooked resulting in some chemical change, proceed though a forming stage where changes to the physical geometry may be made and on to packaging where individual pieces are inspected, wrapped, and assembled into larger units with similar or dissimilar components. Control is often a mix of analog feedback control and sequential logic systems tightly integrated with general purpose motion control. Systems with 100 servo axes coordinated over large distances may be common, resulting in operator workstations on the floor that interact with multiple unit operations and machines that are spread over some distance. Money is made by balancing production efficiency and logistics resulting in mass customization. Think about food, beverages, printing or consumer products made by companies such as Mars, Pepsi, Donnelley, or Procter & Gamble.

By the Numbers

While this classification may seem a bit arbitrary, it is both meaningful and useful. Validation is provided by looking at the numbers when manufacturing is segmented in this way. Total US manufacturing output is approximately $5 trillion. By sector, process and hybrid each account for 31% of this output with discrete claiming a slightly larger 38%. Manufacturing employment is 14 million persons, but the division by sector is quite different than output. Discrete manufacturing claims 50% of the employment with hybrid accounting for 32% and process only 18%. Total wages of $1 trillion are also skewed, with discrete accounting for more than half of the wage base at 52%, hybrid 26% and process 22%.

From this basic data, we can see some important facts that make intuitive sense. First, output per employee, or productivity, is much higher in the process industries, exceeding discrete productivity by almost 21/2 times. Second, process employees, at $97,000, have the highest wages per employee. If we think about large process plants with control rooms full of distributed control systems operated by employees with some college education or maybe even a degree, this data makes sense.

Discrete manufacturing has the lowest productivity, yet the second highest wages per employee. This could be because of higher skill requirements or more changeover issues in the discrete world, or it could be a reflection of the wages that are being paid in industries that are more highly unionized. In any case, there would seem to be some significant opportunity for discrete manufacturers to improve their productivity numbers.

Hybrid manufacturers pay the lowest wages and have productivity midway between process and discrete. Many process plants went fully automated in the last quarter of the 20th century. There are certainly opportunities for continuous improvement in process plants, but many hybrid plants have not yet taken advantage of the opportunities available with new mechatronic solutions, process control, and batch automation. Real opportunities for applying advanced manufacturing automation techniques, and for worker up-skilling, exist in hybrid manufacturing, leading to higher profits for owners and lifestyle improvements for workers.

A very important fact not to be overlooked in this data is that manufacturing wages per employee are 50% higher than average wages overall in the economy, and manufacturing productivity is 21/2 times the national average productivity. The least productive manufacturing sector is more than twice as productive as the economy as a whole.

Models are meant to be useful, not perfect

This model is meant to simplify, not to be all inclusive. It provides rules of thumb, and rules are meant to be broken. For example, some companies may have both process and discrete operations within the same plant and not be considered a hybrid. And there may be blurring at the edges between manufacturing and non-manufacturing. For example, utilities, mining, and agriculture will share some attributes with the various manufacturing sectors. An automation strategy for an electric utility or a pipeline may look a lot like that of a chemical plant. A farmer using geospatial mapping and soil sensors to batch the proper amount of fertilizer to a field using mechatronic systems in a tractor may have needs similar to a hybrid manufacturer.

The purpose of a model is to be useful. We know that F=ma does not explain everything correctly, but in many circumstances it is still useful. The assertion here is that this three-sector model is useful when developing automation strategy. It may be applied to questions of control architecture, technical or vendor standards, procurement, implementation, maintenance, IT, operations, HR, and training.

Your sector should affect your strategies

To discuss how each of the above areas is affected by your sector is well beyond one article. We will be dedicating a separate chapter to the sector impact on education & training in Summit Media Group’s upcoming Workforce Development Playbook. For now, let’s just go a bit deeper with respect to technical documentation and maintenance strategy by sector.

A typical process plant is a “stick-built” operation. The engineers who are hired by the plant’s owner to design the plant design most of it one pipe and one valve at a time. Some equipment may come in as skids, but chances are that every device on that skid has an identifier that fits into the plant’s overall scheme. No two valves or sensors will have the same identifier anywhere in the system. When the project is complete, the plant owns ALL of the documentation, including source code for the software, at the most detailed level available and in the local language and vernacular. This may be many thousands of drawings and pages of software. The engineers and maintenance staff have full access to all the design details and are able and expected to respond accordingly when it comes to troubleshooting and problem resolution.

Contrast this to a discrete plant that will often consist of an assortment of computer numerical controlled lathes, mills, benders, welders, and robots. Most frequently these machines are not integrated with one another over any great distance. A robot may be set up with a mill to feed blanks and remove finished parts, and a chip conveyor may be integrated to remove turnings. The plant’s owner is completely blind to the way the sensors, controllers, drives, and software are integrated in these machines. Chances are that the controller software is object code only and is locked down. The machine distributor’s service department may have the electrical drawings, and the closest copy of the source code may be in Korea in the manufacturer’s engineering department—documented in Korean. Two seemingly identical machines sitting next to each other may have the same or different device designations as each other or as similar machines in a competitor’s shop. If the plant has an engineering or maintenance staff, they have almost no access to the design details of their machinery. They may be expected to perform effective troubleshooting and problem resolution, but will be heavily dependent upon vendor resources.

As might be expected, a hybrid plant is a hybrid of these circumstances. The back end of the plant may be stick-built. As one moves through the plant, the operations become more skid-based. The packaging or other machines at the front end are probably a bit more customized than the machines in the discrete plant and are probably built in considerably lower volumes. Chances are that the plant’s expectations for machine documentation are higher. Physical documentation, in the local language, is required through the procurement process. Source code for packaging machines has been the topic of several internet forums of late. There are arguments on all sides. Here one needs to consider the business, operations, and maintenance strategies of the customer. Larger hybrid plants will require all source code for PLCs HMIs and motion controllers, documented in the local language. Small plants, without a strategy, will overlook the issue or settle for PLC source only, allowing the vendor to maintain the critical motion software. Personally, I don’t like having to purchase my own source code at a vendor’s bankruptcy auction, so I would opt to require it all up front. Engineering and maintenance staffs in sophisticated hybrid plants will perform similarly to those in process plants, but will have gone through an entirely different process of procuring their primary troubleshooting tool, their documentation. The programming languages and the software applications will differ from those in both process and discrete plants.

Leverage your sector

Your manufacturing operations may be unique, or they may be only like those of your competitors. But the attributes of your process, hybrid, or discrete sector have you sharing much in common with other manufacturing companies. Leverage your sector to influence automation vendors, educators, software providers, and others.

If you are providing products or services to manufacturing, don’t assume that one size will fit all. Identify the sectors of your customers, and start out by testing the hypothesis that a solution customized in three sectors may better fulfill most needs.

Once both manufacturers and suppliers recognize and simplify by sector, the task of developing plans, strategies, and winning solutions will become less challenging and the results more useful.