Uncertain economic conditions and structural changes affecting individual end-user market segments for packaging machinery portend near-zero growth in equipment purchase expectations for 2001. So reported the Packaging Machinery Manufacturers Institute (Arlington, VA) in its fourth annual U.S. Packaging Machinery Purchasing Plans Study.

During the current calendar year, PMMI forecasted $4.9 billion in domestic equipment sales, matching its projection for 2000 (see Packaging World, June ’01, p. 81, or packworld.com/go/machinerystudy). The forecast excluded parts, which PMMI said represent about one-fifth of packaging machinery sales. More than 400 end users from various market sectors were interviewed early this year for the study. These decision-makers represented 1꽟 plants.

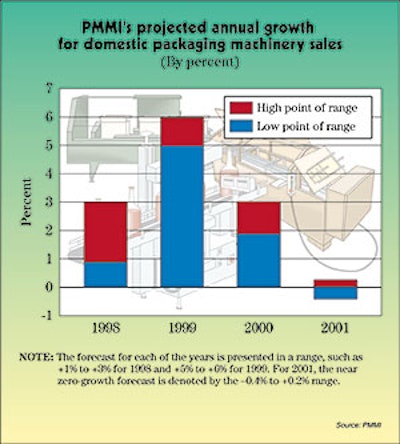

The 2001 outlook proved the most uncertain of the four PMMI equipment purchase studies (see Chart A). According to the institute’s executive summary, “The uncertainty derives not only from the effects of the weakened domestic economy on capital expenditure plans, but also from the mixed combination of factors, trends, and developments currently influencing both the aggregate market and its individual segments.”

Charles Yuska, PMMI president, noted “the packaging machinery industry has experienced growth in the area of three percent each year for the past few years. This year, three of the nine categories we researched—foods, pharmaceuticals, and paper/non-durables—which typically account for 60 percent of annual packaging machinery sales, will increase their rates of spending.”

Conversely, the consumer/commercial durables, chemical, converting/printing, beverage, and personal care product sectors were predicted to reduce spending. Hardware/automotive/industrial spending was budgeted at about the same level as last year. Chart B reports the minimum and maximum percentage change in net dollar volume for the nine market sectors from last year. For example, for the pharmaceuticals and medical category, the net forecast was for higher spending on packaging equipment in the range of 5% to 7%. Consumer/commercial durables spending was predicted to decline in the range of 11% to 13% this year.

Spending rationale

When participants were asked to give their primary reason for ordering packaging machinery this year, their responses most frequently indicated that they were replacing machinery to gain efficiency or to expand production capacity (Chart C). For those planning to reduce machinery spending in 2001 (Chart D), the rationale, included adequate machinery, heavy spending in 2000, and lower sales/profits/budget.

The report said that “on a weighted basis, additions will account for 65 percent of the total [of projected 2001 equipment orders] and replacements 35 percent. The trend reflects the need for additional packaging capacity due to sustained consumer spending and the plethora of new products continually brought to market. But as in recent years, the proportion of machinery ordered as replacements for existing units will remain significant. In fact, replacement business will continue to represent a solid foundation of machinery demand as long as the issues of productivity and efficiency assume center stage in management decisions.”

Replacements, contract packagers

PMMI noted that not all of the packaging equipment replacements would be new machinery. In fact, responses indicated that nearly a third (32%) of those ordering equipment this year were planning to buy some rebuilt machinery. That’s virtually double the 16.5% who said they planned to buy such machinery just last year.

“The relatively high number may relate to the possibility that a large proportion of respondents consciously or subconsciously consider rebuilt packaging machinery as new,” said the report. “Moreover, since original equipment manufacturers are selling rebuilt machinery, customers have the feeling that the units are the same quality as new. Used equipment dealers continue to dominate the market for rebuilts, although OEMs appear to be gaining. But of major significance, the percent of end users planning to order rebuilt packaging machinery is higher than that of last year.”

Respondents were also likely to investigate rebuilt equipment for economic reasons. Roughly three of four respondents reported considering retrofitting machinery with components as a low-cost alternative to ordering new machinery. More than half reported that they planned to retrofit new components to at least one packaging line this year.

Retrofits can often replace potential new equipment purchases, thereby reducing sales. However, the report noted that machinery makers can sell retrofit kits for older models at a higher profit, “while providing end users with the correct components and technology matched specifically to the OEM’s model and serial number.”

According to the survey, end users will continue to rely on contract packagers, though it’s unclear how that translates into CPs’ purchasing of packaging machinery. Respondents said they expected to increase the workload for CPs. “The heavy reliance on contract packagers is largely attributable to overburdened production operations, temporary swings in demand, reluctance to budget funds for new machinery, and a shortage of available labor,” said the study. “But also of major impact on decisions is the flow of new products to the market as more manufacturers farm out the initial packaging until the product’s success or failure is established.”

Comparing studies

Last year, 53.4% of respondents used CPs, down slightly from the 56.6% who relied on them in ’99 (Chart E). The decline was attributable to both, “a slowdown in production in late 2000 and early 2001 requiring less work to be farmed out, and end users seeking to reduce packaging costs and improve profitability by bringing some or all of their packaging back in-house,” noted the report.

In comparison with the 2000 forecasts, 37.1% of this year’s respondents reported plans to spend about the same amount of money on machinery, while one-third plan to increase expenditures, and 24.6% said they’ll reduce spending. About 5% indicated they didn’t or don’t intend to buy machinery in either year.

“Most importantly,” the summary reported, “the largest proportion of companies that reported higher spending for 2001 were from the lower dollar-volume expenditure ranges.”

PMMI concluded that a case for a slight downturn in sales was evident (Chart F) by measuring expenditure data in three different dollar ranges. For example, in the lowest dollar expenditure category of expected purchases (up to $250ꯠ), more than 40% of respondents projected an increase in equipment purchases. The percentages dropped to 32.3% and 22.8%, respectively, in the $250ꯠ to $1 million, and more than $1 million categories.

It’s worth noting that these forecasts were made early this year. Whether purchasing intentions may have changed now that several months have passed is uncertain. It would appear that end-user companies, like many consumers, are continuing to make purchases but are exercising caution in making such investments. Based on comments from PMMI, the long-term forecast is more optimistic than the flat equipment expenditure forecast for 2001.

“Many industries, especially beverage, spent heavily on new packaging machinery the past few years, with 10 to 12 percent growth in 1999 and nine to 11 percent growth in 2000,” added Yuska. “Even with the expected level of purchasing, it is important to emphasize that the fundamentals of demand for packaging machinery remain solidly in place. Companies will continue to need innovative, productive packaging machinery to handle the thousands of new products that are introduced in any given year.”

The summary delved into more detail on market segments and also reported on macroeconomic factors and the use of the Internet in relation to packaging machinery. Available free to PMMI members, the survey sells to nonmembers for $495. (JB)